Hi Multis

I feel a bit like The Beatles.

Picture taken in Hamburg by Kris

Between 1960 and 1962, they famously spent their nights grinding in Hamburg clubs, performing nonstop, often seven hours straight, night after night. This brutal boot camp became the foundation of their success, shaping them into the band they became.

(Indra, one of the bars in Hamburg where The Beatles played, picture by Kris).

My stay in Hamburg was much shorter, and thankfully, my hotel had beds instead of the windowless room and bare floor the Fab Four had to use. So, it's not the same at all. But just like them, I left the city feeling a bit transformed. I learned a lot in a short time.

What exactly did I learn? It’s hard to distill into just a few sentences. I dove deep into Chapters Group, the company that made me go there. But through the conversations with sharp-minded investors and very insightful exchanges with management, I gained fresh perspectives about investing, strategy, and multiple industries.

I hope you find some of that in this Overview Of The Week and especially the upcoming weeks and months. As investors, you know that gains are worth nothing if they are not kept.

Articles In The Past Week

The last few weeks have been a bit calmer here at Potential Multibaggers. That's partly because of the earnings that are calmer but also because I had the feeling I had to study a lot. Reading and studying about companies will always be the substrate that I need to write and I had the feeling I did not have enough nourishing ground left to perform at my best level. The last few weeks have definitely increased that.

This week, I added to my Forever Portfolio and as always, I wrote an article about why I added to those positions and my full portfolio. You can read it here.

Memes Of The Week

This meme is in sync with the time.

The second one is one I made myself when I saw Jackson Pollock's famous painting.

Interesting Podcasts Or Books

This week, I didn't listen to podcast episodes (except for research but I don't want to talk about that yet) and I'm still reading the books I have been sharing in the last weeks.

The markets in the past week

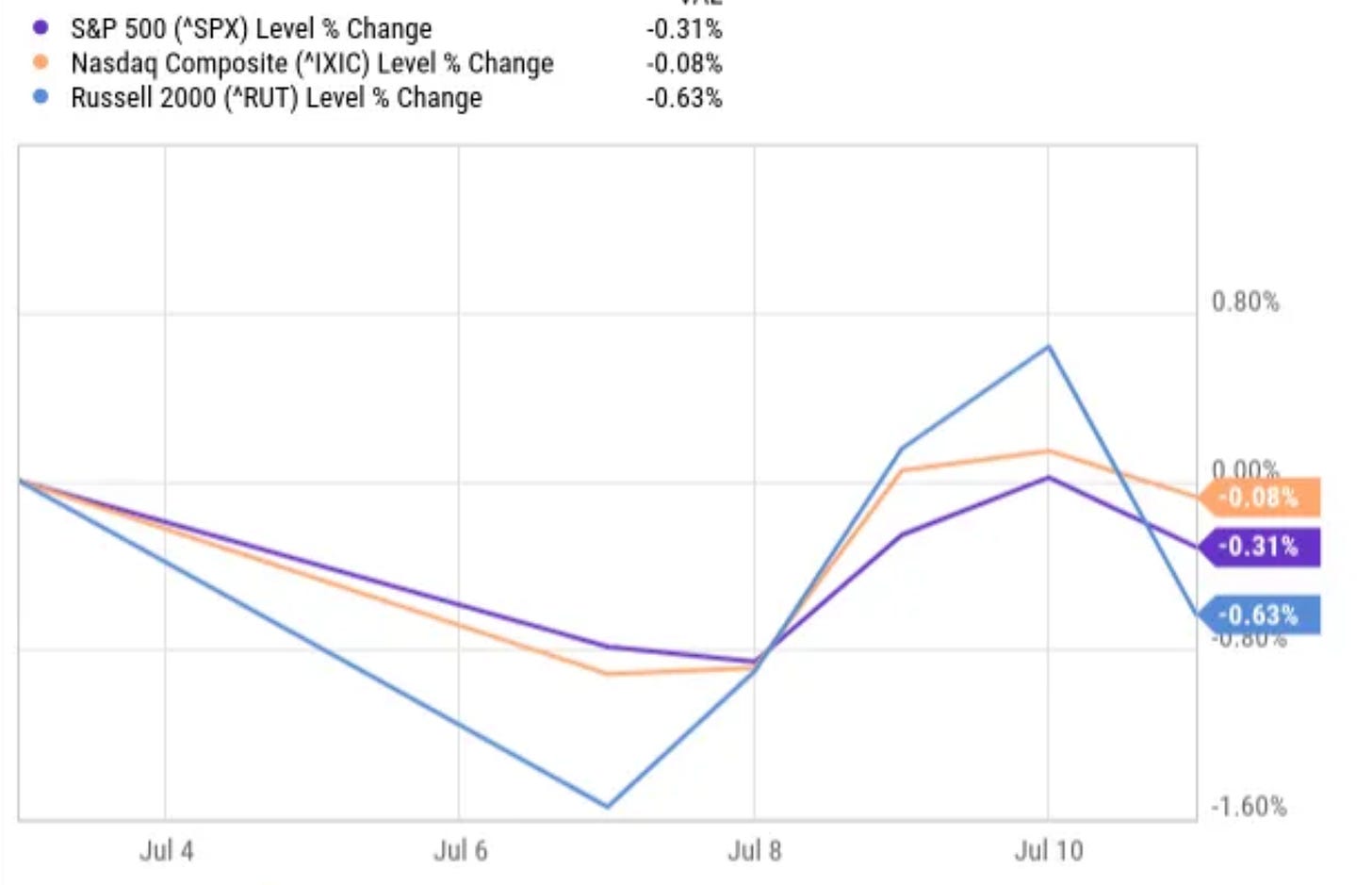

After weeks of markets shooting up, this week, the indexes were down a little bit. The Nasdaq was down just 0.08%, the S&P 500 0.31% and the Russell 2000, which is usually more volatile, was down 0.63%.

The Greed & Fear Index dropped a wee bit, but it remained in Extreme Greed.

Quick Facts

1. A ton of money on the sidelines

The market is full of contradictions. We just saw that the market is in extreme greed and at the same time, the money parked on the side has never been higher. A huge amount of $7.4 trillion stands parked in money market funds.

Of course, more money was printed and there's inflation, so this chart going up is normal. But with higher interest rates, it accelerated more. That also means that if the stock market drops substantially, there could be another 'buy-the-dip' moment, as we have seen so many times already in the last 15 years.

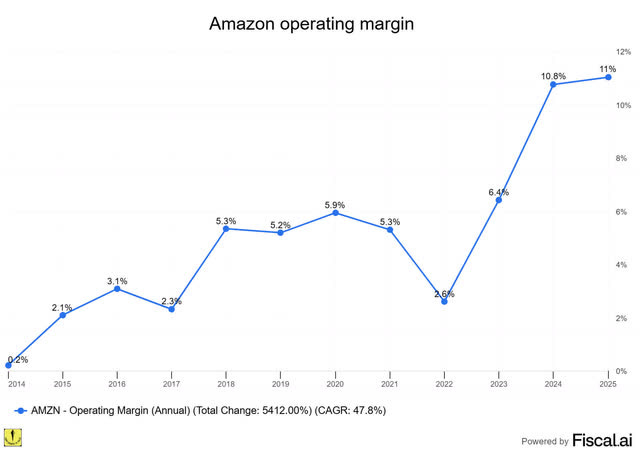

2. Amazon's 1 millionth robot

A week ago, Amazon launched its 1 millionth robot, up from zero in 2014.

Look at the operating margins over the same period.

(If you're interested in Fiscal.ai (formerly Finchat), I have a 15% discount for you.)

Of course, this is not just because of Robotics. We all know AWS is an important element as well. I think it's pretty safe to say both AI for Amazon's cloud arm as for e-commerce are still early. Amazon's robots already use AI in the fulfillment centers to decide on the fastest route but that's just one of the many use cases.

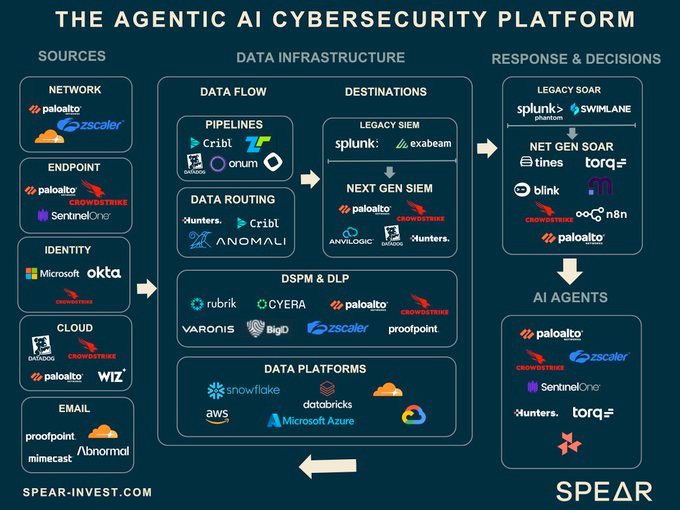

3. Agentic AI players

The agentic AI cybersecurity market is expected to reach $40B by 2030. That means a CAGR of 40%. Cybersecurity for AI agents will be extremely important. These are the players in the field.

I picked Cloudflare at $39 and CrowdStrike at $98, so I'm happy to see them both here too. I think this is fertile hunting ground for good investments.

If you’re already a paid subscriber, thank you. 🙏

You’re getting the full experience.

If you’re still on the free plan, this is just a preview. The full insights are waiting on the other side. News about newer picks, all the picks, stocks on my radar… It’s all just a click away.