Hi Multis

I'm writing the first part of this Overview Of The Week on the train heading home from ValueX Klosters.

It was a great experience. I liked the diversity of the ideas, from net-net stocks to stocks in the Potential Multibaggers portfolio.

Klosters

I understand that you are curious. What happens at Klosters?

Well, it's a fantastic gathering of very smart people in the investing industry, centered around Guy Spier.

There are fund managers with hundreds of millions of dollars of assets under management, investors in Guy Spier's Aquamarine Fund, private investors, and others in the industry.

It was a phenomenal honor to be invited, just like at ValueX Vail last year.

The program consisted of short stock pitches followed by a deep dive into the pitches the public found the most interesting.

There was also a dinner, where you could sit at tables based on themes. I chose Cloud & SaaS and met very interesting people, not just at this table but across all participants. Next to the content, getting to know so many extremely smart people with a passion for investing feels like a warm blanket in winter.

Articles in the past weeks

I don't even know how long it has been since I wrote that the Overview Of The Week is the only article this week. But it was definitely a long time ago.

Finchat

I got several questions from people asking me about Finchat. I use Finchat every single day and I LOVE it.

This link brings you to what is, for me, the platform with the best stock screener, the best charts, the best forecast oversights, the best place for transcripts of earnings calls and conference presentations and so much more.

Finchat also allows you to interact with financial documents. It answers financial questions much better than Claude, ChatGPT, or Llama.

Finchat is 95% of a Bloomberg terminal at 1% of the price (literally!).

To make it even better, this link gives you a 15% discount.

Memes Of The Week

Multi BEP shared this meme this week.

I have one crucial tip for Valentine's Day Friday: DON'T FORGET IT!

My friend Matthew Cochrane was already thinking about Valentine’s Day too. :-)

Regular PM author Karan also shared a great one.

And this is the last one of the week.

Interesting Podcasts Or Books

Klosters had its influence here, too. One of the participants of the conference was Luca Dellanna. I bought his book months ago after I heard so many great things about it, but I hadn't started reading it yet. I wanted to finish it before Klosters, but I couldn't find enough time.

But I have read enough to full-heartedly recommend the book.

Ergodicity is extremely important in daily life. Most books describe it very technically. In this short book, Luca Dellanna describes ergodicity as simply as possible.

I had a long conversation with Luca in Klosters. He's excellent at deconstructing complicated subjects into simple parts and then putting them back together so everyone understands. I also try to do that with Potential Multibaggers.

On top of that, Luca’s a fantastic guy!

You can buy the e-book for just $9.99 here. The physical version can be purchased on Amazon or other platforms.

The markets in the past weeks

It's funny. You dedicate full days to investing in Klosters, but at the same time, you are a bit isolated from the day-to-day action of the stock market. There are almost no weeks in which I don't know beforehand what the indexes did in the past week when I write this. But this time, I really don't.

It seems all three indexes were down, but not too much.

The Russell 2000 lost 0.24%, the S&P 0.35% and the Nasdaq 0.53%.

You hear there's a bubble. You also see that the S&P has been in deep fear, fear and neutral on the Greed & Fear Index for quite a while already. This is the current sentiment:

Quick Facts

Just one quick fact this week: the PayPal earnings. I'll share my short takeaways of the most important earnings of the last week in the next few days.

The PayPal earnings

I looked into the PayPal (PYPL) earnings. The reason? Adyen. And I saw good news there for Adyen.

Braintree's payment transactions dropped by 3% year-over-year. The reason? Braintree hiked its prices.

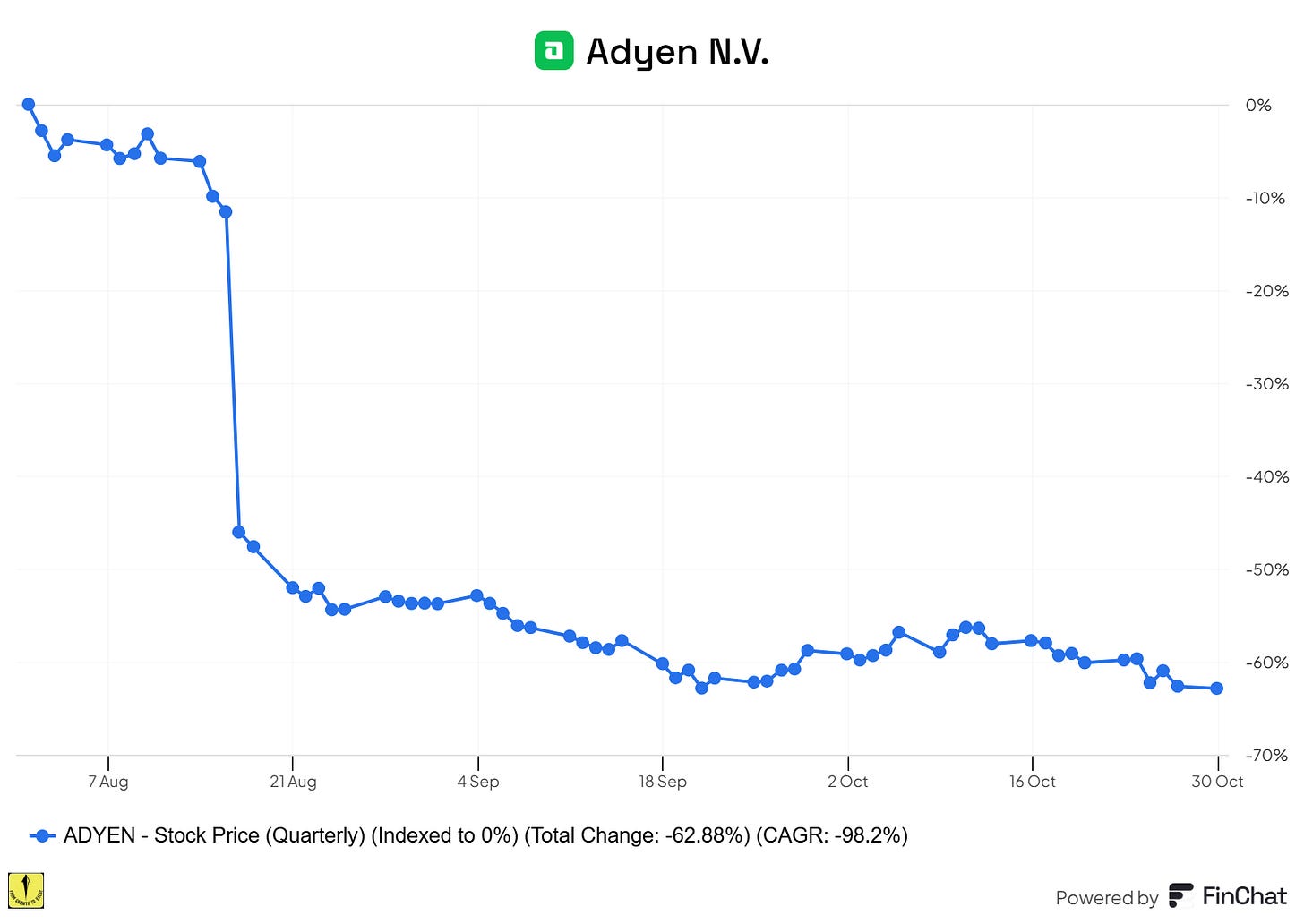

Remember that Braintree tried to compete with Adyen on volume. Adyen lost a bit of volume, which made it miss revenue by

The result was that Adyen missed the payment volume estimates by 8.1% and revenue by 3.6%, which caused a big drop for Adyen's stock.

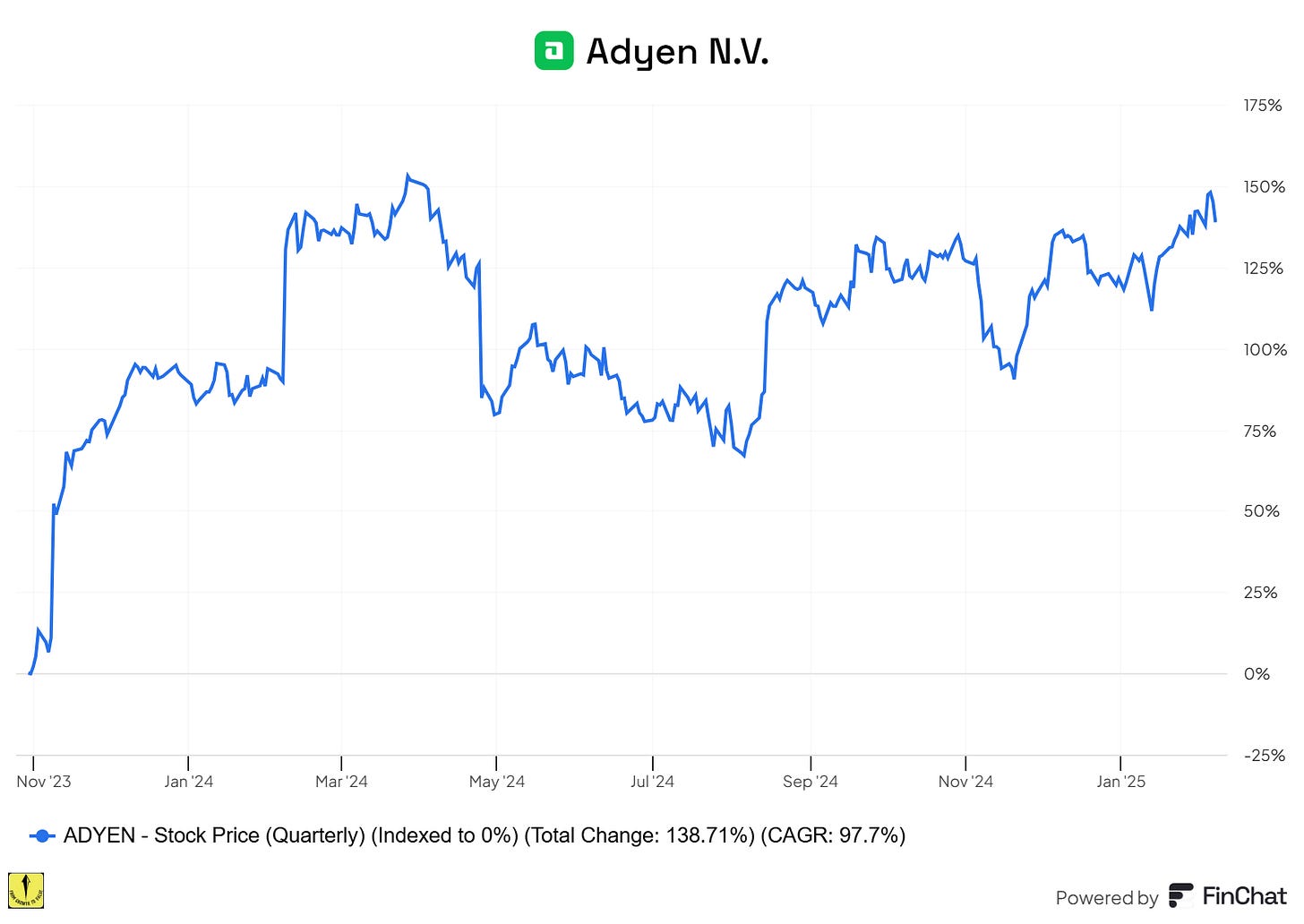

I was very vocal about this being a great opportunity. I made Adyen my biggest position during that period, wrote several articles explaining why, and posted numerous tweets. The stock has more than doubled in the meantime.

Adyen's management was very clear. Braintree fought for volume with Adyen, and this worked in the relatively straightforward North American market. However, Braintree priced its services below the cost to serve its customers. Adyen has by far the lowest cost to serve its customers, so all price wars are temporary, management argued.

Indeed, after just a quarter, Braintree already had to stop the losses it took with this strategy, which was one of the reasons for Adyen's stock to rocket.

Seeing Braintree cut more on volume for profitability can only be a good sign for Adyen.

Adyen reports its Q4 & H2 earnings on Thursday in the upcoming week.

I know that some Multis are long PayPal and may wonder what I think about the company's earnings. To me, PayPal is a value stock now. It has low single-digit growth and a big buyback program. The outstanding shares were down 6.5% year over year, and management announced a new $15 billion repurchase plan, which would mean almost 20% of the current market cap. Don't forget a quite substantial dilution, though. I think it could come down to about 15% in reality.

This is no longer a growth stock, but as a value stock, it could do relatively well. Don't expect a CAGR of 20% per year, but if you still like the company, holding it at this price is not bad.

But personally, I’m not interested, to be sure.