Overview Of The Week 25: War, MEGA, And Rembrand

Your voice of reason in the markets

Hi Multis

I hope you had a great week. For me, I was struggling with the jetlag, but I don't mind it too much. That's part of the game and I always love visiting the US.

didn't get an Overview Of The Week last week, as I only got home on Sunday evening (and so tired!). That's why you will get more this week. Ain't that fun?

Ready?

Go!

Articles In The Past Week

This is the fourth article this week. Let's look back at the previous three.

The first article gave you the Best Buys Now.

In the second article, I evaluated Enphase's situation.

I also added to the Forever Portfolio this week. You can read which stocks I added and why in this article.

Memes Of The Week

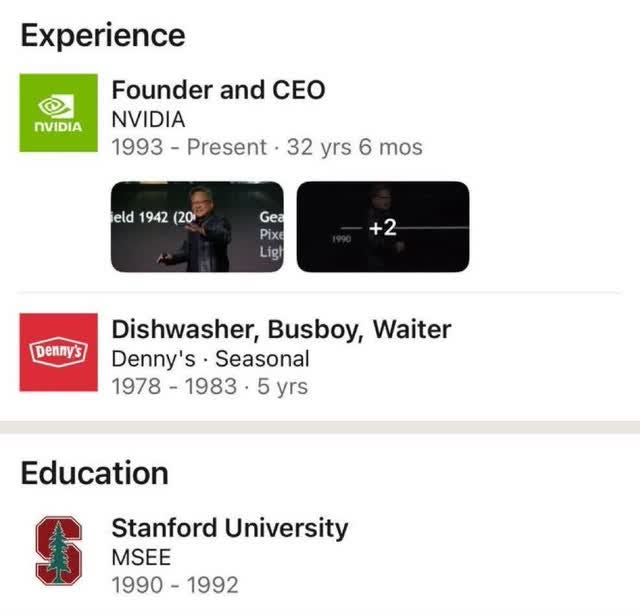

Multi Bep pointed out Jensen Huang's resume on LinkedIn.

Karan immediately saw what was wrong.

Just suppose... You rejected Jensen Huang. That's like the music manager who rejected the Beatles because "guitar groups are on the way out."

This was a meme I found.

For those who don't know, XRP (Ripple) is seen as a crappy stable coin by many crypto bros. The reason: it's centralized, Ripple, the company that created this coin, owns half of the total supply and because it's aimed at banks and financial institutions, which are mostly hated by the crypto community.

I also laughed with Nassim Nicholas Taleb's post on X.

Interesting Podcasts Or Books

For a long time, I listened to every single episode of Rule Breaker Investing with David Gardner, one of the people who has the most eloquent way to talk about stocks. He's an English major, and I have a linguistic background as well (a Dutch major), and in a way, I feel connected with him.

David Gardner is also one of the best investors that I know. He has at least picked 7 100-baggers: Netflix, Amazon, Tesla, Nvidia, Intuitive Surgical, Booking Holdings, Mercado Libre, and Chipotle. There may be more.

Unfortunately, a few years ago, he stopped picking stocks in his podcast. That's why I only listen to his podcast occasionally now.

One of the other things I have in common with him is that I also love board games. And that's why I also like the market cap game, which he invented and which was made better by his listeners.

Two analysts can guess the market capitalization of a company. Who's closest wins the point. The game is played every quarter, and this week, it was that time again. You can listen to the episode here.

The markets in the past week

We have two weeks to look at (because there was no Overview Of The Week last week). But let's first look at the past week.

We see something we don't often see: the S&P 500 is down by 0.15%, while the Nasdaq is up 0.21% and the Russell 2000 is up 0.42%.

So, how about the last two weeks?

Over that period, all three indices are down. The Russell 2000 by 1.08%, the S&P 500 by 0.54% and the Nasdaq by 0.42%.

The Greed & Fear Index dropped to Neutral territory.

Quick Facts

1. MEGA

For at least a decade, I heard some say at the start of a new year that European stocks would make a comeback. That prediction was always wrong. Well, up to now, maybe.

The US stock market has outperformed for 16 consecutive years, the longest series in history.

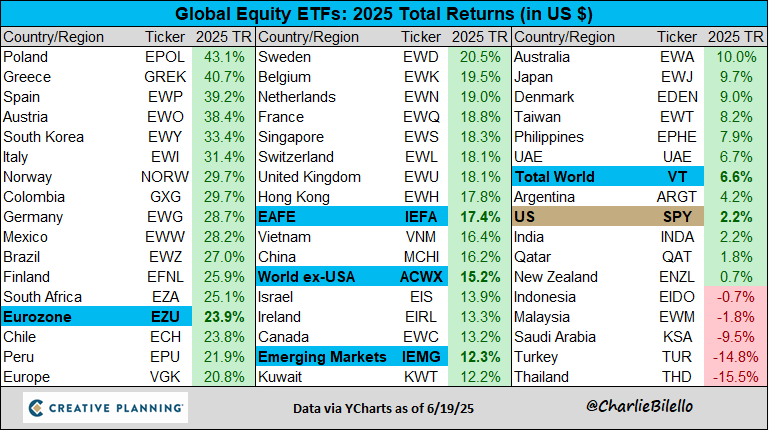

But this year, the mean reversion seems to finally materialize. Charlie Bilello posted this chart with the year-to-date returns.

While the S&P 500 is up a paltry 2.2%, stocks in the Eurozone are up 23.9% on average. Poland leads the way, with a return of 43.1%, but Greece, a former problem child, also performs well, with a return of 40.7% already. Spain takes the third step on the podium.

It looks like MEGA: Make Europe Great Again.

The dollar is already down almost 9%. As a European, mostly earning my money in dollars, that's quite a shave.

2. Iran

The US bombed nuclear sites in Iran this weekend. Potential Multibaggers is not about politics but about investing. The reason I bring this here is that with every war, negativity creeps into the investing world.

The futures and Bitcoin are currently negative, but not significantly so. Oil futures are up, of course. You read everywhere that Iran threatens to shut the Strait of Hormuz (see red box on the map).

However, almost nobody reading this, and probably most who write it, has any idea of the context.

First, the Security Committee in the Iranian Parliament, known as the Majlis, stated that it is studying the possibility of closing the Hormuz Strait. This is just propaganda. The Congress in Iran has very little real power.

Secondly, the Strait of Hormuz is split between Iran and Oman. The part of Iran is shallow waters, and the part in Oman is deep. That means that all the oil tankers that sail and out of the Gulf are in the Omani waters, not in the Iranian. If Iran wants to close the Strait, it would have to occupy Omani waters and start a war with Oman, which has a policy of 'balanced neutrality' and has helped Iran in the past to negotiate the nuclear deal with the US. In other words, this is already very unlikely. But there's more.

But Iran cannot block the Hormuz Strait. Seven navies guard the Strait: the navies of the US, the UK, France, India, Pakistan, Saudi Arabia and Oman. If that is not enough yet, a coalition of 34 countries backs them up. They operate from Bahrain. Their only job is to protect navigation with constant surveillance.

The firepower is overwhelming. Any blockade attempt would fail and Iran knows this.

Bottom line: they cannot block it.

Maybe you wonder if Iran can cause disturbances? Of course, they could. But they won't.

Why?

83% of the oil leaving the Gulf goes to Asia. That means Iran's partner, China, in the first place.

There's also India, with which Iran has the Chabahar Port project. It is a collaboration to develop and operate a deep-water seaport in southeastern Iran.

Chabahar, Google Maps

It can provide India with maritime access to Afghanistan and other countries without passing its arch enemy, Pakistan.

Therefore, China and India would be the primary victims, not the US or Europe.

On top of that, Iran would suffocate itself, as the oil and LNG exports are crucial for its economy.

3. Don't say Finchat, but Fiscal.ai

Finchat announced this week that it changes its name to Fiscal.ai and also announced that it raised $10 million in funding.

The platform gets more and more capabilities and with this money, it will only get better.

At Potential Multibaggers, we have been proudly partnered with this great platform and that partnership continues with Fiscal.ai. I get a lot of questions for partnerships, but I only have one. The reason is simple: I use this one multiple times every single day.

I have a 15% discount for everyone reading this.

Whether it’s scanning earnings calls, building models, comparing analyst estimates, making charts, or using AI prompts to uncover insights, this platform saves me hours of work.

If you’re serious about investing, I think it’s a no-brainer.

4. Stablecoins

Crypto bros rejoiced this week. Visa, Mastercard and Adyen shareholders not so much.

The reason? Stablecoins.

The US Senate passed a stablecoin bill this week. It aims to bring an end to the Wild West era for dollar-pegged tokens. The GENIUS Act, heading to the House in July, forces every stablecoin to hold full cash reserves: one dollar in the vault for every digital dollar issued.

Issuers get a choice to accept federal oversight from the Federal Reserve or face even tougher state rules. Issuers must publish monthly reserve reports and guarantee instant, fee-free redemptions. So far for operating in the shadows of the crypto underground.

These are like boring bank-style regulations that Wall Street loves, and therefore, everyone and their aunt is positive on stablecoins now, even if the act has not been voted on in the House yet.

It also means people think that if stablecoins are more generally used, companies like Visa, Mastercard and even players like Adyen will suffer.

I'm taking the opposite side of this belief. I believe the network will become even more valuable. Both Mastercard and Visa can easily work with stablecoins. As most merchants already use one of the two, they will use them to accept stablecoins.

For Adyen, the bull case also doesn't change: the company will become even more valuable.

Why?

Adyen (and to a certain extent, V & MA as well) is a play on security and programmability. The services added on top of the payments are what matter to merchants. Making sure there is security, customer insights, high acceptance rates and programming functionalities easily when they are needed. That's what Adyen excels at.

If you’re already a paid subscriber, thank you. 🙏

You’re getting the full experience.

If you’re still on the free plan, this is just a preview. The full insights are waiting on the other side.

Join today and get 20% off your subscription.

Stocks On My Radar

In the last few weeks, I did a ton of research. I always love that. That resulted in two new Stocks On My Radar.