Shopee And Sea Money As A User (free post)

You may be (interested in being) a Sea shareholder, but have you tried it?

Hi Multis

There will be an article with the analysis of the Sea Ltd. (SE) earnings tomorrow, but first, something else.

An Insider’s Guide to Sea Money and Shopee

One of the challenges many folks face with an international portfolio is not being able to understand the value proposition of a product. It’s one thing to learn about Crowdstrike or Adyen, which are primarily B2B companies and hence most folks won’t encounter them on a day-to-day basis. However, for consumer-facing companies like Sea Ltd or Mercado Libre, the challenges are more about access. After all, how would you know what the big deal is if you never get to see it in action?

So for this earnings roundup, I will take a slightly different approach and dive deeper into how Sea’s consumer products, specifically Shopee and Maribank (the bank launched by SEA) actually look/feel like, to hopefully give you a better sense of why they have been so successful.

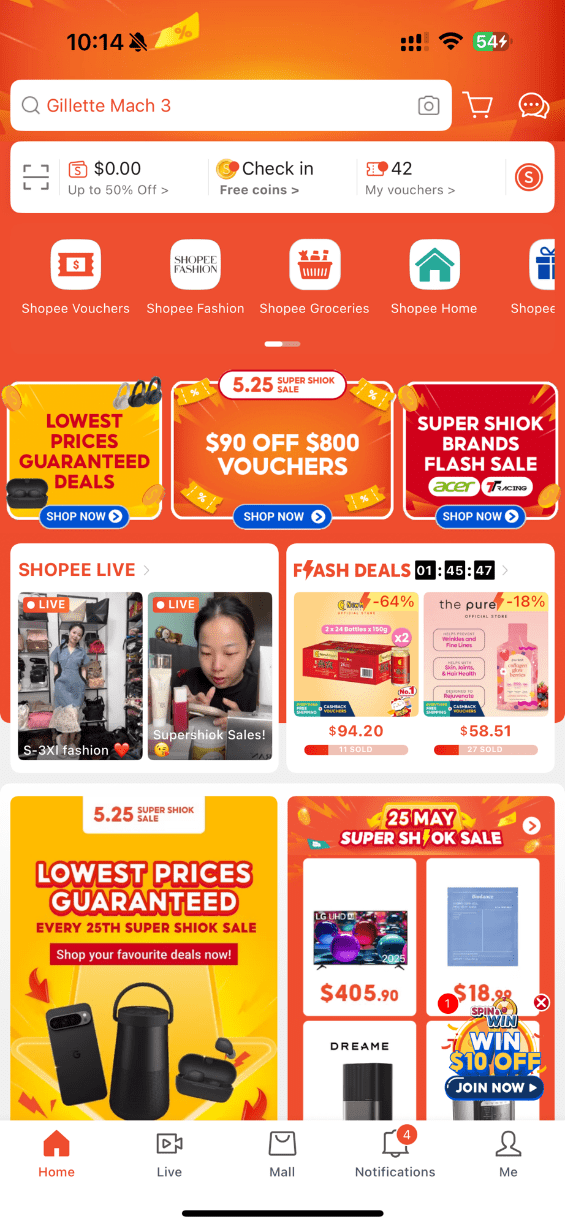

So let’s begin with a use case. Recently, I needed some air-sealed containers for the kitchen, and the first place we checked, of course, was Shopee. This is what you see on the home page of the mobile app:

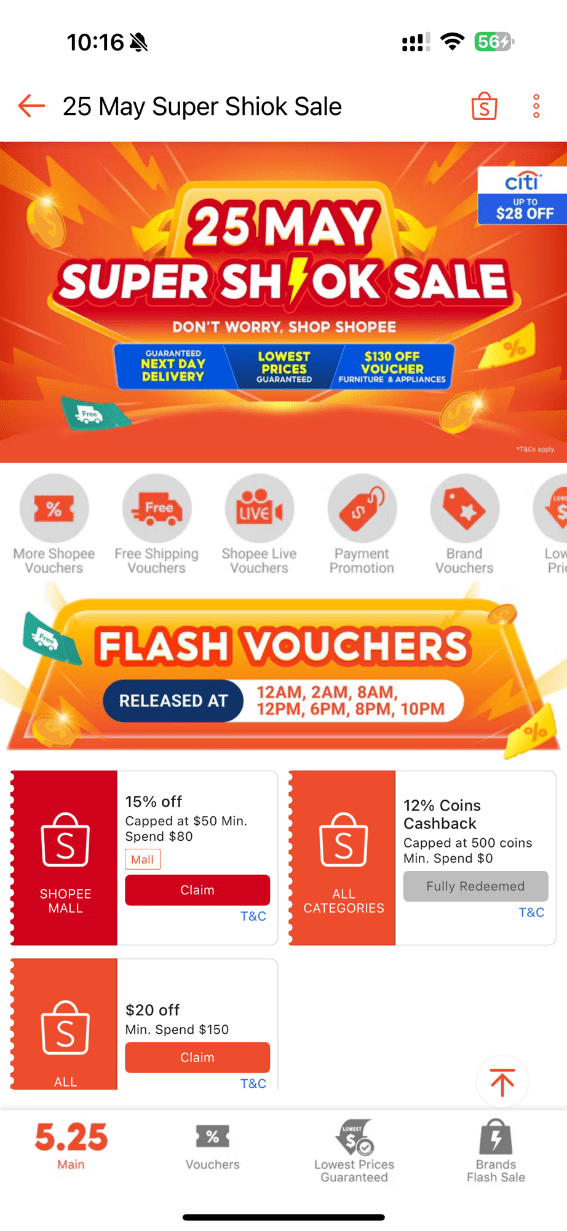

A little chaotic if you ask me, but this is in all apps now. You can see immediately, however, that Shopee is built around “deals” since I immediately got this right after:

Of course, I didn’t come here to be distracted, so onwards I go to find my containers:

Here we see Shopee’s advertising tools in action. I’m automatically suggested a few categories before I even type something, so that casual buyers might get tempted to browse. I’m not one, though, so onwards I go

Now, alongside the results, I see another paid advertiser right at the top, selling the product and securing prime placement. I skip them and select the 2nd item, which is tagged “Shopee Choice” (of course copied from Amazon Basics), this is their in-house store brand label for 1st-party items.

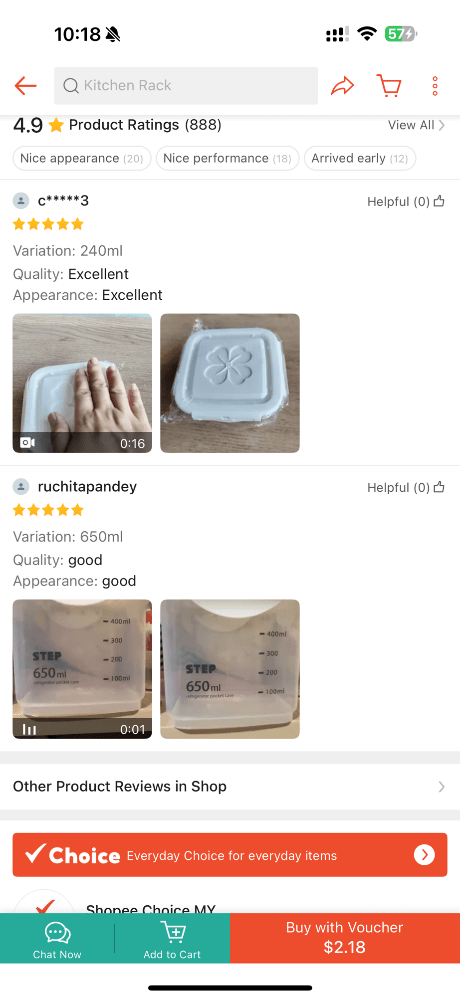

I’ll skip the reviews, which are further down and have videos of people unboxing and go straight to order and checkout

What we see here is the option of sell collect, which Shopee has set up all over Singapore for easy pickups and returns, while the second option is via SPX, their in-house logistics arm. But that’s not all, scroll a bit further and we see the Shopee flywheel in full effect

Pay attention to the 2 payment options below my credit card

Maribank, which is my savings account with Shopee, offers a 0.5% off if I use it (so Shopee saves on card fees). And Mari Credit Card, which has an in-built instant checkout option and offers further benefits we will see shortly.

Since I have an account already, I proceeded to activate it, but it took less than 1 day to open my account to begin with, so this is not a deal breaker by any means. The linkage process was literally 3 clicks:

That’s it, instantly set up to pay my account, which Shopee knows about because, of course, I have the Maribank app installed and it is linked to the same email ID as my Shopee account.

But since you folks come here for cutting-edge reviews, I also took this opportunity to apply for a Mari Credit Card, which offers 1.7% cash back, which is currently the highest uncapped cashback offer available in the market.

I couldn’t take screenshots of the whole process, since it had my personal information, but Mari relied on Singpass (a government identification platform) and the API from the income tax department which had my last 2 years of tax returns. All I had to do was authorize the data pull and confirm it and my application was submitted. I received approval with a basic credit limit 6 minutes later.

I repeat, yes, this is Singapore, so there is a government-backed API for personal data and tax records that banks can tap into, and most do, but the entire process for a new-to-bank cardholder with an existing account took SIX MINUTES. After approval, while the physical card was dispatched, I was immediately able to view my new credit card inside the app and add it to Apple Pay for instant usage.

In a word, seamless. But back quickly to my containers (see how good Shopee is at distracting people to sign up for more?), going back to the checkout page, I see something new:

Suddenly, I have a buy now, pay later option available if I use the credit card, which, because it’s Shopee, also gives me an additional 3% cashback (via Shopee coins, so non-cash) for using the card. Don’t be thrown by the small amount since it’s just an illustration, but for larger ticket purchases we saw earlier (Rolex, Apple, Xiaomi etc) this is a very powerful checkout flow because it makes it instantly easier to pay for goods. And all of this took place inside 2 applications with Face ID login.

What we’re seeing here is almost a form of vertical integration of e-commerce developed by Shopee. You can order goods online, use Shopee to pay for them, and have them fulfilled either by their own in-house arm or customers can self-collect and save on the delivery cost. Short of manufacturing the product themselves, this is an incredible flywheel as a customer.

Going back to Maribank, a bank account and credit card aren’t the only options. As we know, savings accounts' interest rates are famously terrible, even though Shopee is currently offering 2.28% till the end of the month, and people routinely move funds to whoever is offering the best rates (due to instant fund transfers in Singapore). Shopee is aware of this, so it encourages you to keep your idle cash with them through Money Market Funds. Welcome to Mari Invest:

We see two options with different risk profiles: a simple savings product offering 2.73% per annum interest and a higher-risk product offering 4%. Of course to many people, this may be confusing, and so there is loads of information if we click through (with an ad of course, pitching the Income product)

So there you have it, a simple explanation for the difference between the 2.

SavePlus lets you withdraw cash instantly (up to SGD 20,000 per day) while earning slightly higher interest. But if you have emergency funds that can wait 2-3 business days, you have a higher-yielding option – no reason to go elsewhere for your funds. For full reference, the invest income isn’t investing your money in the stock market; it’s investing in a famous market fund called PIMCO GIS Income Fund, which is hedged in SGD to offer relatively low-risk income by investing primarily in short-term bonds and government securities. I’m convinced that managed portfolios are on the way with a mix of stocks and bonds but we shall see.

On a final note, Shopee must have known I was writing this article, so just today they sent me a push notification to ask if I was a small business owner. I took some screenshots of their marketing material for your benefit, as I unfortunately do not own a business, but I do understand what they’re pitching.

This is clearly aimed at small and medium-sized businesses to become their primary transaction accounts.

Given that Shopee is the largest e-commerce platform in Singapore, with a large number of sellers, including third-party businesses that utilize Shopee Pay (such as retail and food & beverages), this product would be an ideal target market for them, as it can fulfill all their banking and payment needs in-house. Imagine if Square were part of JP Morgan.

In the meantime, keep growing!