Hi Multis

It’s already Sunday again (or Monday, depending on where you live). It’s the week of Thanksgiving but even then, you get the Overview Of The Week.

I returned from Lisbon at 1 am this morning and I’m happy to be home. The reason? After three fantastic days, on the last night, I had food poisoning and I didn’t sleep. Just a few hours ago, I ate a little bit for the first time in two days. So, as I write this, I still feel weak.

But Cascais, very close to Lisbon, is a fantastic town. A few pics.

Next to me, the two other people on the pictures are Matt and James.

As I explained last week, Matt developed a tool that can make AI-generated reports. The product’s good already, although it still needs fine-tuning. We looked at how we will do that, next to many other things.

As Multis, you can try it out already. For free, for now.

Just give in a ticker. For now, it’s only for the American and Indian stock markets. But many companies have an ADR in the US, of course. You can use TOITF for Topicus, for example. A Belgian friend used MLXSF for the Belgian chipmaker Melexis and also received a report.

It can take up to 15 minutes before you get the report in your mailbox.

You can try it out here. All feedback is welcome!

You might hear a lot more about this in the coming months.

Articles In The Past Week

This is the second article this week.

Earlier this week, Julien’s first article was published. We looked into whether Topicus is an outstanding opportunity or doomed now.

I have multiple earnings analysis articles in the pipeline, so you expect more this week.

Memes Of The Week

It was a red week and often, that means there are more memes. Laughing is good to understand the relativity of everything, so I love this.

The first one already illustrates this.

This week also showed a couple of events that generated memes. The Nvidia earnings were the focal point of the week.

At the same time, I also saw this one.

As more experienced Multis know, I’ve had a position in Nvidia since 2017, but I sold a majority of my position to buy a car in 2020. I started reaccumulating in the PM Future Fund (which was started in 2021) and it was the second-biggest position there. In the Forever Portfolio, started in October 2024, it is also a sizeable position.

There was also the Cloudflare outage. That inspired someone to make this meme.

And Antonio Linares posted this meme this week:

And PayPal can’t seem to stop losing. Now that it’s a Official Liverpool partner, that seems to extend to the club.

The last one is last-minute addition.

Interesting Podcasts Or Books

This week, I didn’t have the time to read or listen to podcasts.

The markets in the past week

The funny thing is that many (definitely including me) don’t know what the markets have done, unless they are down significantly.

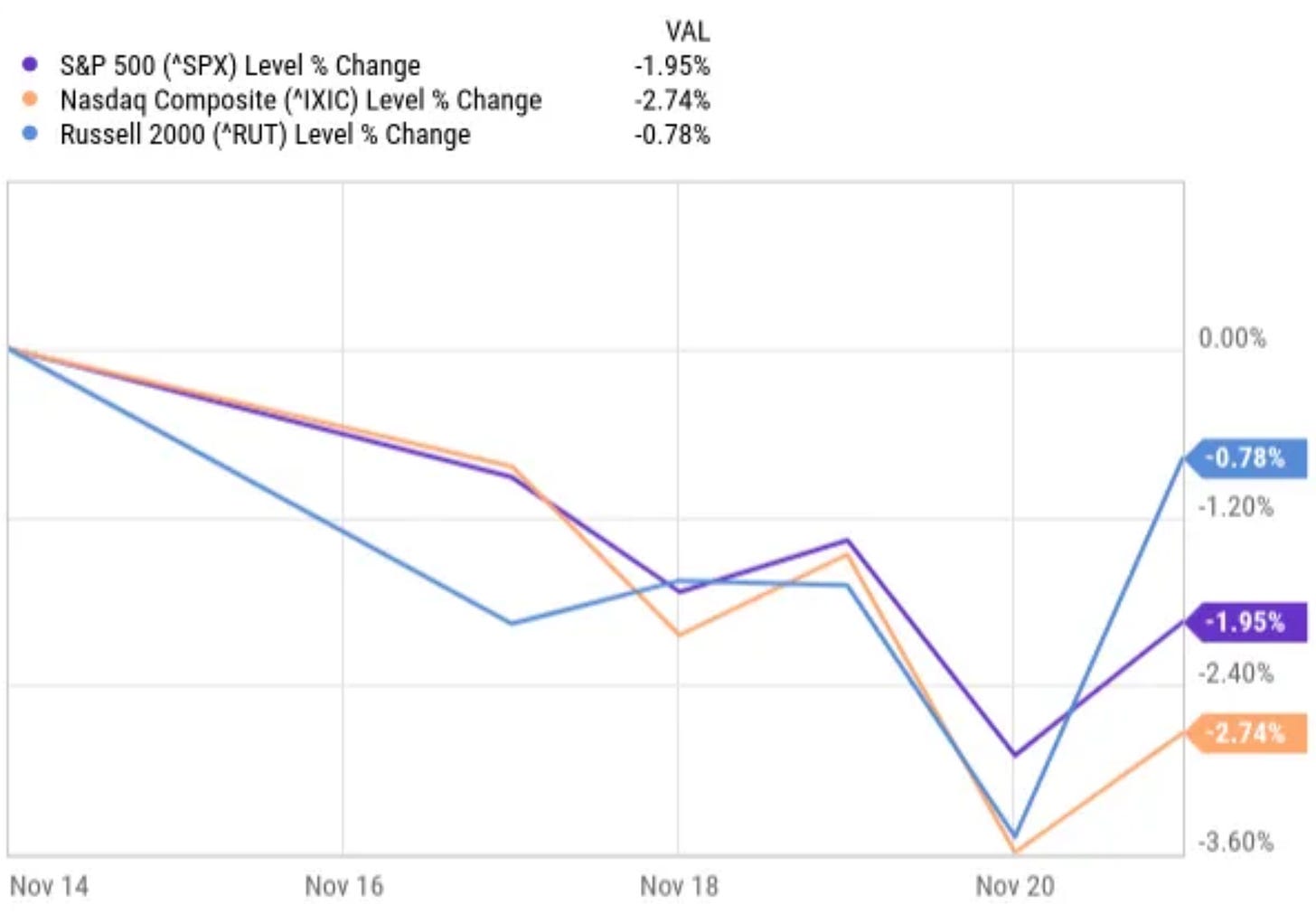

That was the case this week. The Russell 2000 was down 0.78% through a surprising comeback on Friday. The S&P 500 was down 1.95% and the Nasdaq 2.74%.

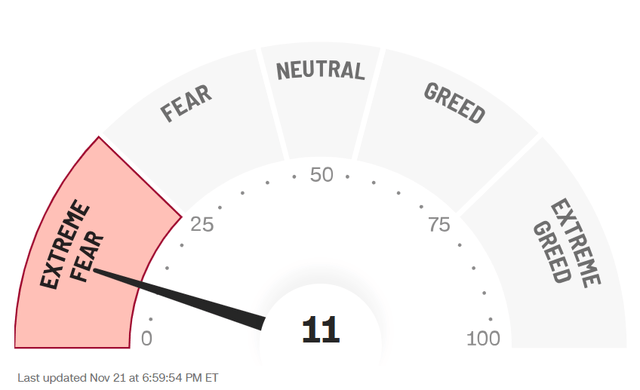

Obviously, the Greed & Fear Index kept dropping, too. It’s now at 11, but was at 6 earlier this week. That’s very low. It ticked 4 at the bottom in April.

Lesson Of The Week

This week, on our Slack channel, John asked this question, reacting to me saying I have considered Cloudflare and CrowdStrike very expensive for a while now.

I am curious- when you say it is very expensive- does that mean you would consider selling now and then waiting for an entry point?

This was my answer:

I never sell based on valuation. So, the answer is no. Why? Because of several things:

Too much activity is by far the biggest reason for underperformance.

I haven’t added when the stock was expensive and that means my positions are smaller now for CRWD & NET. I would welcome a big drop.

It’s extremely difficult. Suppose you sell a stock at $200 because you think it’s way too expensive. It shoots up to $320. You will feel like an idiot. Then it starts dropping. You know that this is an exceptional company for the long term. So, when it seems to bottom around $250: will you be tempted to buy? You will. Then it drops further. You either think: “I should have waited.” or “Luckily I didn’t buy.” It drops to $195. That’s under the price you sold it at. Will you be tempted to buy? You will. Suppose you don’t buy, and the stock never drops under $200 again, you may have missed a multibagger for the long term, which is a much more expensive mistake. If you buy, was that $5 worth all the stress? Not for me.

In a way that $5 could make you poor if you end up selling a big future winner. The biggest mistakes usually come from selling, not from buying.

So, thanks for the question, John. Of course, my answer is not the one and only answer. I have money coming in. If you don’t, for example because you are retired, taking some profits can definitely help you with your goals. Every situation is different.

Quick Facts

I couldn’t find any quick facts important enough to make it here this week. There were more important facts that are highlighted further in the article.

The free part stops here. If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ Deep insights through quarterly earnings deep dives

✅ My complete portfolio (with every transaction)

✅ The Quality Score and valuation updates every quarter.

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% over 3 years!)