Quirky Stock Stories

I'm collecting silly stories, misunderstandings and funny anecdotes about the market, maybe for a book idea. Do you know any? Could you please share them? If possible with a source, if not, no problem. If you don't have any but you think you know someone who knows one, consider sharing this post with this person.

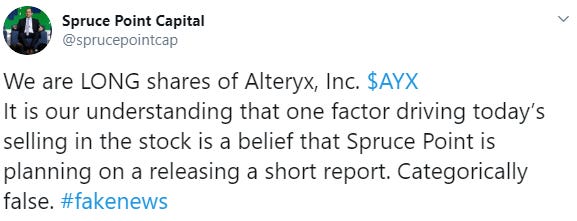

I will turn the tips into a short story if I like them enough. I'll give an example of a story. You could say: the ridiculous drop of Alteryx (AYX) because there was a rumor Spruce Point Capital was short, while in fact, he was long. This is the story I make of it.

Alteryx: the funny 15% intraday drop

On Wednesday, December 11, 2019, there was a completely unexpected drop in Alteryx's stock price, with a sharp decline of 12% intraday, before the stock managed to reclaim some of its lost territory.

It was especially the volume that staggered market followers. While the normal volume of Alteryx shares was 1.83 million per day, a whopping 7.46 million traded hands on that strange Wednesday.

Investors and stock market commenters were grappling for an explanation, checking the news frantically. And of course they found reasons, they always do.

As there was an investor presentation of Alteryx, some immediately assumed the 11% drop was because of news communicated there. But no matter which negative bias you tried to impose on what was communicated there, there was no alarming news in the presentation. The second reflex was turning to the hot topic of the time: the trade tensions between China and the US. But those pointing fingers seemed completely misplaced, as Alteryx had no business in China and no impact of tariffs and trade tensions.

The third explanation linked the decline to Salesforce's guidance disappointment at the time, speculating the cloud computing titan's influence cast a shadow over its peers. But this timing and the logic made this hypothesis look weak.

Another off-the-shelf explanation in investing is always valuation, so of course some shouted how overvalued the stock was and that there was 50% more downside. But if that were the case, why only for Alteryx, while the broader market didn’t see such a trend?

On Wall Street, no matter how modern it is, there is still a human element. The Street is more addicted to gossip than an Italian grandmother known to be the spider in the gossip web in a Sicilian village. And that is what was at play in December 2019.

Rumors started circling about the famous short seller Spruce Point Capital taking aim at Alteryx. But, as the trading day advanced, Spruce Point’s Ben Axler sent out a statement.

One can't help but reflect on the whimsical nature of Wall Street’s trader. A single whisper can move millions or even billions.

Do you know similar stories? You would do me a great favor by sharing them. It could be from the distant past or the more recent past. Just a short mention of the story, and if I like it, I will work it out.

In the meantime, keep growing!

I’m personally a fan of reading about odd stock market stories where HFT or an anomalously bid ask spread happens. An example on December 9, 2011, commencing at 11:01:16, there occurred two anomalous and likely unrelated incidents involving the symbols PDLI and BAC. Both incidents entailed a significant volume of trades originating from the BATS exchange. In the case of the PDLI event, there were oscillations in trade and quote prices reminiscent of a previously documented algorithm observed in Natural Gas Futures. On the other hand, the BAC event witnessed an influx of approximately 800 trades per second, sustained for a continuous duration of 77 seconds. Notably, the cumulative number of trades executed in BAC during this brief timeframe accounted for around 30% of the total trades conducted throughout the entirety of the trading day. http://www.nanex.net/StrangeDays/12092011.html That is the link to the deep dive. Nanex research has some great articles that might interest you