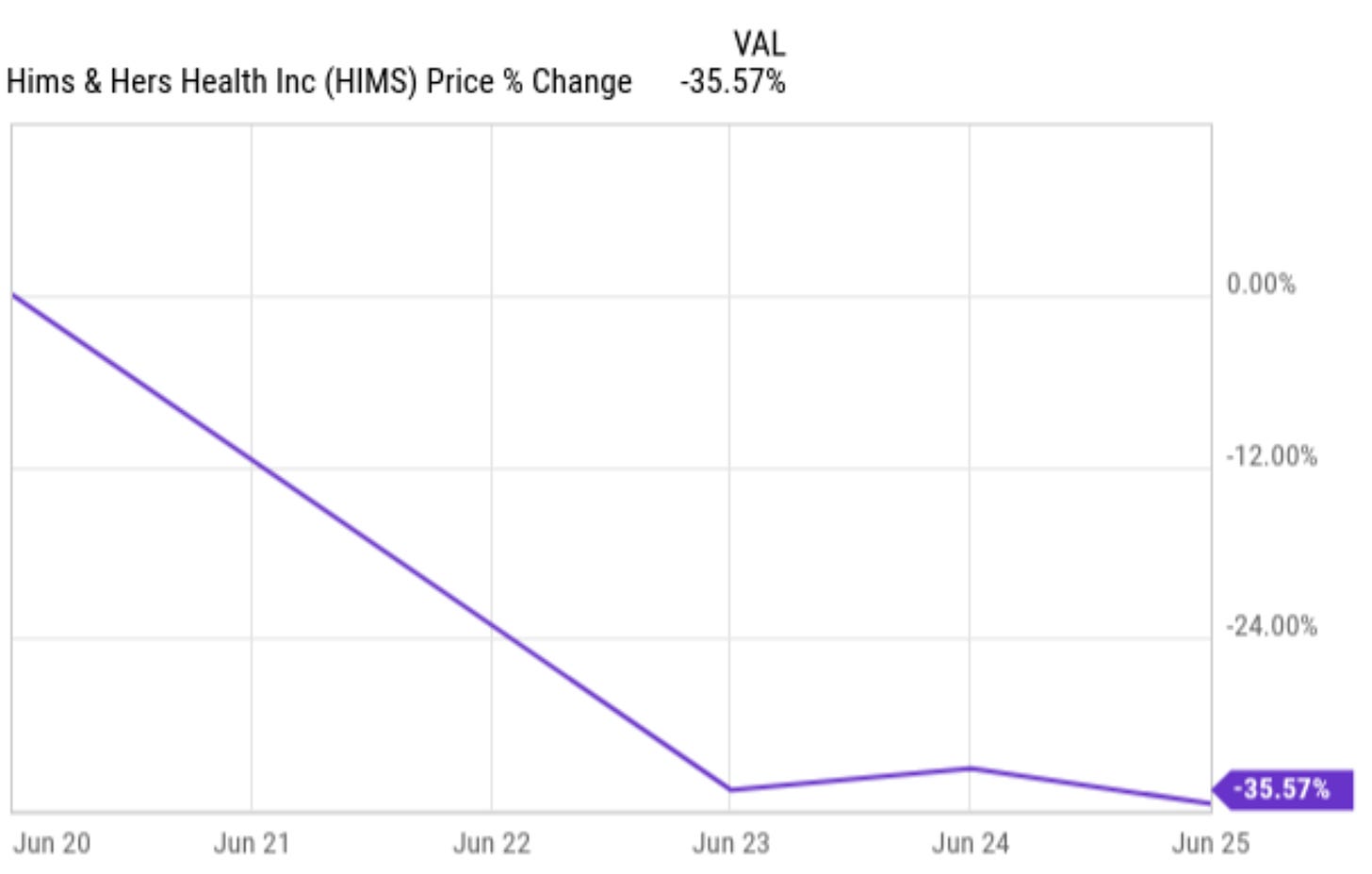

HIMS Just Got Wrecked. Here's What You Need To Know

After the big drop, is the stock a BUY or a SELL?

Hi Multis

I hope you didn't need a telehealth doctor because of the big drop in the stock price of Hims & Hers (HIMS) this week.

I can't seem to be able to find the source anymore but I recently read that Hims & Hers is the most volatile stock of all stocks that trade on the American stock market with a market cap higher than $1 billion. This was not the first big move and it won't be the last.

But of course, with volatility, you should always wonder if the market is right or just reacts like a fish to bait.

That's what this article is meant for.

What happened?

Yesterday, Novo Nordisk (NVO) announced that it will stop its partnership with Hims & Hers for the Wegovy weight loss drug. That partnership only lasted for about a month. This is a part of the press release Hims & Hers used to announce the partnership at the time.

I highlighted a few crucial elements here.

The first is long-term collaboration. Looking back, that's totally wrong, of course. But it was meant to be that. Then there's the announcement that there will be direct access through NovoCare to Wegovy "as a first step." Keep that in mind for later.

The last paragraph says explicitly that Hims & Hers will continue doing what it does and that Novo Nordisk and Hims & Hers will work together for this.

The fact that the partnership blows up, surprises me less than the collaboration, to be honest. The speed at which it untangled does.

Novo Nordisk isn’t happy that Hims & Hers is exploiting a loophole. If the patient can’t tolerate the official dosages, they’re allowed to use a magistral (compounded) formulation. Hims & Hers does this quite often, and Novo Nordisk sees that as an infringement of their patents.

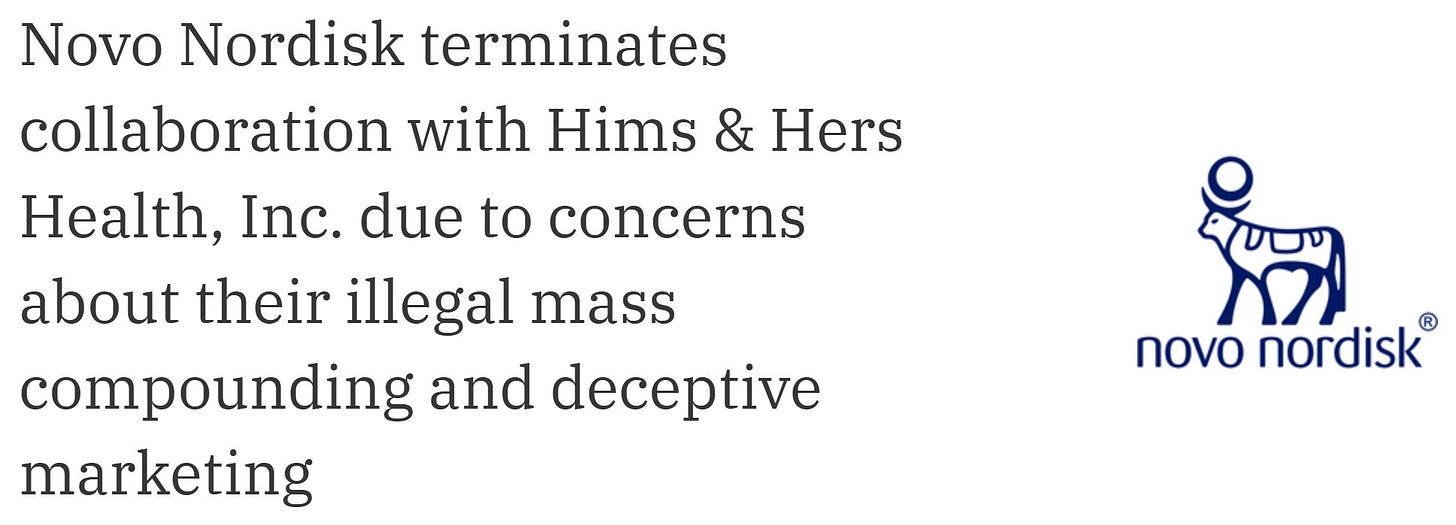

Novo said they stopped the partnership due to concerns about the telehealth company’s sales and promotion of cheaper knock-offs of the weight loss drug Wegovy.'

This was the headline.

The text was very hard (my bold):

Over one month into the collaboration, Hims & Hers Health, Inc. has failed to adhere to the law which prohibits mass sales of compounded drugs under the false guise of "personalization" and are disseminating deceptive marketing that put patient safety at risk.

(...)

when companies engage in illegal sham compounding that jeopardizes the health of Americans, we will continue to take action.

Based on Novo Nordisk's investigation, the "semaglutide" active pharmaceutical ingredients that are in the knock-off drugs sold by telehealth entities and compounding pharmacies are manufactured by foreign suppliers in China.(...)

The report also found that a "large share of [these Chinese suppliers] were never inspected by FDA, and many of those that were [inspected] had drug quality assurance violations." US patients should not be exposed to knock-off drugs made with unsafe and illicit foreign ingredients.

That's pretty blistering criticism.

Hims & Hers reacted with this statement from founder and CEO Andrew Dudum.

Putting This In A Broader Context

As a (potential) Hims & Hers investor, the Novo Nordisk allegations probably seem pretty scary.

That's why I waited a bit to make sure I had all the information available for a nuanced view. Quality information and time to distill insights from the information are crucial in such a context. I see so many just spitting out an opinion without real insight. It's based on emotion. The opinions go from "Hims & Hers is doomed" over "a typical fight between an incumbent and an innovator" to "Hims & Hers should sue Novo Nordisk for defamation."

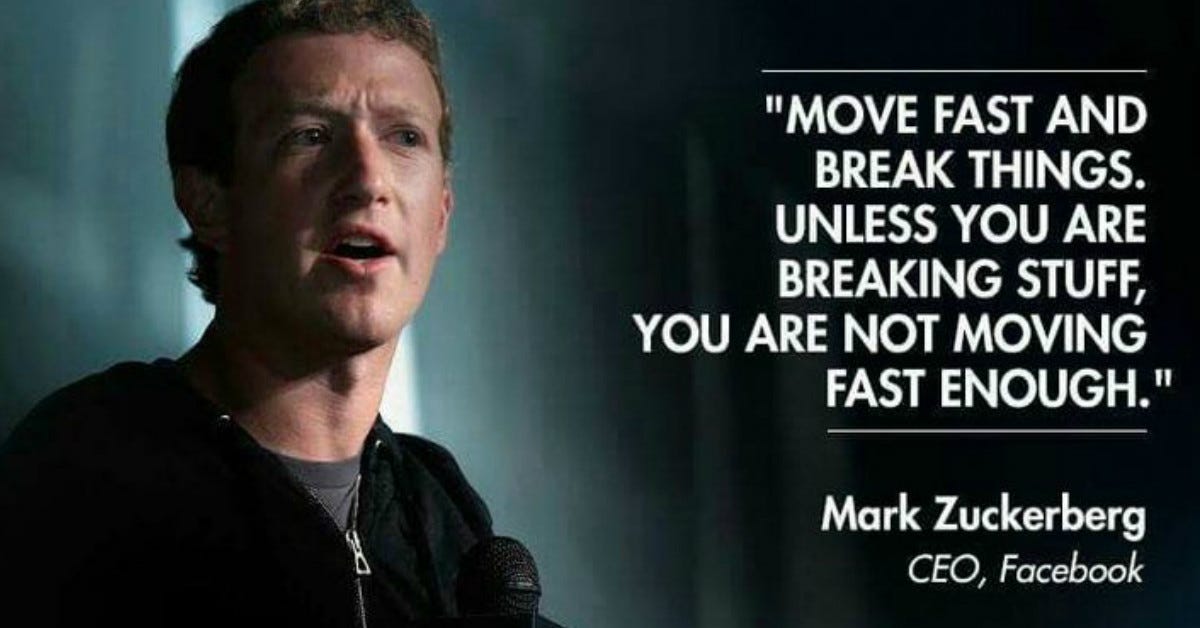

Let's be clear upfront. Hims & Hers is a clear disruptor and those very often seek the edges of what is allowed and what isn't. I'm not even discussing that.

It's an obvious risk, of course, but it's also what sets apart disruptors from the rest. It's a thin line. If you know the history of investing, you know that many of the companies that disrupted industries broke the law or had questionable moral behavior at times.

For example, multiple anonymous Amazon executives reported that they placed ghost orders from their own warehouses to secure that the competition could not get the best transportation at an affordable price. Once they had secured that, they canceled the orders.

This is Mark Zuckerberg:

And boy, things did break with Facebook's Cambridge Analytica scandal.

Uber was illegal in many cities for a long time. Uber used a fake version of its app to fool regulators. When officials in cities where Uber wasn't legal tried to order rides, they saw fake cars and fake wait times. This helped Uber avoid getting caught by authorities. The company was faced with hundreds of lawsuits for various forms of misconduct.

For more than two years, Doordash collected the tips of its Dashers illegally to make the company a little less money-bleeding.

Airbnb is another example. As if their core product wasn't already controversial enough, they went beyond that and expanded into non-residential areas.

In 2011–12, Google inserted invisible JavaScript into its ad tags to trick Safari into treating third-party cookies as first-party to bypass Safari's block on cross-site tracking.

The Saint of Tech, Steve Jobs, launched his first product with Steve Wozniak: the Blue Box. It was a machine to hack the telephone network. Not very legal.

I could go on, but you get the point. Innovators want to move fast and use all possible ways that are legal, even if that means walking that thin line between legality and illegality and sometimes tripping over it.

Back to Hims & Hers. There are loopholes in the drug rules and Hims & Hers is using that loophole. Under Section 503A of the Federal Food, Drug and Cosmetic act, it is allowed to use compounding for personalization. There are all sorts of reasons why this can be done: the dose is not fit for the patient, the patient has an allergy, a certain element of the drug interacts with other medications the patient takes, etc.

One of the reasons compounding is allowed deserves a bit more attention: if there's a shortage of the drug. That was the case for Wegovy. Novo Nordisk could not make enough Wegovy for the huge demand. That shortage status was stopped by the FDA earlier this year and in May, compounding for shortage reasons was terminated.

Eli Lilly and Novo Nordisk were very frustrated by the shortage status, as the compounded versions ate into their margins and their patent was temporarily powerless in that sense. It's essential to understand this to understand Novo's reaction.

Why Did This Happen?

There's never a single reason why such things happen.

The context I just described, the frustration of Novo Nordisk about the FDA granting the exception of compounded drugs because of the shortage, is definitely one element. Novo knows that the American market is by far the most profitable.

Hims & Hers grew fast with its compounded GLP-1 and probably that caught Novo Nordisk's attention. For them, it was simple: Hims & Hers could not produce any semaglutide anymore and it made sense to partner with Hims & Hers for the distribution of Wegovy.

Let me rehash two key passages from the press release here.

Remember, this press release was from Hims & Hers.

I think these passages suggest that Hims & Hers saw the collaboration as a way to continue what it did, but with the support of Novo Nordisk. In other words, it wanted to be in the driver's seat. I think it wanted, so to speak, Novo Nordisk to make a 'compounded' version for them. In the meantime, it could continue with the compounded formulas if necessary, until Novo had a good alternative that was not their general Wegovy drug.

The results on Hims & Hers are better because of the platform. Hims & Hers reports that its integrated, on-platform approach leads to better adherence, lower discontinuation rates, and improved patient-reported outcomes compared to industry averages.

For example, only 13% of Hims&Hers' GLP-1 customers discontinued within the first month, compared to a 30% discontinuation rate reported in a Blue Cross study for commercially available options.

Hims & Hers attributes this success to its ability to personalize dosing, manage side effects, and provide comprehensive support.

In other words, Hims & Hers is confident about its approach and I think Novo Nordisk completely misjudged that.

Novo Nordisk went in with other expectations. They probably saw Hims & Hers as a distribution platform for their Wegovy. Partnering with Hims & Hers would make it easier to stop H&H from using the loophole for compounding. Seeing that this didn't happen and Hims & Hers continued to use the loophole made it furious. The press release is written from that point of view. It kicks around wildly, trying to paint Hims & Hers as a scammy company.

The message Andrew Dudum sent out to defend Hims & Hers was also as expected: it paints Novo Nordisk as a part of the Big Pharma complex that bullies independent companies like Hims & Hers that only care about the patient.

The truth? Probably, it's somewhere in between.

Lawsuit Incoming?

My initial reaction to this was that this was the first step for a big lawsuit that Novo would use to try to prevent Hims & Hers to use compounded semaglutide.

However, here you see the value of thinking things through before publishing an article. While initially, I thought the chances were 90% or higher, I'm not that convinced anymore.

There are at least three reasons to believe Novo Nordisk will not sue Hims & Hers.

1. Suppose Novo Nordisk sues Hims & Hers and the judge affirms that Hims & Hers acts within the law, which I still think is likely, it would be a total disaster for Novo Nordisk. It would be a green light for all other platforms like Ro and others to follow in HIMS' footsteps. After all, the judge said it was OK, right? Now those other platforms are worried about their reputation and lawsuits. Losing would mean a disaster for Novo Nordisk.

2. The prescriptions, and therefore the decision about whether the patient needs a personalized version of semaglutide or not, is not made by Hims & Hers. Dozens of independent doctors prescribe these personalized drugs. They evaluate the patients and use their professional judgement. They have medical licenses and they know they can lose these if they don't act properly.

This first layer already makes it hard to claim that Hims & Hers is responsible. Unless Novo Nordisk can produce a smoking gun, such as an internal document that instructs doctors to prescribe as much compounded semaglutide as possible, it's not easy to prove that Hims & Hers is responsible for what Novo Nordisk believes is the excessive prescription of personalized medicine instead of their generally available Wegovy.

3. On top of that, there is another layer. Hims & Hers also doesn't produce or even distribute the compounded semaglutide. They use a network of compounding pharmacies to service the personalized semaglutide prescriptions.

So, any lawsuit would have to prove with hard evidence that Hims & Hers is the spider in the web of doctors and compounding pharmacists.

That doesn't mean there can't be a lawsuit. Novo Nordisk could use a lawsuit to try further to damage Hims & Hers' reputation. But after wild allegations and a lot of media fuss, I also suspect that it would be eager to settle the case.

Hims & Hers would probably use a lawsuit as a marketing opportunity and profile itself as the David vs. Goliath, the small but righteous party fighting for the people against the evil giant.

In that context, I came across an interesting poll.

As you can see, I voted for 'take the fight' because if Hims & Hers really wants to be a disruptor, it has to do disruptive things like this.

Reputation Damage?

I hear many professional stock analysts talk about 'the reputation damage' Hims & Hers is having now, but I don't believe that. There's a saying in marketing: "There's no such thing as bad publicity." It means that even if you are in the news negatively, there's often a positive effect on sales because your name is more well-known.

Now, of course, in healthcare, reputation is of utmost importance. However, it's not as if poison has been found in Hims & Hers' products. The fact that the compounded drugs come from China may sound scary to the general public, and that's definitely Novo's intention, but it is common practice for drugs in the US.

China is only responsible for about 6% of the drugs in the US, but that's only if you look at the finished dosages. When examining Active Pharmaceutical Ingredients ('APIs'), which are used to manufacture drugs, China holds a 17% market share of imported APIs in the US. But that's not all.

Most generic drugs are made in India. Where do they source their APIs from? You guessed it, predominantly China. Estimates suggest about 80% of APIs used in India are Chinese.

For certain products, China's market share is extremely high. Approximately 95% of Ibuprofen comes from China (either directly or indirectly, through India), for example.

Making it appear scammy that products come from China is just a dirty marketing tactic from Novo Nordisk. Many of the drugs Americans take come from China. You can discuss if that's a good thing, but that's another discussion. Here, I just wanted to add context to Novo's claim.

As for the accusation of illegality of the loophole, there could be some truth there, but as I argued before, it won't be easy to accuse Hims & Hers of this. You would have to sue all prescribing doctors and prove that Hims & Hers forced them to prescribe as much personalized medicines as they possibly can. Not so simple.

Hims & Hers keeps claiming that it is fully compliant with the law.

Adding Fuel To The Fire

A Bloomberg article shared news that makes the situation even more interesting. It reports that California will stop reimbursing Medicaid for weight-loss drugs.

This is in HIMS' advantage and puts extra pressure on Novo Nordisk. If the semaglutide is not reimbursed, you can as well buy it on Hims & Hers, where the distribution is much easier.

Financial Impact?

Some worry about the financial impact. I think it will be limited because the partnership was so short. It was only announced on April 29, which is already in Q2, so I don't think it will have been included in the guidance.

This is guidance management projected.

This is what Yemi Okupe said about this guidance:

Embedded in our outlook are a few key assumptions that reflect the intentional evolution of our platform and how we're setting ourselves up for long-term success.

First, we expect continued strong growth across many of our most tenured offerings, including mental health as well as men's and women's dermatology, all of which are benefiting from years of investment in brand retention and personalized offerings.

That said, while sequential and year-over-year growth is expected to continue, we do expect uneven trends in sexual health as we navigate transitions in the treatment mix, which we believe is temporary as new daily personalized solutions gain traction. We're already starting to see encouraging signs of momentum that we believe will strengthen with the addition of new offerings over the course of the year.

Second, we expect to complete the transition of subscribers previously on commercially available doses of semiglutide to either appropriate alternatives on our platform or other platforms entirely by the end of the second quarter.

This transition is expected to result in a one-time quarter-over-quarter revenue drop in the second quarter, from which we are confident we can continue to build upon through the remainder of the year.

Third, we expect gross margins to expand in the second quarter. Based on the information that we see today, our expectation is that operational efficiency gains and growth from more tenured specialties can offset potential headwinds from macroeconomic factors such as tariffs.

Do you see anything that would be changed here? I don't. Management already knew that compounded semaglutide because of the shortage was ended by the FDA and reflected that in its commentary and guidance.

So, I expect Hims & Hers to still post similar YoY growth. Suppose (suppose!) there would be a miss, I don't care too much. If that miss is not gigantic, I don't care too much. I'm not in Hims & Hers for the short term, but for the long term. With solid growth in non-GLP-1 (+30%) and the expansion into Europe with the ZAVA acquisition, I don't see the long-term investment case hurt.

This is how I feel about Hims & Hers.

So, Is HIMS A BUY, HOLD, Or SELL Now?

I understand the fear. The Novo Nordisk press release sounds pretty scary, doesn't it? But sometimes, the best opportunities come at a time of peak fear.

If you’re already a paid subscriber, thank you. 🙏

You’re getting the full experience.

If you’re still on the free plan, this is just a preview. The complete insights are waiting on the other side.