Hi Multis

Nu Holdings' (NU) stock has seen quite a drop recently. The stock is down about 30% from its recent highs.

Source: Finchat, the best AI-powered finance platform. Get 15% off here.

So, it's time for an update on both the quality and the valuation.

Personal conviction 9/10

Last change: January 2025

This is mainly my or your own conviction based on everything I/you know about the company. Your own conviction may be very different here and you could adapt this score to your own liking.

I picked the stock at $4.47 in April of 2023. During that period, I have been deeply impressed by the management, its execution and how every extra detail I learn about this company is a positive one. An example?

But this is just one of the dozens of small details that all together show greatness. This company is exceptional.

Nevertheless, I lowered my personal conviction by half a point. The reason is the situation in Brazil. While I have very high confidence in the company, it's still subject to the context in which it works. Therefore, I keep a high score of 9 but lowered it from 9.5.

Profitability 10/10

Since September 2024

Over the last year, Nu's profitability has increased substantially, perfectly illustrating the company's operating leverage.

Source: Finchat, the best AI-powered finance platform. Get 15% off here.

Here, you can see the operating leverage in full swing. I find this is very impressive. Let’s look at it from antoher perspective. This is the average revenue per customer.

Source: Nu

As you can see, that's $11 in average monthly revenue per customer. Combine that with this chart.

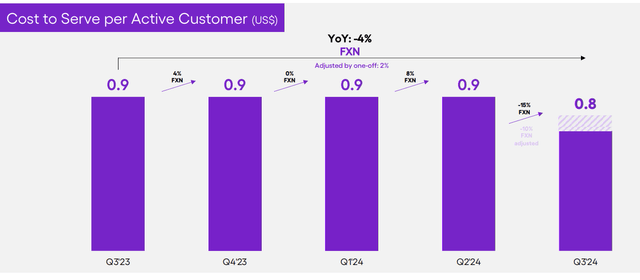

The cost to serve customers has not moved and was even lower in the most recent quarter.

Because of the higher net income (again) and the eye-popping operating leverage, keeping the score at the maximum seems logical.

10/10.

Sales efficiency 10/10

Unchanged since the start

The sales efficiency score first looks at the marketing efficiency by looking at what percentage of revenue goes to SG&A (selling, general and administrative) and how much revenue growth that brings in the trailing twelve months and what is expected next year. I divide the average of those two by the SG&A number as a % of revenue and that is marketing efficiency. I then multiply that by the gross margin to look at sales efficiency. I give a score out of 10 by dividing the percentage by 10.

Of course, this formula is far from perfect, but it gives you some idea of how well the company sells its product. There are plenty of nuances to add here, but the numbers are what they are.

NU's efficiency is great. Although it went down a bit, it still stands at 485.71. The company spent more on sales: $100 million on marketing, up from $47 million. But on revenue of almost $3 billion, that's still only 3.4%. Revenue growth also decelerated (I took it in USD, to be conservative), and the forecasts have dropped.

Normally, I divide the number by 10. That's 48.5/10, but let's keep it at 10/10, haha.

Innovation 4.5/5

Changed in March 2024

This is part subjective, part measurable. Subjective: How many new products does the company issue versus its competitors? You can partly measure that, too, if you want, but the magnitude of the innovations is much more important than the sheer number of innovations.

As for measuring, you can look at the % of the revenue that goes to R&D. At the same time, I want some efficiency there, too, so I usually look at R&D efficiency by dividing R&D expenses in the previous year by revenue growth in the trailing twelve months.

However, this is impossible for Nu because the company doesn't split up R&D, as is typical in its sector. With revenue growth of 38%, though, I'm pretty sure Nu is in the first quartile.

I also see constant innovations in the products.

The company is rumored to explore going to other geographies as well but it's still growing fast in the three countries it operates in now: Brazil, Colombia and Mexico. So, I kept the score at 4.5/5.

Must-have? 4.5/5

Since 2024

I introduced this score because of what Matthew Prince, the founder and CEO of Cloudflare (NET) said, as I reported in the Overview Of The Week #125:

I think that the world is about to get sorted into must-haves and nice to haves.

I kept the score at 4.5/5 because, for people using it, it's very important and they won't ditch it because times are tougher, to the contrary. This is often their first actual bank, which they use for many things.

Revenue growth 5/5

Unchanged since October 2023

This is very simple: how high was the revenue growth over the last twelve months?

For Nu, this was 38%. It's simple in that case. 5/5.

Revenue growth durability 9.5/10

Unchanged since October 2023

At least as important as revenue growth is the durability of revenue growth.

For Nu, I think the probability of high growth for so long is quite high because it targets a big need in a big territory and can add additional services. I do think that 20%+ is attainable for the next ten years.

Because the company is only established in Brazil, with fast growth in Mexico and Colombia, there are quite a few countries left to launch in. On top of that, in countries with quite a substantial market share, as in Brazil now, the company can add extra financial services over time. That's why The score for Nu stays the same here, at a high 9.5/10.

Management Quality Score 10/10

Since September 2024

Excellent management is often one of the most essential keys to long-term success. I look at the track record, execution, and vision.

I have talked quite a bit with Fede Sandler, who used to work at Nu as the Investor Relations Officer, IRO. He thinks David Vélez is on the same level as Marcos Galperin, founder and CEO of Mercado Libre (MELI), where Fede was the IRO for six years. When an insider and truthteller like Fede (he's not afraid to speak out and show his opinions) is so lyrical about this management, why wouldn't we be a bit more optimistic than we would be if we didn't have that information? If you haven't seen my interview with Fede, you can watch it here.

In the meantime, I have seen that Fede was right, so I keep the score at 10/10 now.

Insiders' Ownership 5/5

This is the management ownership overview.

Founder and CEO David Vélez now holds 967,309,863 shares, and Christina Junqueira, founder and Chief Growth Officer, holds 125,356,631 shares.

So, let's look at what that means. Junqueira's ownership is worth more than $1.4 billion at the current price of $11.15. Many founders would give an arm and a leg for that, but David Vélez does even better. His stake is worth almost $10.8 billion. Together, that's more than $12 billion.

Of all the Potential Multibaggers picks, I have, that's currently the highest owner stake. No doubt about it, 5/5.

Multibaggers Potential 5/5

I picked Nu at the time at $4.47. The stock has shot up considerably over that time, but I think that the multibagger potential is still there.

Of course, at this size, the company is worth more than $50 billion, we shouldn't take multibagging for granted. A 5x and especially a 10x would put NU between the biggest banks in the world. But while that may seem preposterous to some, you should not forget that Nu is already the biggest online bank outside of China when you look at the number of customers (more than 100 million). And there are plenty of opportunities to keep growing both the number of customers and the revenue per customer.

The 5/5 doesn't mean that this is a guaranteed multibagger, of course. It means that the potential is there.

TAM/SAM: 5/5

Since March 2024

TAM stands for total addressable market and SAM for serviceable addressable market, the market you serve because of your specific product and geographical limitations.

These are the assets of the top 15 banks in LatAm at the end of 2023.

Right now, Nu concentrates on Brazil, which has the top 5 for itself, Mexico, which has 3 banks in the top 9 and Colombia, which is growing fast. Nu could go to all of the countries and on top of that, it could go to the US to serve the Hispanic population.

The company also recently invested in Tyme, a digital bank with 15 million customers that operates in South Africa and the Philippines. This could also be a route into different territories. But I don’t expect that any time soon.

The SAM is vast, with just Brazil, Mexico, and Colombia, but the TAM is gigantic, especially because many of these countries are seeing fast GDP growth and an expansion of the middle class.

So, only a 5/5 can be correct here.

Financial Strength 8.5/10

Unchanged since October 2023

Financial stability is much more critical in this environment, so I rate it out of 10. This is the company's capital situation:

The company has $2.4 billion in cash and $1.6 billion in extra flexibility. The $2B capital requirement is to fulfill the legal duties of a cash buffer.

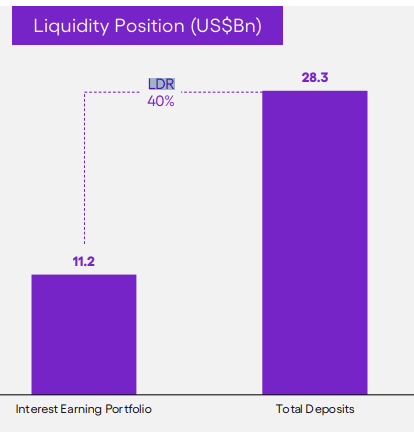

This is also important.

As you can see, the LDR is 40%. That means the company uses only 40% of the deposits for loans (LDR= loans-deposit ratio). Typically, a bank has 75% to 90%, some even higher. This shows that Nu is very conservative in its approach, which is another lever they could use in the future.

With a bit extra risk-handicapping for the loans, I give Nu 8.5/10.

The negatives

I also have negative scores that can subtract extra points from that score. The scores are marked on five because a lot is implicitly captured in the other criteria.

Risk 2.5/5

Since September 2024

A lot is already baked in financial strength, but this overall risk score shows more than just financial risk.

The main reason why I give a score that indicates a medium risk is that Nu is quite vulnerable to local laws and that is generally already a weakness, but in Latin America even more. For the rest, management has shown that it's very capable and that reduces the additional risks.

Competition 2/5

Unchanged since October 2023

How strong is the competition? Again, you can't objectively measure that but there are indications.

The competition will mostly come from incumbents, but those often have the capacity for government lobbying. But right now, it seems they target Mercado Libre much more than Nu. But overall, this is not about lawsuits but about real-world competition. And while I still incorporate this risk, I don't see any of the incumbents that can compete with NU. The reason is that they would have to give up their profitability. The classical innovator dilemma.

Dilution 1/5

Dilution is a negative over the long run but that doesn't mean that companies should not issue stock when they are still growing fast. Look at Apple's shares outstanding before 2012, when it started buying back shares:

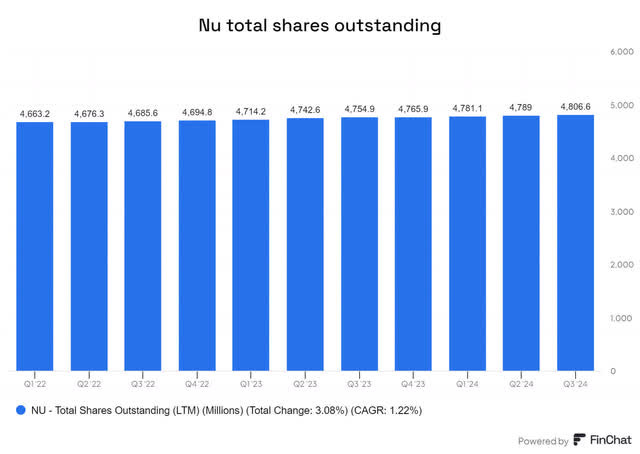

We normally look at this over a 3-year period but NU has not been on the public market that long. That's why I start in Q1 2022.

Total dilution of 3% or a CAGR of 1.22? That's very reasonable, especially one that is not that long a public company.

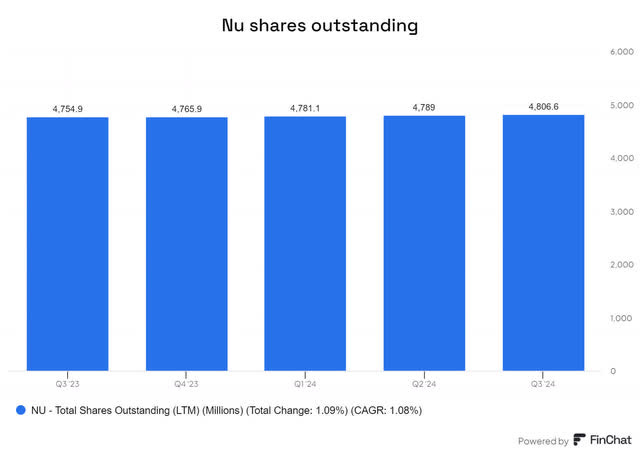

Let's look at the last year.

As you see, that's 1.08%. That's very reasonable if you know 75% of the company's employees owns shares of Nu Holdings.

That's why I give a low (negative score) of 1.

Scale advantages shared 5/5

Since March 2024

When I looked back at some of the best investments, they did not only have substantial scale advantages, but also shared them with their customers in some way. For Amazon or Walmart (at the time), I think this criterion is obvious. Because they are bigger, they can give their customers better prices.

Google has always had a scale advantage: the more people used their products, the more they could give away for free. The data of people were leveraged to generate profits for Google, but the fact that Google could offer so much for free (Gmail, Fotos, Drive storage up to a certain limit, etc.) was because of this mechanism.

I have not come up with this concept myself. This is one that I borrow from Nick Sleep from Nomad Capital. He uses this concept to guide all of his investments. That's why he started investing in Amazon in 2003 already. And he mostly held on to that position to now. He did the same thing with Costco, another company that shares the advantages of its scale with its customers, by only charging 15% on the purchase price, no matter what. This makes these companies almost impossible to compete with unless you start doing exactly the same thing.

The most prominent advocate of this? Jeff Bezos, who made this napkin sketch about it.

So, this competitive advantage can be significant. I'm going to withdraw or add points with this criterion. For some companies, extra scale only adds extra complexity. Those will get a negative score. I think of Uber (UBER) here. The normal scaling is the second level, which will be given some points. This means that if you grow, your scale gives you cost advantages. The third level is where all users also benefit from the scale. Here you will see higher scores, 4/5, maybe 5/5.

For Nu, I keep my score at 5/5. It starts with this chart that I shared earlier.

The reason why Nu can give higher interest rates to its customers and is less expensive for its services at the same time is a clear example of scale advantages shared. The reason it can do that is because it doesn't have the tower-high (literally!) costs of big banks: no branches, no employees that only serve to keep the administrative trail alive and so on.

Conclusion

Nu's Overall Quality Score drops by half a point, from 86 to 85.5, but it jumped from 80 to 86 in the previous quarter.

This again shows that NU is an outstanding company.

But now that we know the quality is this high, I also want to know if it's a buy at this price.

The QPI Score

For the Quality Price Score, we need the valuation, of course. So, let’s look at that.