Hi Multis

Karan here with an earnings update of Kinsale Capital Group (KNSL). Kris will update the Quality and Valuation Scores after the earnings update.

Kinsale reported its earnings on April 25, so it's time to analyze the earnings.

The Earnings

One of the better books I’ve read this year is Against the Gods: The Remarkable Story of Risk by Peter Bernstein.

It details the story of how it took 450 years for probability theory and modern risk management to develop, the culmination of which is the modern insurance industry that allows delivery of your specialty dog food from Sweden over the weekend. Seriously, there would be no Amazon(.)com without shipping insurance.

Fast forward to today, and the modern economy gives rise to niche financing and insurance needs – whether it’s for cars, homes, disasters, AI chatbots going rogue, you name it. Oh, in case you thought that the AI chatbots going rogue was a joke, read this: Insurers Begin Covering AI Mishap-Related Losses).

The book is not a light read by any means but it’s worth it if you want to understand how we get from basic algebra to statistical modelling of disasters and create actuarial science from nothing. Frankly, it’s a bit boring, but underrated. Maybe a bit like Kinsale, because, hey, that's why you are here, right?

I said this before and I’ll say it again. Insurance is boring and a great insurance company is consistently boring in a good way. Because the model is extremely simple:

When things are good, the company keeps the premiums it collected.

When things are bad, the company pays out.

All we need to do is see how bad things got on a quarterly basis, and if the answer is “eh, it was fine”, Kinsale made money. That’s it, really.

And yet we know the stock sold off 16% on earnings, a decidedly “not” boring reaction, which means either the results were worse than expected, or guidance was. Or just the market being the market. Let’s find out.

The Numbers That Matter: Earnings and Revenue

* Net Income: $89.2 million ($3.83 per share), down nearly 10% year-over-year.

The culprit? Catastrophe losses, mostly from the Palisades Fire (California), which cost Kinsale $17.8 million after tax. We will explore this a bit more later.

* Net Operating Earnings: $86.4 million ($3.71 per share, beat expectations by $0.45), up 6% YoY, showing that, even with more claims to pay, Kinsale’s core business stayed solid. The annualized operating return on equity was 22.5% for the three months that ended on March 31, 2025, and it remains best in class.

*Revenue: $423.4 million, up 13.6% from last year, but still “missed” Wall Street’s estimates by a "jaw-dropping" $1.54 million. I might be generous, but I call that a rounding error on a spreadsheet. Of course, we know the market doesn’t like “misses,” so it is what it is.

The Engine Room: Underwriting Performance

Gross Written Premiums (GWP): Up 7.9% to $484.3 million. While this does represent growth, we have to remember that KNSL itself targets at least 10-20% growth, so this is a negative surprise vs their own expectations. But even here we have an obvious culprit: if you exclude the struggling Commercial Property Division ( down 18.4%), the rest of the business grew premiums by 16.7%. We will revisit this topic shortly in more detail.

Combined Ratio: 82.1%. That’s higher (worse) than last year’s 79.5%, mostly because the loss ratio jumped to 62.1% thanks to those catastrophe claims. The expense ratio actually improved a bit, down to 20%.

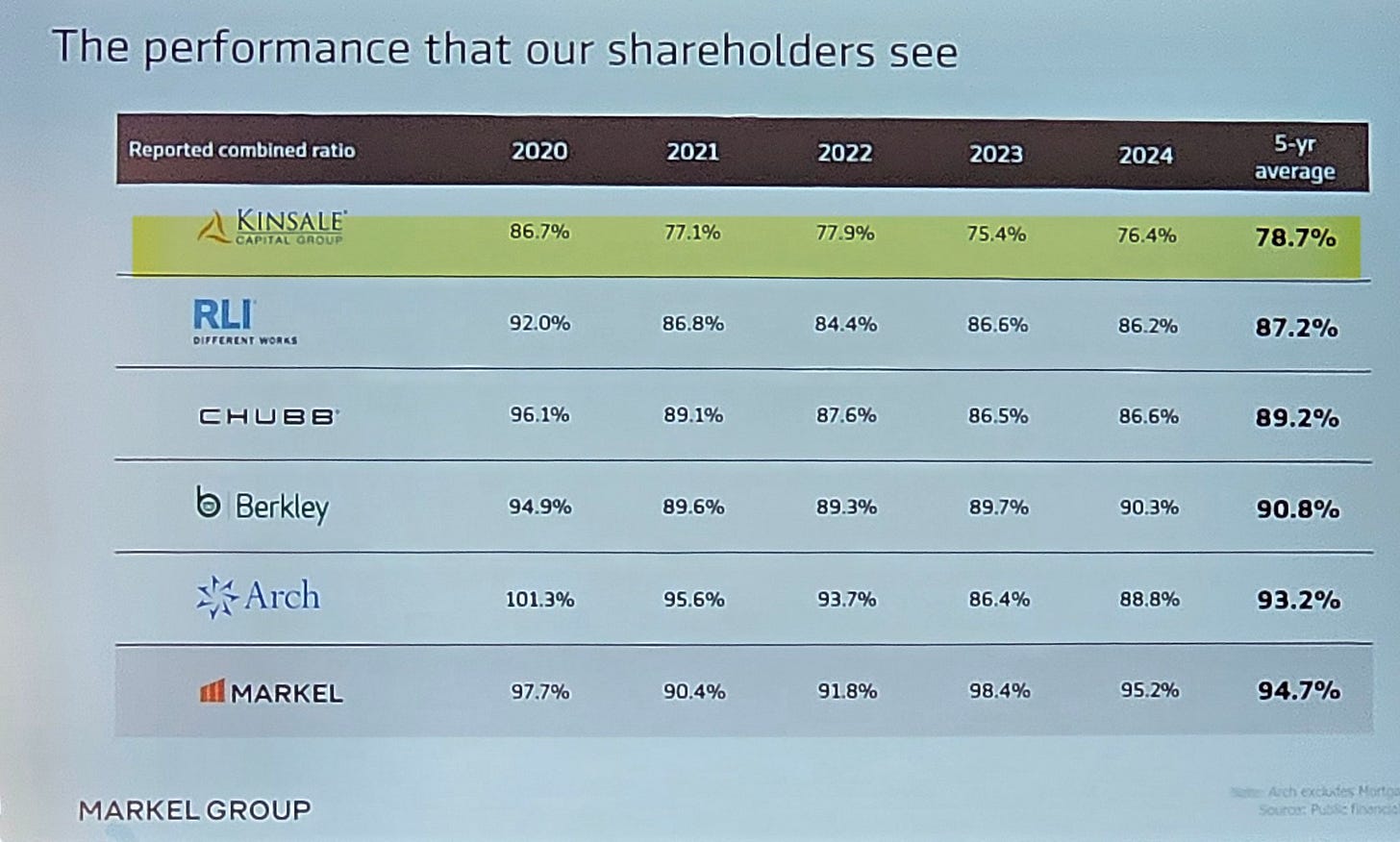

Remark from Kris here. Overall, this is still great, though. This is what Markel shared on its latest brunch in Omaha. Don't forget: the lower, the better.

So, Kinsale is still superior, even with that 82.1%. Back to Karan.

Underwriting Income: $67.5 million, up 3.7%. Kinsale also got a $14.6 million boost from releasing reserves set aside in previous years.

Investments and Capital

Net Investment Income: $43.8 million, up a whopping 33.1%. Thank you, Jerome Powell, for keeping higher interest rates. Plus, whoever is managing that equity portfolio, may you become Buffett 2.0.

Share Buybacks: $10 million was spent to buy back about 23,000 shares at an average price of $428.28. So that gives us a hint of what the company thinks is an attractive price. They also said they will continue to deploy opportunistically at a similar run rate moving forward.

Let’s Talk About Commercial Property

Commercial Property was down. Why Was It So Bad? Profit Over Growth

Commercial Property was down. Remember that Commercial Property was Kinsale's largest underwriting unit last year, so any slowdown here hurts. Also note, however, that this business had grown 20X (!) in the prior 5 years and has produced immense profits, which explains the heavy competition now entering the space. So, Kinsale can no longer charge 20% rates and collect premiums at will.

In this respect, the management team was clear on the call: Kinsale isn’t chasing growth at any cost. With treasury rates (which influences funding costs) softening and competition heating up (especially in commercial property) they are underwriting only the business that makes sense for them and walking away from the rest.

COO Brian Haney pointed out that their tech-driven, low-cost model lets them adjust pricing quickly, sometimes even cutting rates in certain lines to keep the right business coming in, all without sacrificing profitability. This quote provided some great context:

Our property-related divisions as a whole shrank by 8% while the rest of the company grew 15%.

The decrease in the property premiums was driven entirely by our Commercial Property division, all the other property divisions were up for the quarter, as Mike mentioned. The rates in commercial property in this space had reached all-time highs and the margins have become very significant, which is bringing in competition, including from MBAs and admitted companies. That market is now normalizing after a period of crisis pricing conditions in past years.

In summary, this seems less like a catastrophe than Kinsale becoming a victim of its own success. However, Kinsale’s leadership—CEO Michael Kehoe, CFO Bryan Petrucelli, and President/COO Brian Haney—all emphasized that this slowdown is a deliberate choice to prioritize profitability over chasing volume in a softening market. That looks like the right choice to me.

Additionally, most of that 2024 premium was collected in H1’24 so Q1 and Q2’25 are both going to look bad, but Q3-Q4 should be normalized.

Catastrophe Losses: The Cost of Doing Business

Talking about actual catastrophes, the Palisades Fire alone added a big chunk to Kinsale’s loss ratio this quarter.

Management had guided to about $45 million in losses 3 months ago and have followed up, saying actual losses were $41 million direct (better), followed by another ~$22 million in re-insurance (not great), for a net additional loss of $17.8 million. Management says they’re taking a more conservative approach to reserves henceforth, building in a buffer for inflation and the unpredictability of big events. That means fewer big reserve releases going forward, but also less risk of nasty surprises.

Note the key here: Kinsale is NOT saying it will stop taking risks moving forward; it is just managing its balance sheet conservatively to avoid getting punched. While higher reserves do affect growth, they are more prudent for a business constantly battling the future and the unpredictability of earnings.

For example, the Palisades fires in LA took a big chunk out of Kinsale's profits, but the premiums Kinsale can now collect moving forward, precisely when others retreat (Exhibit A: When Insurance Companies Cancel Fire Insurance | Merlin Law Group), will drive those profits every year in the future when there are no fires. From the article:

In March of last year, State Farm General, California’s largest home insurer, announced it was nonrenewing more than 30,000 homeowner and condominium policies throughout the state, including more than 1,600 in the Pacific Palisades, according to the LA Times, and more than 2,000 in two other Los Angeles ZIP codes, which include the Brentwood, Calabasas, Hidden Hills, and Monte Nido neighborhoods.

State Farm isn’t the only insurer that has been dropping policies or exiting the state’s market (the insurer announced in 2023 that it wouldn’t be taking on new homeowners insurance customers in the state due to the volume of natural disasters). Allstate stopped writing new policies in California in 2022, and Tokio Marine America Insurance Co. and its subsidiary Trans Pacific Insurance Co. pulled out of the state in 2024. Likewise, Chubb and its subsidiaries stopped writing new policies in 2021 for high-value homes determined to have high wildfire risks.

Other Southern California homeowners have faced steep premium hikes and had to give up their policies. The LA Times reports that last year, one Pacific Palisades homeowner with Farmers Insurance was told his homeowners’ insurance premium would jump from $4,500 to $18,000 annually.

This is the nature of the beast for an insurer.

So, we have some clues as to why the stock dropped:

Revenue Miss: Growth slowed, especially in commercial property and Gross Premiums, which spooked the market.

Catastrophe Exposure: Big losses from fires and storms are part of the business, but still hurt when they are incurred.

Competition: Standard insurers are muscling into some E&S lines, making it harder to grow premiums without giving up margin.

Management Q&A: a.k.a when analysts think the world is ending in Q2’25

This question perfectly captured the tone of the Q&A, I am producing it in full so you can understand the difference between a highly paid professional analyst and a retail investor:

Your stock is down over 10% pre-market. It seems largely on a continuation of the decelerating top line growth theme, which feels like it’s been under scrutiny for a long time.

But it looks like the top line growth comparisons are going to get easier as we progress through the year, as you pointed out and that should help mitigate the growth headwinds.

But what I think is notable is that many investors have called attention to is your ability to more than offset top line weakness with a lower combined ratio. Can you give a little bit more color on your confidence level in being able to sustain that kind of underwriting performance? There has been some concern that potential degradation in underwriting quality would exacerbate the sort of top line deceleration concerns? And it would be just helpful to get your thoughts.

That’s an awful lot of words to ask: “Your underwriting is still working right?”

Seriously, this is one of the few calls on which the analysts’ questions are harder to understand than management’s responses, and this was true for more than 60% of the call!

To avoid wasting everyone’s time, here’s the bullet point summary of the Q&A:

Inflation, Tariffs & Reserves: I have no idea why a specialty insurer with a 100% business in the US is being asked about tariffs but I guess it was on an analyst bingo card to do so. The important stuff is that Reserve releases will slow as management turns cautious, but as of April’25 seasonality is holding up in the business, so there’s no signs of panic.

Commercial Property: Yes, it’s struggling, but margins are still attractive. Growth could return if pricing stabilizes but we shouldn’t expect this to be a material driver in the near term anymore.

New Business Lines: Commercial Auto and High-Value Homeowners aren’t moving the needle yet, but give it a few more years as rate differentials are promising.

Casualty Lines: There’s an opportunity here as some competitors pull back, and pricing could improve.

The Bottom Line

Kinsale’s Q1 2025 wasn’t perfect, but it showed why this company has earned its good reputation. Even though there were hiccups, they were very much in line with the realities of such a business.

For us, the key thing to remember is that the tech-driven, low-cost model and disciplined underwriting are still working. If you’re a long-term investor, the recent selloff may look like a buying opportunity in hindsight - assuming Kinsale keeps its edge and weathers the next storm as well as the last. I suspect it will.

Let’s look at the Quality Score update and then the valuation to decide whether Kinsale is a buy now.