Hi Multis

It's Sunday and I know many of you are looking forward to this moment: The Overview Of The Week.

For me, it's still a pleasure to write, even if it's already episode 278. Yeah, you read that right, 278, not 30. I started on Seeking Alpha and there it’s the 278th installment of the Overview Of The Week. That's pretty crazy when I think about it.

By now, the OOTW feels both routine and remarkable at the same time. Routine because sitting down to write this has become a natural part of my weekend rituals. Remarkable because each week brings stories I never saw coming. Let's find out new stories together.

Articles In The Past Week

This is just the second article of the week. Some services brag when they hit two per week. In 2024, Potential Multibaggers averaged 4.17 articles per week. Maybe that was too much for some of you, but two feels low.

Last week, I mentioned I wasn’t feeling great. That continued. It turns out I needed a reset. I’ve been pushing hard, and my body finally said, “Enough.”

I don't have a burnout, don’t worry. But I’m listening to my body before it gets there.

It’s like investing. You give up spending now to build something bigger later. I’m investing time in rest, so I don’t pay a bigger price down the road.

That said, I haven’t stopped working. I’ve just shifted gears. Funny enough, with more rest, I feel sharper. More focused. The ideas come easier, and my writing feels stronger. I enjoy it more too, even though I thought I was at peak enjoyment before.

You could already see that this week with “The Q1 Earnings Cleanup Part 1.”

It’s a new format, and I like it. I’ll likely use it more going forward, not just to 'clean up,' but also during earnings season when the volume of earnings releases becomes overwhelming. It’s short, focused, and efficient. That doesn’t mean I’m dropping deep earnings dives. I’ll use both formats depending on the company and the story behind the numbers.

On Monday, you can expect part 2 of the cleanup, with the last four companies. The article is written. It just needs some editing and it's good to go.

Memes Of The Week

No memes this week.

Interesting Podcasts Or Books

This week, I watched an interesting YouTube clip that Brian Feroldi had pointed out to me. It's about 5 new Google AI tools and you can watch it here.

The markets in the past week

It's almost the same every week in the last three months: the markets were up again this week. The Russell 2000 was up 0.94%, the Nasdaq 1.02% and the S&P 500 1.46%.

Weirdly enough, the Greed & Fear Index dropped by 1 point, which means it went from Extreme Greed to Greed.

Quick Facts

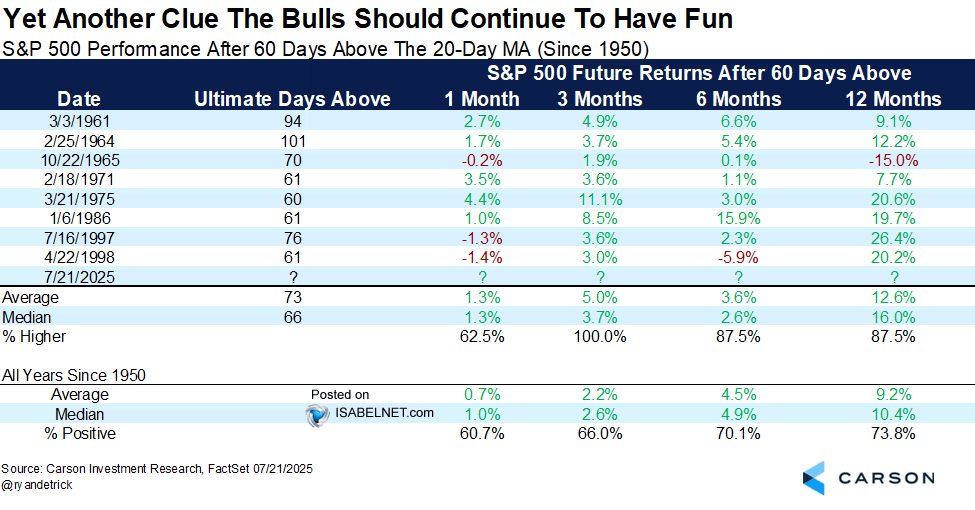

1. More upside?

The stock market has been up consistently. Here's a trading sign that this could go on.

When the S&P 500 stays above its 20-day moving average for 60 days in a row, history says the rally’s not over: +16% median return over 12 months, and up 87% of the time.

2. Fiscal(.)ai

Not really news, but I just want to point out how fantastic Fiscal(.)ai is. I use it multiple times every single day.

If I want analysts' estimates of revenue, EPS, EBITDA, FCF, or other metrics? Fiscal(.)ai.

If I want an earnings call transcript or the earnings slide deck? Fiscal(.)ai.

If I want to see what superinvestors have invested in? You guessed it, fiscal(.)ai.

I could go on and on: charts, company-specific KPIs you won't find anywhere else except if you pay 100x more, Morningstar research, insider ownership, a top-notch screener and so on and so on.

The great thing?

With my discount link, you get the Plus plan for just $244.8 per year and the Pro plan for just $652.8 per year.

Don't hesitate to try it out with this link.

If you’re still on the free plan, this is just a preview. The full insights are waiting on the other side. News about newer picks, all the picks, stocks on my radar… It’s all just a click away.