Sea Ltd. Is So Back!

The stock is up 117% over the last year but here's why it's still attractive

Hi Multis

Potential Multibaggers and Sea Limited (SE) go way back. I picked it at $54 in 2020 and it was one of my best picks until it wasn't. But unlike many others, who only looked at the stock price and the headlines, I never lost faith in the company.

Yes, it expanded too much in 2020 and 2021, but with the cheap money and the Covid momentum, that was the most logical thing to do at the time. But something happened on the way to paradise (a smooth 10x): interest rates were raised at the fastest pace ever. So, the market switched from wanting growth to profitability in a matter of months.

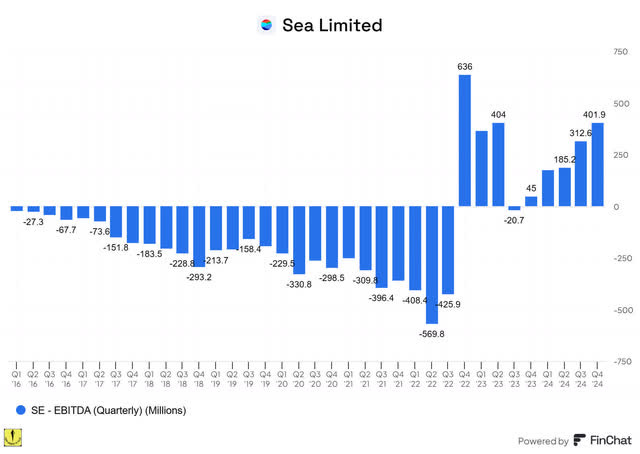

Sea had taken the 'expansion mode' to the extreme, but it took the 'profitability mode' to the extreme as well. It's the most impressive turnaround I've ever seen in business. Before Sea, the most impressive change in focus was Amazon's turnaround to profitability in 2002. But it took Jeff Bezos and his team 2 years. Sea? From announcement to profitability in two quarters. Just look at the massive jump from deeply negative to firmly positive.

But investors and analysts are never happy. Some criticized the company for expanding too fast before (as if they knew circumstances would change so fast). Others berated the company for having invested in the right things (totally wrong, in my opinion) or because there was no growth left during the switch to profitability.

I felt like I was the only one who was impressed by what management did. Of course, now that the stock is up 117% over the last year, some have become bulls again. It's the same story over and over again: the stock price determines the stories, not the fundamentals. The company now balances profitability with strategic investments for growth (as you can also see in the above chart).

With this context, let's go to a short earnings analysis of the Q4 2024 results, before we move to the Quality Score and Valuation Score updates.

The Results

Sea Limited reported its Q4 earnings a bit over a month ago.

Revenue grew by 36.7% in Q4 to $4.95 B. Gross profit rose 44.6% to $2.21 million, and Sea reported a GAAP net income of $237.3 million, much better than a loss of $111.6 million in Q4 2023.

For the full year 2024, Sea reported a GAAP net income of $448 million, up from $163 million in 2023. That made 2024 the second consecutive year of GAAP profitability for the company.

Total revenue for the year was $22.5 billion, an increase of 28.8% YoY.

Shopee

Before we go to the Q4 results, I want to highlight that Shopee, Sea Limited's e-commerce platform, achieved a huge milestone. It surpassed $100 billion in annual GMV in 2024. GMV = Gross Merchandise Volume, the total dollar amount of all products sold on the platform. That's really impressive.

The Q4 GMV contributed $28.6 billion to that number, up 23.5% YoY. That GMV came from 3 billion orders, up 20.1% YoY. That's an average GMV per order of just $9.53. In other words, a lot of expansion is still possible for the average order size. That expansion would make things more efficient and push profitability higher. Forrest Li, Sea's founder and CEO Forrest Li projected Shopee's GMV to grow around 20% in 2025.

Revenue for Shopee was $3.7 billion, a jump of 41.3% YoY. The marketplace brought in $2.4 billion, up 49.8%, and value-added services added $794.8 million (up 20.8%). The biggest part of value-added services is distribution.

Adjusted EBITDA for Shopee turned positive at $152.2 million, compared to a loss of $225.3 million in Q4 2023. There was profitability not only in the core Asian market but also in Brazil.

SeaMoney

SeaMoney reported a 55.2% YoY revenue increase to $733.3 million, with adjusted EBITDA up 42.1% to $211.0 million.

The segment's consumer and SME loans principal outstanding grew 63.9% to $5.1 billion. This makes SeaMoney one of the largest consumer lending businesses in Southeast Asia.

SeaMoney is fulfilling its promise. Don't forget that it was one of the main reasons I picked Sea at in 2020. During the transition to profitability, just like the rest of the company, growth stalled a bit, but the results in Q4 2024 were very convincing. The fact that non-performing loans didn't increase also shows that this is sustainable and profitable growth.

While no real guidance was given for SeaMoney, Forrest Li said growth would be higher than Shopee's GMV growth (so more than 20%).

Garena

For a long time, Garena was the problem child (there's usually one if there are three children, right?) But finally, Garena turned back to growth, just as management had been projecting.

In Q4, Garena's bookings increased 19.0% YoY to $543.2 million. For the full year, bookings were up even more: 34%. Revenue was $519.1 million, slightly up from $510.8 million in Q4 2023. Bookings are a basis for future growth, so that's why you see the disconnection with revenue.

Quarterly average users were up 16.9% to 618 million. That's strong, but quarterly paying users were up even more: 27.2% to 50.4 million. That means paying users are up to 8.2%, up from 7.5% last year. The average booking per user was $0.88, up from $0.86 last year.

Free Fire was the world's largest mobile game by daily average users and the most downloaded title worldwide. Africa has become a big tailwind for Free Fire. In Nigeria, active users surged 90% YoY in December 2024. Many games age fast, but after 8 years, Free Fire continues to do exceptionally well. Management also projects double-digit growth in users and bookings in 2025.

Conclusion

Sea reported strong earnings again. Shopee’s fast growth, its milestone of surpassing $100 billion in GMV, SeaMoney’s rapid loan book growth with no additional risks, and Garena’s return to growth show that the company is back on track and performing very strongly. Add the positive outlook for 2025 and you see a company that was written off as a Covid fluke way too fast.

The market also reacted positively to that, as the stock shot up 7%.

But at the same time, from that point, the stock is down, together with the total market.

Can we see the better earnings also in the Quality Score? And how about the current valuation? That's what we look at in the rest of this article.