Nu Holdings: A Buy?

A banking insider looks at Nu's earnings, I update the quality and valuation scores

Hi Multis

Karan here with my take on the Nu earnings. If you are newer and you don't know me, here's my banking experience in short:

I work in finance, for a large multinational bank, where I have a range of responsibilities primarily on the credit side in wealth management. I have past experience in transaction banking, equities technology, asset management and consumer operations.

So, from this perspective, I'm always happy to look at Nu.

Here’s an investment proposition for you:

Imagine you have a company built on a modern tech stack, operated by the founders to capture an underserved but huge and growing market.

Because of its technology advantage versus established incumbents, the company enjoys the lowest cost structure in its industry, is loved by its customers for its sleek and clean interface, and while it starts with 1 product, it routinely ends up using multiple ones in its daily lives and more of them as time passes.

This gives the company tremendous economies of scale as its cost to serve continues to go lower, the more customers it serves, and the company enjoys profitable, high double-digit growth in every market it launches in.

Up to here, it sounds like I’m talking about the likes of CrowdStrike, aren’t I?

Unfortunately, its customers aren’t sophisticated enterprise clients with multi-million-dollar contracts but low- and middle-income customers in South America who routinely have to deal with sustained, high inflation.

Furthermore, it earns revenues in Latin American currencies that routinely get routed via tweets in the middle of the night, while it reports results in dollars. This means their reported revenues and gross margins can swing by millions of dollars over a weekend. Finally, it’s a bank, something most people don’t really care for.

And because of all these reasons, NU has returned only 12% since its public listing in December 2021, underperforming the US financials ETF (XLF) but beating the Brazil ETF (EWZ), never mind high-growth companies that round-tripped in 2022 and back.

Now that I’ve scared you away from this company, you should ask – why bother even talking about such a risky company at all, exposed to Latin American economies, whose stock has behaved like a dog?

The answer, simply, is because it’s a great company.

In fact, it’s one of the two best banks I have ever seen (shoutout to Handelsbanken in Sweden for the other), which is saying something because most banks are terrible businesses with a laundry list of risks to manage. Hey, I live this life, so I know.

And because of the nature of their business mode, well-run banks can get punished for mistakes and get shuttered over a weekend – First Republic famously almost never lost money on its loans while Silicon Valley Bank rarely took much risk – both dissolved effectively over a single weekend thanks to a bunch of VC guys panicking in their WhatsApp groups.

Still, our philosophy around these parts is if we own good businesses with good fundamentals, the market will eventually wake up and reward them – we don’t know when, but like gravity, stock prices will eventually catch up to earnings growth. If that doesn’t happen, we should all just YOLO into crypto and call it a day because investing is truly dead.

And so, with that backdrop, once again, Nu Holdings (NU) delivered exceptional fourth-quarter results, although they may have been a bit more hidden if you only read the headlines.

Key Highlights

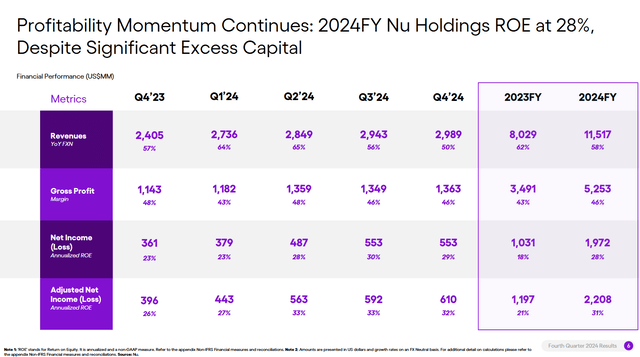

For Q4, total revenue reached $2.99 billion, representing a 24% year-over-year increase and a 1.5% sequential improvement from Q3 2024.

While this doesn’t seem like hypergrowth and Seeking Alpha reported this as a “miss”, the amount of FX headwinds the company had to deal with was comical. On an FX-neutral basis, the revenue growth was actually 50% YoY and 9% sequentially.

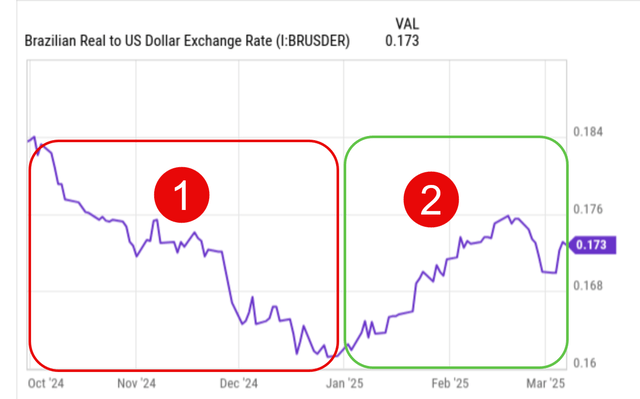

Kris has already shared this graph before in the Best Buys Now article.

This review is about period 1, where the Brazilian real lost a lot of value versus the dollar. When you look, you see that in the current quarter, Q1 2025, it looks completely different up to now. But for the rest of this article, you should think about the effects of FX on the results.

The key thing is that this revenue growth was primarily driven by higher interest income from the credit portfolio expansion and increased transactional activity across the platform, which is what you want to see. The monthly average revenue per active customer ('ARPAC') grew to $10.70, representing a 23% year-over-year increase, as Nu successfully deepened wallet share among its customer base.

This metric reflects Nu's effective strategy in transitioning customers from single-product users to adopters of multiple services across banking, credit, insurance, and investment products.

GAAP net income came in $552 million, adjusted net income for the quarter surged to $610 million, marking a whopping 87% increase (FX-neutral) compared to the same period last year. This translated to a GAAP EPS of $0.11, effectively matching estimates. The company's return on equity ('ROE') remained strong at 29% despite an arguably over-capitalized position (meaning they are very conservative).

Long-time readers also know that I love NU’s IR team for their charts that do most of the talking, so instead of typing out everything, I will supplement them instead so it’s easier for you to skim through.

We’re going to divide the rest of this piece into things that we track for our thesis, specifically: Customer acquisition, Profitability, Credit quality, Product portfolio and Geographic footprint.

Customer Acquisition

Customers keep going up, and the Activity Rate remains stable. As a reminder this is monthly active customers divided by total, so 83 out of 100 customers use NU regularly in a month, which is tremendous given the growth we’ve seen in just a year.

Profitability

Everything is up by double digits for both Q4 and FY 2024 on a YoY basis – the company is not showing any signs of slowing down.

We get a glimpse here of the tremendous growth embedded in the business without the FX headwinds, This matters because at some point, these will turn into a tailwind and so it’s important to keep perspective when that happens and not that NU suddenly accelerated.

How are they able to do this? A reminder of the most awe-inspiring chart:

This will never stop being wild, especially the fact that costs not only stay stable but actually come down. And that’s how you get a structurally advantaged business that can get operating leverage from its growth:

An efficiency ratio of 30% - I would buy this bank solely on these two graphs – absolutely incredible. As a reminder, the best bank in America, JP Morgan, (JPM), pays its CEO millions for a best-in-class efficiency ratio of 53%. Of course, JPM is much more mature than Nu.

Credit Quality

The bread and butter of a bank, how responsibly it can lend to its customers – remains strong and growing at a healthy pace.

Surprisingly, delinquencies have come down since peaking in Q1, showing NU’s focus on bringing risks under control, something they told us would happen. 90+ continues to remain stable after going up in a straight line, showing some signs of stabilization. We see the same thing when dividing the delinquencies by the interest-earning portfolio. This is great news and shows there is no sign of deterioration at the moment

One of the reasons it's able to do this is by introducing an easy way for affected customers to restructure their debt (aka renegotiation, where customers can get a lower interest rate by converting their unsecured balances into instalment loans)

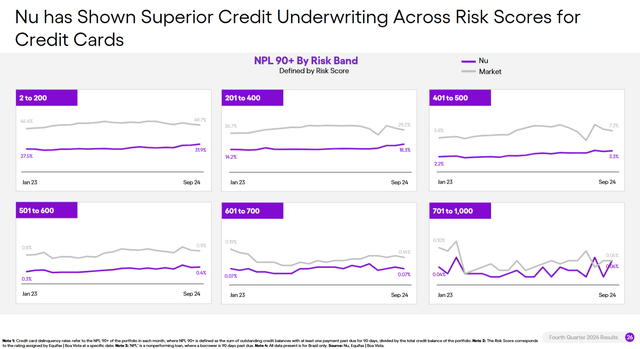

Channeling their inner Upstart, NU also showed their underwriting performance vs. an average of the markets they operate in and were better across the board across all risk scores.

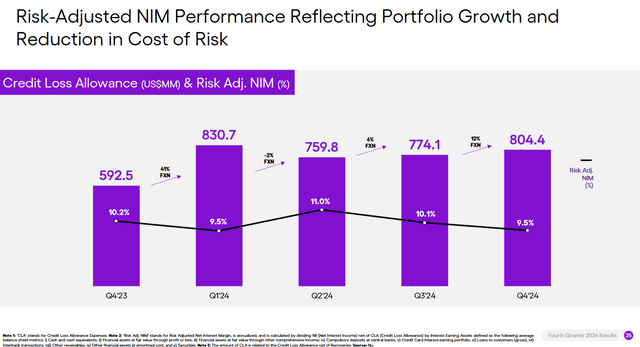

Finally, the proof that NU knows a thing or two about risk management shows that their credit provisions are growing slower than their portfolio, indicating an improvement in the portfolio’s quality and NU’s confidence in the risk they’re taking.

The following chart is generally meant for analysts and not individual investors but I’ll toss it in here because it makes NU look great:

In simpler terms, NU’s cost or risk is reducing at a higher portfolio balance while they’re defending their margins, showing a good trade-off between risk and return.

Product Portfolio

Ok, chart storm incoming because this is how NU makes money, but the headline is “Everything went up.”

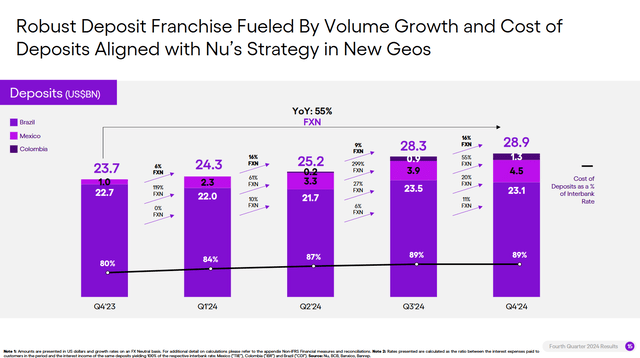

Deposits:

More customers are placing more of their savings with NU across markets. Don’t be put off by the minor reduction in Brazil; that’s just FX. On an FXN basis, every market grew by double digits.

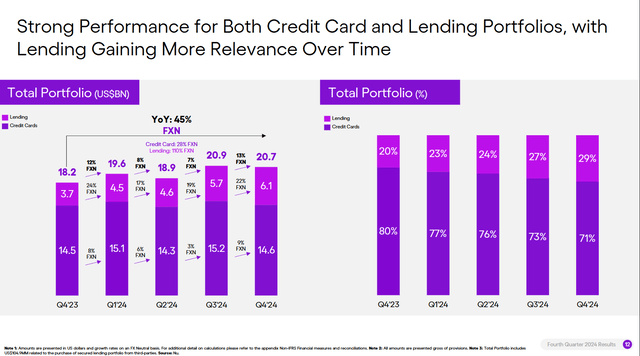

Loans And Credit Cards:

Remember, originations is just another word for new loans, so folks continue to borrow in Brazil.

Same story here, except on an FXN basis, the growth was actually the fastest compared to any other quarter in the year.

Revenue Per User increased due to cross-selling:

Key Related Highlights

61% of active customers now use Nu as their primary bank (up from 60% in Q3). Customers hold an average of 4.1 products, slightly up from 4 in Q3, as cross-selling efforts remain strong. Mature customer cohorts generate a significantly higher $25 ARPAC (average revenue per active customer) per month; this is a strong indicator of future growth.

This is why NU continues to gain market share in Brazil even after banking basically everyone.

In this chart, pink is NU, while blue is competition.

This chart shows us that NU carries lower revolving balances as a percentage of its book and higher installment balances, with the lowest non-interest-bearing percentage.

For those who are unfamiliar with the difference, it’s best to understand it as follows:

Revolving balances are like your credit card outstanding balances, where you only pay the minimum due and roll over the rest. Yes, the bank earns higher interest from you, but the odds of it snowballing are higher and can lead to losses from those who can’t pay it back or need to renegotiate. Hence, while this revenue is the most profitable, it’s also the most volatile over a cycle.

Installment balances are your classic personal loans or credit card balances that have been converted to installments. These are almost always lower interest rates but more stable since the rates are generally locked in at the time of approval, and the customers can see how much they have to pay. So, this is less profitable for the bank but leads to lower delinquencies in general and is a more stable revenue stream.

Non-interest-bearing balances consist of both transactors (people who pay off their balances in full) or buy-now-pay-later arrangements where a customer converts an amount into 0% installments over a short period of time – here; the bank won’t earn interest but probably a little from interchange fees.

That said, purchase volume also showed growth, showing that the transactors on NU’s books also continue to spend on their cards.

So, in summary, NU’s mix minimizes the non-interest portion but has a higher proportion of installment balances, which helps it better manage its risk as the portfolio grows. This is what drives the net income in a stair-step manner.

Performance in Key Geographies

Brazil

Nu maintained its dominant position in Brazil, where it serves over 100 million customers, representing approximately 58% of the adult population. They continue to add an average of a million new customers every month. Will every Brazilian eventually have a NU relationship?

Mexico

Nu's Mexico operation showed tremendous growth, with its customer base reaching 10 million and about 12% of its adult population. This was up 91% YoY. Both deposits (up 438%!) and credit cards grew(up 70%), hinting at the exciting possibilities that await when NU hits critical mass in the country. This will only improve as NU slowly normalizes deposit rates which are currently elevated to draw in customers and will come down over time.

Colombia

The Colombian market, Nu's newest geography, continued its rapid expansion, up 213% with the customer base now hitting 2.5 million & deposits now up to $1.3 billion. Similar to Mexico, there are higher rates to attract customers, which will come down over time. This already makes NU a top 5 deposit-taking bank in Colombia, which is very impressive.

Conclusion

Before we go to Kris for the quality and valuation update, first, my conclusion.

Once again, Nu helps me. It’s easy to rate a company’s year when they publish their own scorecard and compare it to their targets. I wish more companies would do this (publicly).

I would argue the company hasn’t quite “won” in Mexico yet, although growth has been phenomenal.

They definitely ramped up secured lending (specifically payroll loans) and high-income customers in Brazil. The secured lending portfolio in Brazil surged 615% year-over-year to $1.4 billion, driven by nine new agreements with public sector collateral counterparties. This expanded the total addressable market ('TAM') for payroll loans to 70%.

The platform also made progress in bringing more customers into NU’s ecosystem, which drives the high activity usage.

When I factor in the amount of FX and macro volatility the company has had to go through with the collapse of the Brazilian real (Brazil is by far their biggest market), political instability, as well as economic slowdowns, I’d give the company an A+ for 2024.

Frankly, this company is the gold standard when it comes to operational excellence across the board – credit, profit, revenue, customers – they did it all. Yes, there are pressures, but will I forgive them for a slight compression in NIM (net income margins) and a slowdown in PIX financing? Absolutely, running a bank is hard, NU is better than any management team in managing an absolutely crazy environment. In fact, I give them credit for putting PIX financing on pause because it wasn’t meeting their expectations so they will only launch a revamped offering when they are convinced it will be beneficial. The best companies don't only look at opportunities but can also say no to things they have already rolled out before.

Nu has done this responsibly and that's why the company is in great shape for the future, with more than enough cushion to withstand whatever volatility will continue to come their way.

Speaking of the future, NU laid out its priorities for 2025 as follows:

We need more color on what this will look like, but stock price performance aside, the future is bright for this company, and its customers are likely the ones to benefit the most. If the company continues to execute like this, I'm convinced investors can join in as well.

The Quality Score And Valuation Update

Kris here. I really enjoyed that earnings analysis from Karan. Having an industry insider is terrific. I know Karan better than most of you, and he'll hate me for saying this, but he's extremely intelligent, very broadly interested, a ferocious reader, and an industry insider who sees the strengths and weaknesses of the system much better than most others. It helps me with my confirmation bias to know Karan sees the same things (and more) than I see at Nu. That's why it's one of my highest-conviction stocks.

Will that be reflected in the Quality Score again? And is the stock attractive to buy now? And how do the two add up? That's what we focus on in the next part.

To know how attractive the stock is right now, upgrade NOW with this 20% discount!