Hi Multis

I've been thinking about "selling" Upstart for a while already. The reason that it is between quotation marks is that I no longer hold a position in Upstart since I sold the PM Future Fund last year.

Upstart was a stock "in isolation," which means I don't add to my position. Because the Forever Portfolio is new, I don't have a position, but I still followed up the stock, like in this article.

The earnings of this quarter are an important element in fully understanding why I doubt even more about selling. Karan, who didn't know about my sentiment versus Upstart, by the way, analyzed the earnings and came to a few conclusions that were extra fuel to the fire. Let's first look at the quarterly earnings.

The Q1 2025 Earnings Analysis

Karan here with an analysis of Upstart (UPST) Q1 earnings. Kris will take over after the earnings analysis to update the Quality & Valuation Scores.

There are certain things in life you need to see to believe, because otherwise, it feels like it only happens to other people. Like black-colored swans, rainbows and Upstart having a normal single-digit price reaction to an earnings release. Maybe one day, someone will see it.

Of course, long-time holders of Upstart would know the stock is an absolute rollercoaster, as likely to hit $200 as it is $20, and many people find that volatility quite tiring. But this is in part due to Upstart being heavily shorted and not well understood. The other part, of course, is that Upstart is a very cyclical business. So, if people think we have a recession, sell Upstart. If they think the economy is booming, sell Upstart because everyone else benefits more.

I’m kidding, Upstart did in fact double from its lows when the market was ripping, so the stock clearly remains volatile, but as always, we need to dig a little deeper to parse good news from bad.

3 months ago, I wrapped up my Q4 2024 recap with a rare dose of optimism for Upstart:

We’re on the cusp of the other side now... if you’ve been waiting to right size your position or take profits, the moment shall soon be upon us.

Well, Q1 2025 is in the books, and let’s just say the cusp is a little wider than we thought.

First, the headlines of a phenomenal Q1’25:

Revenue: $213 million, up 67% year-over-year and well ahead of the $201 million consensus. However, this was down from $219 million in Q4’24 and the beat mainly seems to have come from higher interest income (thank you Jay Powell, we saw the same thing with Kinsale.)

Adjusted EPS: $0.33, almost double the $0.17 forecast. This was also better than the $0.26 last quarter and way better than $-0.30 in Q1’24. Q1 GAAP EPS of -$0.03 beats by $0.16.

Adjusted EBITDA: $42.6 million (vs $27 million consensus), up from $38.8 million in Q4’24 and up significantly versus a loss of $20.3 million a year ago. Adjusted EBITDA Margin was 20%, up from -16% in Q1 2024.

GAAP Net Loss: $2 million - improved after last year’s $64 million bloodbath. Funnily, Upstart called this “near breakeven” in their deck, because what’s a few million among friends, really?

We know the drill by now, business must be firing and indeed it was. Loan originations? $2.1 billion, up 89% year-over-year. Platform transaction volume? Up 102%. Conversion rate? 19.1%, a new high-water mark, with 92% of loans now fully automated, no humans required.

If you’re just looking at the headline numbers, it’s hard not to applaud the turnaround from just a year ago. So, if Q1 smashed expectations and the stock tanked 17%, the culprit must be something else.

Margin Compression: The Canary in the Coal Mine?

Here’s one suspect: Contribution margin fell to 55%, down from 61% in Q4 and 59% a year ago. Management blamed “faster expansion into super-prime and new products than anticipated,” which is a fancy way of saying they’re investing heavily to grow into more competitive segments - and it’s costing them. Variable expenses for borrower acquisition and verification rose 7% sequentially, even as transaction volume dipped 2% from Q4. Fixed expenses were down 8%, but mainly due to accounting reasons, so I don’t count them.

In other words: Upstart is growing double digits YoY, flat sequentially, but it’s paying up for every new customer.

Product Mix: I was promised some “Diversification”

Personal loans are still the overwhelming driver - $2.03 billion in Q1 originations, up 83% year-over-year, out of the total revenue of $2.1 billion. However, this was flat vs. Q4’24.

And as for the new verticals:

Auto loans: $61 million in originations, up 5x from a year ago and 42% sequentially

HELOCs: $41 million, up 6x year-over-year and 52% sequentially.

Super-prime borrowers (credit scores 720+): Now 32% of originations, a massive jump from last year, thanks in part to the Walmart OnePay partnership.

Let’s pause here for a moment to assess this. The new verticals are growing well, but it’s because the base is smaller. Of those personal loans, 1/3 rd are now going to super-prime loans, which are the best customers. This segment has grown consistently for four straight quarters and offset some of the slowdown in personal loans.

On the one hand, this seems to be a better mix than what Upstart has had in the past, however, the company has been public for a while and there are some questions that remain open:

On a YoY basis, we can see “core loans” increased 81%. However, small-dollar loans increased 182% while super prime (“the best”) increased by 78%. But these are clearly more expensive to acquire, based on the decline in margins. What is the steady state to acquire and service these customers? Upstart didn’t publish any update to its delinquency performance vs FICO, which is a first from what I remember. Management said on the call:

Beyond the technology, the work we’ve done to prioritize direct collections efforts for borrowers at risk of default have continued to have a meaningful impact. For example, in Q1 we realized a 50% increase in debt settlement acceptances by extending repayment terms for at-risk borrowers.

So that’s restructuring a lot of loans about to be written off, at least a 50% increase. These will lead to lower profitability, so what is the marginal cost of serving these loans?

I call this a yellow flag, because I want Upstart to tell me their AI model is superior, their borrowers are better than the average, go delinquent less often and hence the company can grow sustainably despite macro uncertainty.

Instead, I see declining margins as the company grows, personal loans continuing to be the driver of revenues and it will seemingly take years for the other products to catch up unless there’s an increase in partnerships, which weren’t really a big topic during the call.

Look I get it, it’s likely personal loans are easier to approve and issue (hence the high conversion ratio), but that continuous decline in contribution margin bugs me.

It might seem strange that I’m complaining that the company is going after better customers, but the original thesis was that Upstart’s models are superior, so people will get better rates and come to Upstart. Instead, if they’re spending money just like everyone else to acquire and service these customers, it’s going to be difficult to both grow and earn profits starting from scratch. This means that Upstart’s competition has changed from Oppfi and Pawn shops to American Express and JP Morgan, which own most of these super prime customers. This is before Upstart even had a card product. What happens to margins then?

As the company admitted,

Our Contribution Margin, a non-GAAP metric which we define as revenue from fees, minus variable costs for borrower acquisition, verification and servicing, as a percentage of revenue from fees, came in at 55% in Q1, down 6 percentage points from the prior quarter and 2 points below guidance, largely due to the lower takes rates realized in the primer borrower segments where we exceeded expectations.

Guidance: I’ve seen this movie before

Management is guiding for Q2 revenue of $225 million (up 7% sequentially), with adjusted EBITDA of $37 million (vs 36 million consensus) and a contribution margin holding steady at 55%. Full-year 2025 guidance is unchanged: $1.01 billion in revenue, $920 million from fees, $90 million net interest income (vs $80 million expected), and a 19% adjusted EBITDA margin. They expect to be GAAP profitable in the second half and for the full year.

It makes sense that the stock sold off. Even if Upstart “beats” this guidance, whether for Q2 or for FY25, it’s already baked into the price since it was announced several months ago. This is where Upstart's being a cyclical stock hurts. I understand management’s need to be conservative because we can’t know what’s going to happen, but this is supposed to be a growth story, and yet, as we’ve seen already, they’re clearly a slave to macro.

AI, Automation, and the Tech Edge

Upstart’s AI flex is as strong as ever. This quarter, they rolled out new embedding algorithms into the core underwriting model, boosting automation and conversion rates. 92% of loans are now fully automated, and automated approvals convert at 3x the rate of manual reviews. If you’re betting on Upstartart, you’re betting on their tech moat.

Funding and the Fortress Deal

On the funding side, Upstart locked in a $1.2 billion forward-flow agreement with Fortress Investment Group, securing capital for consumer loans through March 2026. They also grew co-investments in capital partnerships to $526 million, up from $433 million last quarter, with a current value of $564 million. Upstart highlighted the addition of Fortress Investment Group as a new committed capital provider, noting that over 50% of funding now comes from third-party capital relationships.

Balance sheet loans ticked up to $726 million (down 21% YoY but up sequentially), while unrestricted cash fell to $600 million from $788 million, mostly due to R&D loan funding and bonus payouts.

The Bottom Line

To summarize, there seem to be two justified reasons for the sell-off:

Margins: Contribution margin continues to slip as they are chasing growth in a competitive segment (super prime)

Guidance: Adjusted EBITDA is projected to dip sequentially in Q2, despite the strong start, with single-digit revenue growth.

While Q1 2025 proved Upstart can grow when the macro winds are at its back, the path to sustainable, profitable growth is still lined with potholes: margin pressure, competitive intensity, and the ever-present risk that AI lending hits regulatory or macroeconomic speed bumps.

When Upstart was founded, being an AI-first company founded by ex-Google folks was a strength, as they brought a novel approach to a well-known problem. In 2025, every single bank and financial institution in the world has easy access to AI tools thanks to OpenAI, Amazon, Google and Microsoft, except with significantly larger pools of borrower data than Upstart. We should not be naïve enough to think that Upstart will remain the only player that can use AI to improve credit underwriting.

Heck, FICO itself is investing in AI to improve their scoring. (I mean of course they are).

So is American Express.

So is JP Morgan.

The way I see it, there are 2 possible outcomes for Upstart:

The best-case scenario is that Upstart gains a distribution advantage, i.e., scores large partnerships at a cost that’s lower and with performance that’s better, for someone to ditch their existing model and switch to Upstart. And the longer we’re talking about “near breakeven,” the harder that future gets.

The worst-case scenario is that Upstart remains a partner to credit unions and smaller regional banks that can’t afford to deploy AI clusters or hire data scientists but fails to reach scale as entrenched banks catch up.

In this outcome, nobody needs to “beat” Upstart’s technology, just create something good enough to narrow the gap vs traditional FICO models. I think I have been underweighting this outcome frankly, because traditional banks are ridiculously slow to adopt new technology, but that’s an issue of time, not capability. Upstart needs to get its act together and become a meaningful player (my guess is within the next 5 years) to avoid being a story stock forever.

For long-term believers, the post-earnings dip might look like a gift. For skeptics, it’s a reminder that this is still a high-beta, high-drama stock. Either way, one thing’s clear: Upstart is never boring.

Additional Remarks (by Kris)

Karan touches on a few pain points that I also felt after the earnings call. I would also add this.

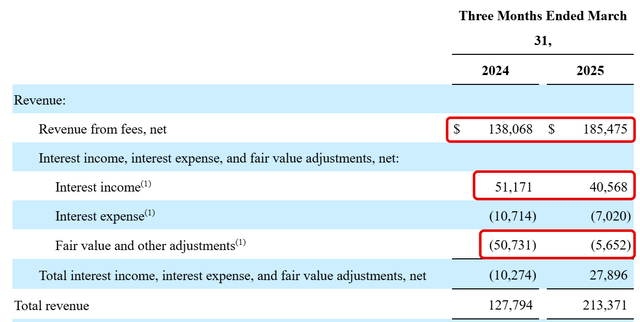

A few remarks (where I put the red boxes).

67% revenue growth looks amazing, right? But that's on paper and has everything to do with GAAP adjustments. I have already said multiple times that people who only look at GAAP results also miss certain elements. Here it is clearly on paper, but you have to look a bit deeper than the superficial (headline) numbers.

The headlines show the last row: revenue of $213.371M in Q1 2025 versus $127.794M in Q1 2024. That's 67% revenue growth. But there's a huge distortion here. Last year, the company had to write off $50.7M in fair value, now just $5.6M. That's not real revenue, of course.

So, let's recalculate that, excluding the adjustments.

For Q1 2024: $138.07M + $51.17M - $10.71M = $178.53M

For Q1 2025: $185.48M + $40.57M - $5.7M = $220.35M

So, I would consider "real" revenue growth 23.4%, not 67%. That's also what I will use in my updates.

We could even go further and estimate this for the Q2 guidance as well.

Last year, there were $44.32M in adjustments. Suppose there would be a similar adjustment as in Q1, then you look at about $39M that you have to remove from the revenue guidance.

With $225M in guidance, that would mean $186M in "real" revenue. Last year in Q2, this was $171.95M. In other words, "real revenue growth" would only be about 8.2%. There's a margin here, but I think it's pretty safe to say "real" revenue growth will be limited.