Hi Multis

Here we are again with the Overview Of The Week!

Of course, as a paid subscriber, you will always get the most value and you will be able to read this whole article.

But as a free subscriber, I hope you will always learn something, too. If you want the full experience (with my real-money portfolio), you can always upgrade.

Memes Of The Week

It seems like the meme market production goes hand in hand with the market making new highs, so three memes this week.

I got this from a friend who is a value investor. :-)

The second one is not really a meme, but it's funny. It's from Calvin and Hobbes, one of my favorite comics of all time.

The third and last one for this week is looking forward to 2025.

Interesting Podcasts Or Books

Last week, I wrote this:

This week (and probably the upcoming weeks), I'm trying to finish some books. I'm always reading 8 to 10 books at the same time, so sometimes, it takes a while to finish them. That could (!) mean that I won't mention books here in the upcoming weeks.

Well, I have a confession to make... I started a new book, haha. And it's a GREAT one! Many of you may have already read it but I had not, so far. I am at page 175 and it's fantastic. I'm talking about the Elon Musk book Walter Isaacson wrote.

I was so absorbed by this book that I didn't listen to podcasts this week, but I have an interview ready to listen to tomorrow. It's Leandro's interview with Clay Fink of We Study Billionaires. It's a YouTube-only interview.

Leandro and I run Best Anchor Stocks, where Copart is one of the picks that has done really well. You can find Best Anchor Stocks here on Substack as well (and there’s very valuable free content!)

The markets in the past week

This week saw a big diversity in returns from the different indexes. The S&P 500 was up 0.96%, the Nasdaq 3.34% and the Russell 2000 lost 1.06%.

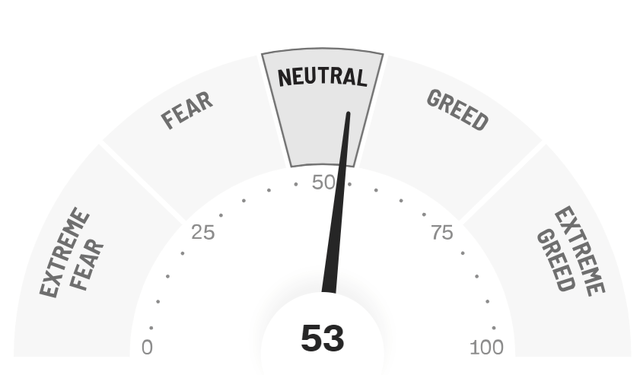

Weirdly enough, the Greed & Fear Index dropped from Greed to Neutral.

Quick Facts

1. Why Was Roku Up So Much This Week?

The stock was up more than 20% this week because an analyst launched the idea that The Trade Desk might buy Roku and other analysts then chimed in that this could be a good idea.

I'm not convinced. I believe Roku is valuable indeed, has great distribution and a ton of data. But for The Trade Desk, it would mean they go into SSP as well, as Roku has its own Roku Channel with its own content. Jeff Green has always said he doesn't want to go into SSP.

Of course, he could change his mind but why then, would he have just announced that The Trade Desk built its own operating system for CTV? I think a tighter integration between the two could be interesting but I see it as unlikely that The Trade Desk will take over Roku.

2. Shopify's & Global-e's impressive Black Friday - Cyber Monday numbers.

Shopify (SHOP) had impressive numbers to share from the Black Friday - Cyber Monday campaign.

It's great to see these numbers.

But Global-e (GLBE) announced even more growth from Black Friday - Cyber Monday. Revenue was up 43% year-over-year. Very strong.

3. Best FinX account

This week, to my surprise, I was chosen as the best FinX account in an online vote. I'm very honored. If you don't follow me yet you can do that here.

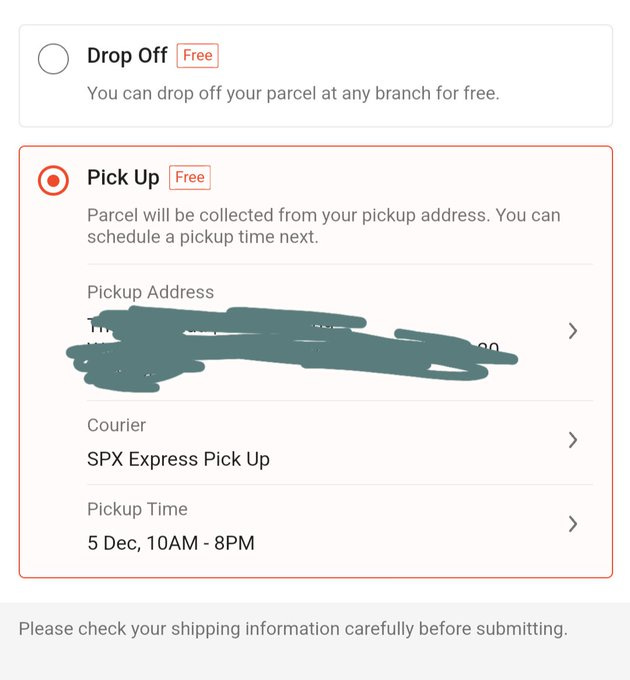

4. Sea's Shopee Now Also Does Pick Up

On X, Thomas Chua shared that Shopee now also does pick up. Coupang has already been doing this for quite a few years in Korea.

5. Why Company Culture Matters

Brian Feroldi shared this chart, with the Best Places To Work from Glassdoor, which outperform the S&P 500.

Stocks On My Radar

As I researched a lot, you can expect new Stocks On My Radar.

If you want, you can upgrade to read the rest. If not, thanks for reading!