Inside My Portfolio: Today’s Buys

My new position revealed

Hi Multis

Today, I bought shares for the Forever Portfolio, just as I do every two weeks.

As I (almost) always do, I added the 5 Best Buys Now and several other stocks. One is a new position, a stock that the news has driven down. I also had several positions where I doubled my position. The smaller positions in my portfolio got some love.

I did not add to my biggest four positions and that's what made the number five position grow to the fourth-biggest.

A few newer Multis reached out to me recently, asking which portfolio they should follow. Thank you for that. The Forever Portfolio is my real money, and I want to invest there as well as I can. It shows position sizing and my conviction is backed by my money.

The Best Buys Now are meant for those who are starting out and want to know what to start with. Or for Multis who want fewer stocks. I will (almost) always include all Best Buys Now stocks in the Forever Portfolio shortly after I release the Best Buys Now. Sometimes, I don't add as much as you may expect because a stock already holds a big position in the Forever Portfolio, so I only want to add a little, but it can still be a Best Buy Now stock.

Having said that, let's look at the additions I did today.

Mastercard

Mastercard (MA) is the new position I already referred to.

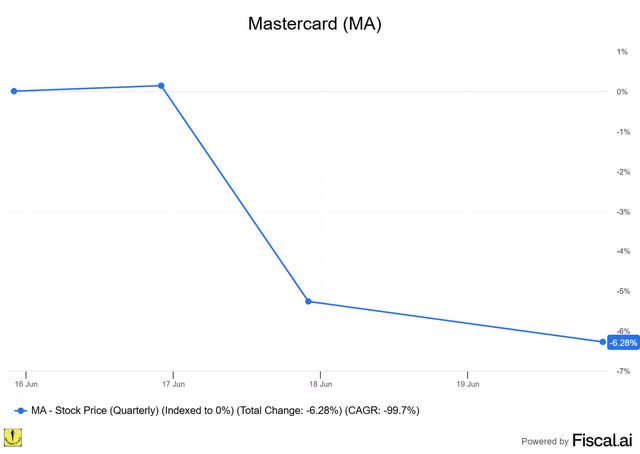

This week, the stock was down 6.28%.

The reason? Stablecoins.

The US Senate passed a stablecoin bill this week. It intends to end the Wild West era for dollar-pegged tokens. The GENIUS Act, heading to the House in July, forces every stablecoin to hold full cash reserves: one dollar in the vault for every digital dollar issued.

Issuers get a choice to accept federal oversight from the Federal Reserve or face even tougher state rules. Issuers must publish monthly reserve reports and guarantee instant, fee-free redemptions. So far for operating in the shadows of the crypto underground. These are like boring bank-style regulations that Wall Street loves, and therefore, everyone and their aunt is positive on stablecoins now, even if the act has not been voted on in the House yet.

It also means people think that if stablecoins are more generally used, companies like Visa, Mastercard and even players like Adyen will suffer.

I'm taking the opposite side of this belief. I believe the network will become even more valuable. Both Mastercard and Visa can easily work with stablecoins. As most merchants already use one of the two, they will use them to accept stablecoins.

For Adyen, the bull case also doesn't change: the company will become even more valuable. Why? Adyen (and to a certain extent V & MA as well) is a play on security and programmability. The services added on top of the payments are what matter to merchants. Making sure there is security, customer insights, high acceptance rates and programming functionalities easily when they are needed. That's what Adyen excels at. Now, Adyen is already a big position, so I decided not to add now. But I started a new position in Mastercard.

Let’s move on to the other additions.