Launching A New Portfolio And Service

Sharing My Biggest New Position and announcing much more!

Hi friends

Last week, I launched the Forever Portfolio. That’s my new portfolio, where I start from scratch. I invested the first $11K.

The Goal of the Forever Portfolio

The goal is straightforward: buy great companies and not sell them, unless the investment thesis goes belly-up. Only by investing for the long term, forever, as it were, you give full room to the magic of compounding. Never forget this.

It's a strategy that requires patience and equanimity, but history proves that this approach can lead to incredible returns.

The paid subscribers to Potential Multibaggers (get your 20% discount here) already got all my positions, as I always share them right after I buy. Often, I also share what I think of buying in the days beforehand.

But before I give away my biggest addition to the new portfolio, and therefore currently my biggest position, I want to share exciting news.

In two weeks, I’ll launch a paid version of Multibagger Nuggets. There, I’ll share much more in-depth analysis, all the additions to the Forever Portfolio (I invest every two weeks), new stock picks, my quality and valuation scores of all the picks, a weekly Overview Of The Week and much more that you won’t want to miss.

I’m committed to make the free content here more valuable as well, so don’t worry about that. You’ll get more free insights here as well. More about the paid version launch soon. For the people that pay a gift now, I’ll contact you and give you the alternatives of being paid back or an additional discount for the new paid version. There will be a launch discount for everybody, but you deserve something extra.

My Biggest Position: Mercado Libre

My biggest position in the brand new Forever Portfolio is Mercado Libre (MELI).

If you have followed me for a while, you know that I love Mercado Libre a lot. My love is tough love, though, as it’s always based on numbers. Since 2022, I score my picks on quality and valuation, so it’s not just an intuitive decision to like certain stocks more than others. These scores are updated every quarter and that’s also what you’ll get if you become a paid subscriber. I’ll give this one to everybody, though, as I want you to judge if it’s valuable for you or not.

Personal conviction 10/10

Since January 2024

This is mainly my or your own conviction based on everything I/you know about the company. Your own conviction may be very different here and you can adapt this score to your own liking.

Paid subscribers will get the scoring sheet, so they can give their own scores alongside me.

In January this year, I finally caved and gave Mercado Libre a 10/10 personal conviction score. This was not a rash decision because of the market it operates in—Latin America is less stable. But Mercado Libre has proven for 25 years now that it can navigate difficult economic situations. Its 42% revenue growth in US dollars (113% FX-neutral) shows that the company keeps operating in beast mode.

Profitability 10/10

Raised in January 2024, up from 8.5

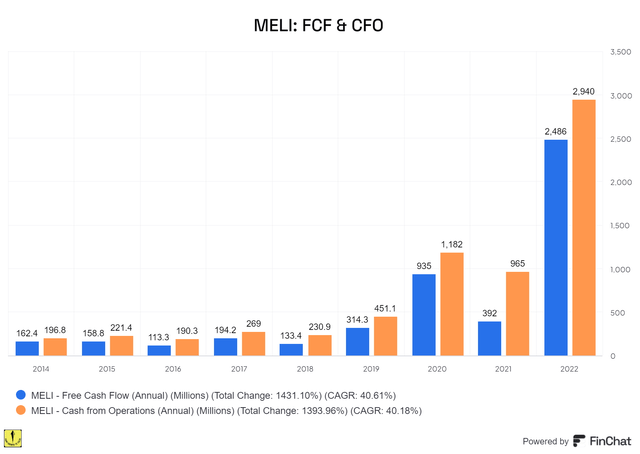

I always first look at Free Cash Flow and Operational Cash Flow (=cash from operations). Both have trended up impressively for Mercado Libre. And mind you, Mercado Libre invested in fulfillment all the way through.

If you want to know how impressive this is, this is Amazon (AMZN) versus Mercado Libre.

Now, if you think that this is because of a special situation in the last three years, that's not the case. Just look at this 15-year graph.

This is not against Amazon, of course. I'm a shareholder of both, but one is a bigger position than the other. And I know that Amazon has been investing, but so has MELI, which built out its entire fulfillment network in the last few years.

============================================================================

If you like Amazon as well, it’s covered extensively at Best Anchor Stocks, just like many other picks with lower volatility and the potential to beat the market.

============================================================================

Mercado Libre is also very profitable on a net income margin.

In Q2 2024, net income on a GAAP basis was 10.5%, which is spectacular for a company that grew its revenue by 42% in that quarter. There was a one-time tax hit in the Q4 2024 quarter. The company is back to strong profitability now.

Mercado Libre has been flexing its profitability muscle over the last few years. And I reward it with a perfect score. 10/10.

Sales efficiency 10/10

Unchanged since September 2022

The sales efficiency score first looks at the marketing efficiency by looking at what percentage of revenue goes to SG&A (selling, general and administrative) and how much revenue growth that brings in the trailing twelve months and what is expected next year. I divide the average of those two by the SG&A number as a % of revenue and that is marketing efficiency. I then multiply that by the gross margin to look at sales efficiency.

Of course, this formula is far from perfect, but it gives you some idea of how well the company sells its product. There are plenty of nuances to add here, but the numbers are what they are.

Since I started using the Quality Score, Mercado Libre has had a 10/10 score.

Innovation 5/5

Since January 2024

This is part subjective, part measurable. Subjective as in: how many new important products does the company issue versus its competitors? You can partly measure that, too, if you want, but the magnitude of the innovations is much more important than the sheer number of innovations.

As for measuring, you can look at the percentage of revenue that goes to R&D. However, I also want some efficiency there, so I look at R&D efficiency by dividing revenue growth by the R&D expenses in the previous year.

Mercado Libre spent 10.85% of its revenue on R&D in 2023.

With revenue growth of 42% in Q2 2024, the R&D efficiency is 3.87, which definitely puts Mercado Libre firmly in the top quartile, based on the 2015-2018 numbers. It does even better than the previous quarter, when it scored 3.32.

Throughout the years, MELI has proven that it can launch and nurture very valuable new products. Think of its payment arm Mercado Pago, for example, or its ads business and, more recently, Meli+, the company's subscription service similar to Amazon Prime. In this quarter, management also talked about how it integrates generative AI.

Because innovation is not just throwing out new products and see what sticks, but also and maybe primarily a matter of execution, I maintain Mercado Libre's score of 5/5. Oh, boy, isn't this getting too freaky, with all these maximum scores? Am I a fanboy of MELI? Well, I am, but I just look at the numbers to give my scores. The only total exception is the personal conviction score, which is totally personal, as the name suggests.

Must-have? 4.5/5

Since August 2024

I introduced it because of what Matthew Prince, the founder and CEO of Cloudflare (NET), said:

I think that the world is about to get sorted into must-haves and nice to haves.

Is Mercado Libre a must-have? That's a hard one and the answer will be 'it depends'. People often prefer online shopping to physical shopping when they are more money-constrained, as they know that prices are often lower and they are less tempted to buy other stuff they don't need.

Mercado Libre might benefit from this. However, discretionary spending would go down, a force that could pull down Mercado Libre. In 2021 and 2022, spending remained very high on Mercado Libre, though. And if you look at the period 2014-2016, which is called "The Great Brazilian Recession," you see this.

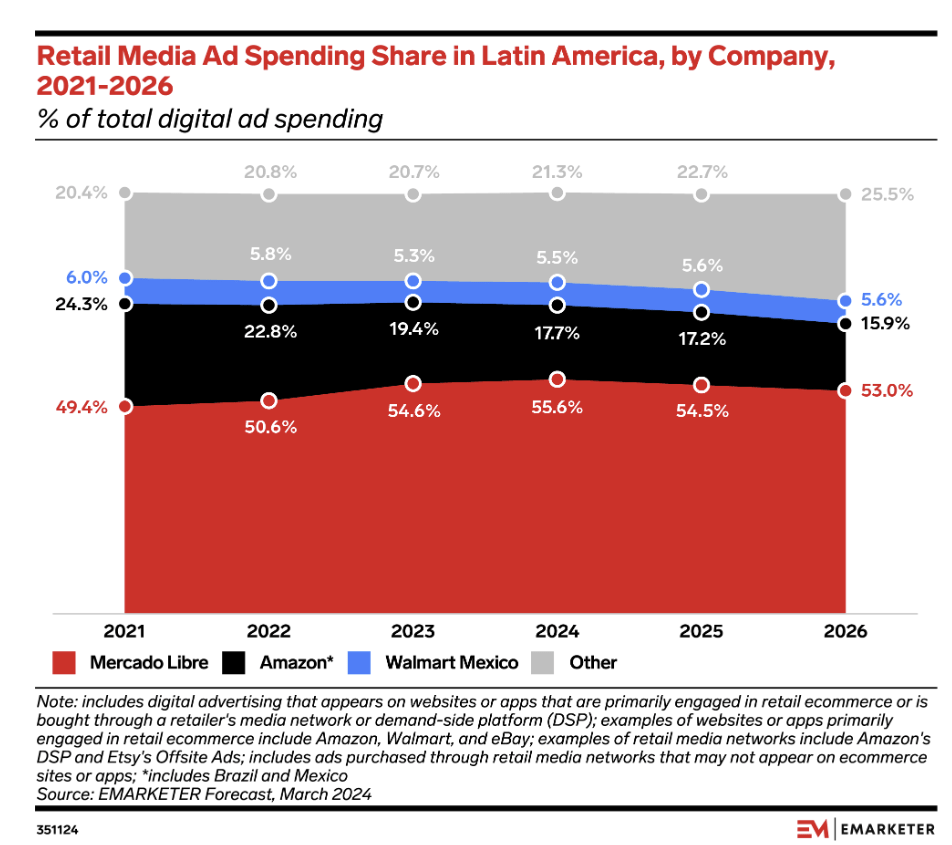

A CAGR of 33% during the worst recession in decades? Most companies would give an arm and a leg to have that during the best of times. I have always given Mercado Libre 4/5, but the fact that it's gaining market share versus Amazon in advertising shows me that this company is something special.

Revenue growth 5/5

Unchanged from the start

This is very simple: how high was the revenue growth over the last twelve months?

For Mercado Libre, that is 42%, so that deserves a clear 5/5, no discussion.

Revenue growth durability 10/10

Unchanged from the start

Even more important than revenue growth is the durability of revenue growth.

Management Quality Score 10/10

Since June 2022

Great management is often one of the most important keys to long-term success. I look at the track record here, so execution and the vision.

I see a fantastic track record for Mercado Libre in a region that's harder than in the US. Argentina, Mercado Libre's home turf and its second-biggest market (after Brazil) for a very long time, has seen extremely high inflation for years, culminating in a whopping 236.7% now but down from 292.2% in April.

That's just insane. Nevertheless, Mercado Libre has achieved 42% revenue growth in US dollars! That's an Olympic golden medal in pricing power. It even grew in dollars in Argentina in this quarter. Can you imagine?

MELI is very adaptable and changes quickly if necessary. Marcos Galperin has instilled a company culture like few others have done before him. But his co-founder, Stelleo Tolda, is often not appreciated enough. He successfully launched Mercado Libre in its biggest market, Brazil. He was the leader there too for the first 10 years, before becoming COO of the group and Executive VP for Latin America (which is all of the company's market).

I will examine this question more in the future: How deep is management quality? This is inspired by Phil Fisher's 15 questions. I refer to question number 9 here.

I had an interview with Fede Sandler earlier this year. Fede is the former IRO (Investor Relations Officer) of Mercado Libre. He touches on this subject and shows that Pedro Arnt, Mercado Libre's CFO for years but now the CEO of DLocal (DLO), was perfectly replaced from within the company.

He also talked about this in the interview we had last year. You can watch that interview here.

It's not always easy to measure the depth of management quality. But in the case of Mercado Libre, I'm pretty confident.

Insiders' Ownership 5/5

Unchanged since January 2024

Does management have skin in the game? This is out of 5, and not 10, as it is not always a make-or-break but often it's a valuable indication.

For Mercado Libre, the only insider with a stake bigger than 1% is founder and CEO Marcos Galperin, although it's through a trust.

At the current price of $1,963, this means about $7.5 billion, which is fantastic and deserves 5/5.

Multibagger potential 5/5

Since January 2024

To look at multibaggers, the law of large numbers plays a role, which means it's harder to grow your revenue as much in percentages when your revenue is larger. Mercado Libre already has a market cap that’s close to $100 billion. But you shouldn't forget that Latin America is the fastest-growing e-commerce market in the world and that won't change anytime soon.

Combined with new projects just starting out like advertising and Meli+, Mercado Libre's subscription business similar to Amazon Prime, I think the chance that Mercado Libre becomes an absolute juggernaut is realistic. Could it be the first $1T Latin-American company? Who knows, but that won't be for anytime soon. Not in the first years.

Nonetheless, the fact that I even consider such a market cap means that I think Mercado Libre's multibagger potential is big, and hence, I give it a score of 5/5.

TAM & SAM 4.5/5

Since August 2024

TAM stands for total addressable market and SAM for serviceable addressable market, the market you serve because of your specific product and geographical limitations.

In this case, the SAM is limited, as Mercado Libre is focused on Latin America. This is a huge market, and it's growing rapidly, but I used to knock off a point for this limitation. However, the economy in general will probably grow so much in Latin America over the next decades that I give 4.5/5.

Financial Strength 8.5/10

Since June 2024

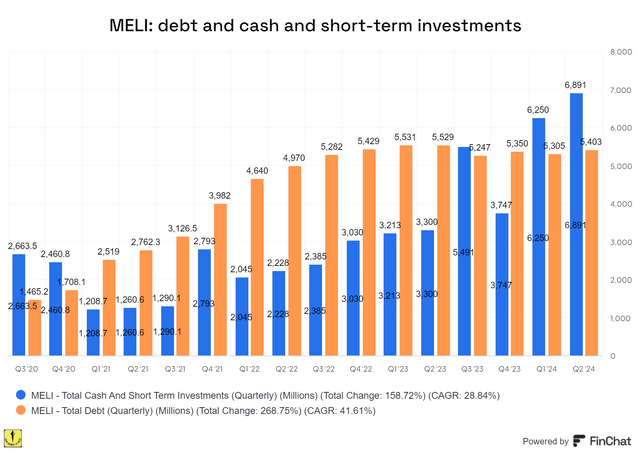

Let's make this simple with a Finchat chart.

There is more cash than debt, that's great. And as the debt has gone down a bit and cash up, that's good as well. But don't forget that with more credit, there will also come more debt. That's OK, though.

Negative Scores

I also have negative scores, which means I am subtracting points from the score so far. The scores are marked out of 5 because a lot is implicitly captured in the other numbers already.

Risk 1.5/5

Since August 2024

A lot is already baked in financial strength, but this is an overall risk score that shows more than just financial risk.

For Mercado Libre, I used to give 2/5. The company is in a region of the world that is a bit less stable, but it has found a way to navigate the problems for 25 years now. That deserves knocking off half a point.

Competition 2/5

Since the start

How strong is the competition? Again, you can't objectively measure that but there are indications.

Mercado Libre is the big gorilla in the room in Latin American e-commerce. It's the only player all over Latin America, and there is a reason Morningstar puts it in the "wide moat" category. At the same time, I don't want to put the score too low, as competing with Amazon (AMZN) on its core competency and with many local players is intensive.

Dilution 1/5

Since August 2024

I used to call this SBC (stock-based compensation), but dilution is a better term, as it is broader. Dilution is negative over the long run, but that doesn't mean that companies should not issue stock when they are still growing fast. At the same time, I don't want to ignore dilution completely, so I give a negative score.

We look at this over a 3-year period to exclude missing something.

This is Mercado Libre's evolution of outstanding shares over the past three years.

As you can see, there's a total dilution of 0.55%, or a CAGR of 0.22%. That's low, but I don't want to fully ignore it. The number of shares has slightly increased since the last update, so I give a 1/5 now.

Scale advantages shared (-5/+5): 4/5

Since July 2022

I introduced this concept in this article. When I looked back at some of the best investments, they did not only have substantial scale advantages but also shared them with their customers in some way. For Amazon or Walmart (at the time), I think this criterion is obvious. Because they are bigger, they can give their customers better prices.

Google has always had a scale advantage: the more people use their products, the more they can give away for free. While Google leveraged people's data to generate profits, this mechanism also enabled Google to offer so much for free (Gmail, Fotos, Drive storage up to a certain limit, etc.).

I have not come up with this concept myself. This is one that I borrowed from Nick Sleep from Nomad Capital. He uses this concept to guide all of his investments. That's why he started investing in Amazon in 2003 already. He has mostly held on to that position to now. He did the same thing with Costco, another company that shares the advantages of its scale with its customers, by only charging 15% on the purchase price, no matter what. This makes these companies almost impossible to compete with unless you start doing exactly the same thing.

The most prominent advocate of this? Jeff Bezos, who made this napkin sketch about it.

So, this competitive advantage can be significant. I'm going to withdraw or add points with this criterion. For some companies, extra scale only adds extra complexity. Those will get a negative score. I think of Uber (UBER) here, when it comes to its taxi business (food delivery already shows a bit more scale advantages shared). The normal scaling is the second level, which will be given some points. This means that if you grow, your scale gives you cost advantages. The third level is where all users also benefit from the scale. Here, you will see higher scores, 4/5, maybe 5/5.

For me, Mercado Libre is a clear third-level cost-advantage-shared. In the Q2 2024 earnings call, management talked about the win-win that the integration of Mercado Pago and Mercado Libre brought. I rate it 4/5. It follows Amazon's steps closely.

Conclusion Quality Score

The Quality Score went up again, from 86 to 87. Mercado Libre remains a top-quality company and that shines through in all the numbers.

The QPI update

For the Quality-Price Score, we first need the valuation Score.

Valuation 8/10

No matter how you do them, valuations remain a bit tricky and subjective. As long as you know that, it's not a problem. Be wary of false precision because valuations are always just guesses. That doesn't mean these guesses can't be useful, of course.

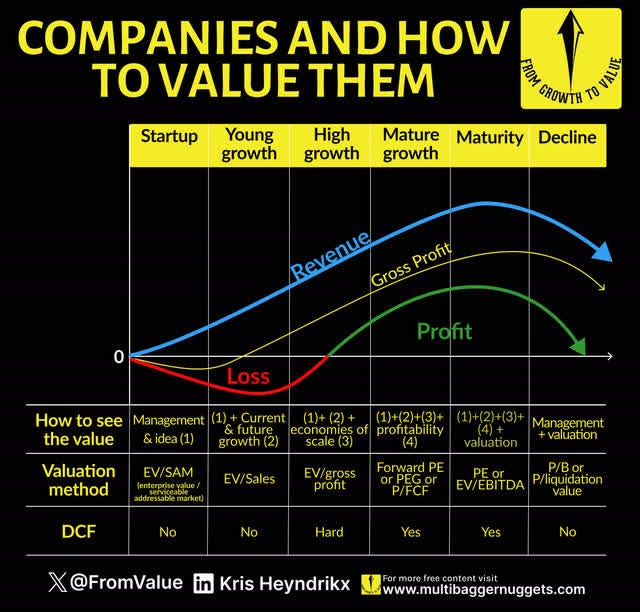

This is how I value stocks, depending on the stage they are in.

With 42% revenue growth, I would argue that Mercado Libre is still in high-growth mode, even though they recently celebrated its 25th birthday. So, let's first look at EV/gross profit.

As you can see, the stock trades at 10.5 times EV/gross profit, which is historically low. Before the big tech crash in 2022, only in 2016 the stock traded at this low multiple.

We also get this handy overview per year.

So, except for 2022 and 2023, the valuation has never been this low on average.

If we look at the Price/free cash flow, you see that the stock currently trades at 16 times FCF.

We should not focus too much on FCF, though, as the company still invests a lot in its future, so FCF streams can be very volatile. The forward P/FCF, for example, stands at more than 30. This is not the right metric for Mercado Libre at this stage of growing 42% YoY.

I also like to look at the forward PEG.

As you can see, the 2024 PE stands at 52.64, which may look high in isolation, but there's 63% EPS growth as the consensus. That's a 2024 PEG of 0.83 (52.64/63.27). Peter Lynch taught us that a PEG below 1 is considered cheap, between 1 and 2 fair and above 2 expensive. I have been using that with forward numbers for a while already and it's often a good indicator for growth stocks, but not always, of course, as no single ratio does that for all stocks.

The 2025 PEG of 1.19 looks fair, the 2026 PEG (which is of course much more uncertain) at 0.85 also looks cheap. I have to remark here that, despite the higher price for Mercado Libre’s stock, the 2025 and 2026 PEG ratios have dropped, because the growth consensus has gone up. So, that fair 2025 PEG might turn out to be cheap. The 2025 PEG stood at 1.66 just after the Q2 earnings were released in August.

Overall, I think Mercado Libre is still relatively cheap or at least fairly valued right now, making it still an attractive investment for the next years. That's why I rate it with a valuation rating of 8/10. That may seem a bit generous and it might be. But I let the high quality also play a role in this valuation. Premium companies deserve a higher valuation. If Mercado Libre would have been fair quality, I would probably have given it a valuation score of 7 or 7.5, not 8.

Conclusion

While this scoring may already be valuable on its own, it’s even much more valuable if you add all of the other picks I have and see the ranking and the changes in ranking over the quarters. That’s exactly what you will get with the paid subscription, next to all of the other things, of course.

I’ve started the Forever portfolio and you’ll be able to follow it here soon. I made Mercado Libre my biggest position because the quality is so high and the valuation is still reasonable for such a great company.

If you like this post, please share it with your friends and colleagues!

In the meantime, keep growing!

What's the difference from this upcoming service here to your seeking alpha subscription?