How Can CrowdStrike Grow So Fast After That Outage?

At CrowdStrike, we deliver both AI for security and security for AI.

Hi Multis

Last week, just before Thanksgiving, CrowdStrike (CRWD) reported its earnings.

This stock has been a long-time Potential Multibaggers holding since $98 in June 2020.

Of course, the big outage on July 19 this year is still a dark cloud hanging over CrowdStrike. Initially, the stock tanked. It was down 44% from its highs set a few weeks before the outage.

Source: Finchat

But the stock recovered fast. It reached the bottom on August 2 and it's up 58% since then.

Source: Finchat

Sometimes, I bring the earnings very fast, but usually, there's some time in between. Like now, with a week between the earnings and the article.

What I have noticed is that the time in between is often very valuable. I'm optimistic by nature (most growth investors are) and that means that if I report immediately after the earnings, I usually see the glass half full. Now, that's a good characteristic, but it may cause me to gloss over some more negative elements. When I wait a few days to a week, I see both sides of the story.

Having said that, let's look at the results.

The Numbers

CrowdStrike reported strong results again for Q3 of fiscal 2025. No, that's not a typo. CrowdStrike lives one year ahead with its fiscal year, so it’s 2025 instead of 2024.

Revenue surpassed $1 billion per quarter for the first time, at $1.01 billion, up 28.5% year-over-year and beating the analysts' expectations by $26.97 million.

Source: CrowdStrik’s earnings slides

As you can see, if you look at the year so far, revenue is up 31% in the first nine months. Very strong.

CrowdStrike's non-GAAP earnings per share came in at $0.93, beating the consensus by $0.12. That's a strong beat of more than 14%.

Annual Recurring Revenue grew 27% year-over-year to $4.02 billion, driven by $153.0 million in net new ARR during the quarter.

So far, so good. However, free cash flow decreased by about 3% year-over-year to $230.6 million, compared to $239.0 million in Q3 fiscal 2024.

CFO Burt Podbere explained on the conference call why free cash flow was down:

Free cash flow was $230.6 million or 23% of revenue, and was impacted by the July 19th incident as well as planned investments in data center and workload optimization, R&D and sales and marketing. Additionally, the $49 million in deals financed through CrowdStrike Financial Services had a de-minimis impact to Q3 free cash flow as expected.

Now, you remember that revenue growth was 27.5%, right? With a free cash flow margin of 23%, that means that CrowdStrike still has a score of 50.5% on the Rule of 40, which is just outstanding.

For those who don't know the Rule of 40, it's a rule that is used in venture capital and high-growth businesses, especially SaaS (Software-as-a-Service). You should add the revenue growth percentage up to the free cash flow margin and the result should be 40 or higher for a good business. So, if a company's revenue grows by 65% and the company has a negative free cash flow margin of 15%, that's 50% on the Rule of 40 and still outstanding.

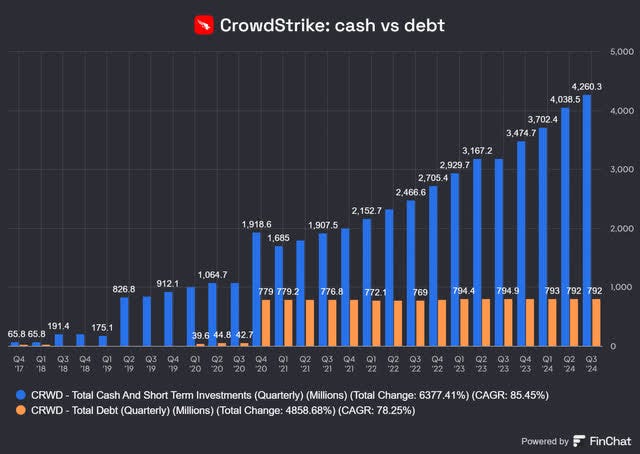

CrowdStrike strong free cash flow resulted in a solid balance sheet, with $4.26 billion in cash and cash equivalents.

Source: Finchat

Customer adoption of CrowdStrike's modules continued to expand, with 66% of customers using five or more modules and 20% adopting eight or more.

You can safely say that CrowdStrike's land and expand model works great.

As for guidance, CrowdStrike guided between $1.0287 billion and $1.0354 billion for Q4. At the midpoint, that's slightly higher than the $1.03 billion consensus.

For non-GAAP EPS, CrowdStrike guided for $0.84 - $0.86. The high end of that range was the consensus.

Insights from the call

Of course, everybody wondered about the outage and the impact it had on CrwodStrike. One of the very first things founder and CEO George Kurtz said was that customer retention was stable.

Falcon customers are staying with CrowdStrike as their trusted cybersecurity platform of choice. Q3 gross retention was over 97%, down less than 0.5 percentage point. Strength in retention was driven by the value that customers receive from the Falcon platform.

Many investors will have been very happy to hear that. On top of that, George Kurtz added in the Q&A that most churn came from smaller customers. He said he had intense conversations with big customers, but churn was never really a subject in those conversations.

Kurtz also shared the dollar-based net retention rate or DBNRR. That's the comparison of all the revenue from last year and the same customers this year.

Q3 dollar-based net retention was 115%, temporarily impacted by the incident and reflective of customers strengthening their commitment to CrowdStrike. Customers are leveraging our customer commitment package and Flex subscription model to both increase their long-term investment in CrowdStrike and increase their adoption of the Falcon platform.

Almost any company would die to have a DBNRR of 115%. For CrowdStrike, it was a reason to explain why it was impacted. What Kurtz basically says here is that customers get a discount in return for a longer contract.

There's also the Flex model the company introduced a while ago. It's a plan that allows companies to buy a certain number of modules at once, without the need to immediately determine which ones (hence the name Flex). This bundling is, of course, also cheaper and that impacts both DBNRR and revenue growth, but it strengthens CrowdStrike's long-term outlook, so I'm positive about these developments.

Founder and CEO George Kurtz shared how Flex lowers the barriers to adopting new modules through the acquisition of Adaptive Shield:

So, we are excited about the licensing mechanism; customers are. We talked about Adaptive Shield. The day we announced that, we were at Fal.Con Europe and customers said, "Okay, if I'm a Falcon Flex customer, can I use it day one when it closes?" And we're like, "Yeah, as soon as we close the deal, and we get it SKU'd up, you'll be able to use it," which again, removes a lot of friction and aids in the adoption.

And Flex is getting big fast. George Kurz:

Accounts that have adopted the Falcon Flex model now represent more than $1.3 billion of total deal value, with the average Falcon Flex subscription being multiples larger than our typical contract value.

And this is the reason:

As we steadily engage with more CFOs over the past year, the feedback has been resoundingly consistent. With Falcon Flex, CFOs can see the economic benefits of platform consolidation.

In other words, CrowdStrike talks to the CFO (Chief Financial Officer) now, not just the CTO (Chief Technology Officer) or CSO (Chief Security Officer).

How Can CrowdStrike Continue To Grow?

I bet that many wonder about this question: How is it possible for CrowdStrike to see its revenue grow at that pace despite the big outage? Especially now that you have heard about the headwinds of longer contracts and the impact of the Flex formula on revenue.

George Kurtz already gave the first piece of the puzzle here: