Here's What I Bought For My Portfolio

Money speaks louder than words

Hi Multis

Today, I added to the Forever Portfolio again. It had been a month since I last added, which is about twice as long as my usual two-week interval.

So, why didn't I add to my portfolio two weeks ago?

And why did I decide to add to my portfolio now?

And what did I buy?

All questions that will be answered in this article.

Why didn't I buy two weeks ago?

As I have written a few times in the Overview Of The Week, I have taken extra time to dig deep into new companies on my radar. In a way, the buying was not on my mind because of that. I wanted to study uninterrupted. S-1s, quarterly and yearly reports, I've read a ton in the last few weeks. I chose to focus rather than blurt out some hurried buys.

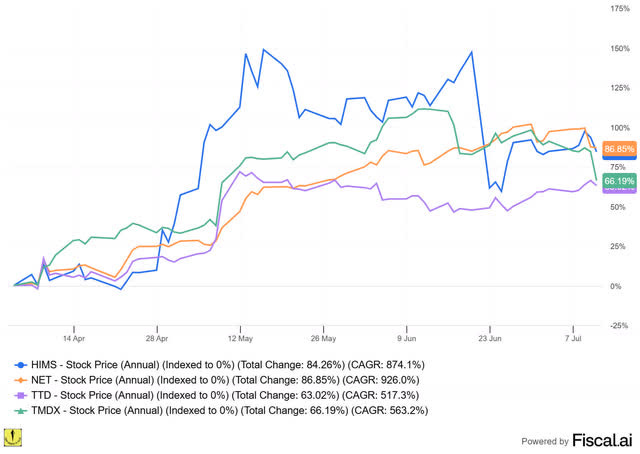

On top of that, stocks have been on a strong run lately, and that's why I see fewer obviously attractive opportunities. I didn’t want to rush into buying just to stay active. Right now, it takes more effort to separate what’s truly attractive from what’s just riding momentum. These are a few Potential Multibaggers since the April lows.

If you're interested in Fiscal.ai (formerly Finchat), I have a 15% discount for you.

As you can see, all are up 63% to 87%. That's not an improvement in the company outlook or other fundamentals. That's purely market sentiment.

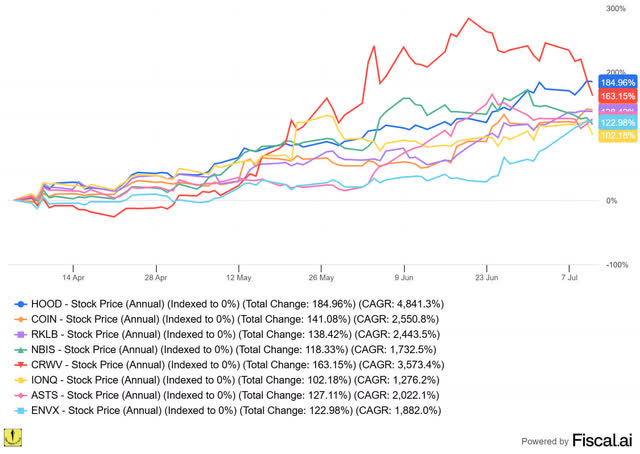

It's not 2021 yet, but it seems to be getting closer. Crypto is hot, momentum stocks with no revenue almost tripled over the last year (I'm looking at you, AST Spacemobile) and I see too many people on X sharing their year-to-date gains. If you think the above stocks have jumped a lot, they are not among the leaders. Just look at these eight stock. They all more than doubled in just a few months.

If you're interested in Fiscal.ai (formerly Finchat), I have a 15% discount for you.

Companies like IonQ and ASTS don't have any meaningful revenue. I've seen this picture before.

In the meantime, the impact of the tariffs is not clear yet.

So, why did I buy now?

I always think it's good that an investor can hold two opposing thoughts in his or her mind.

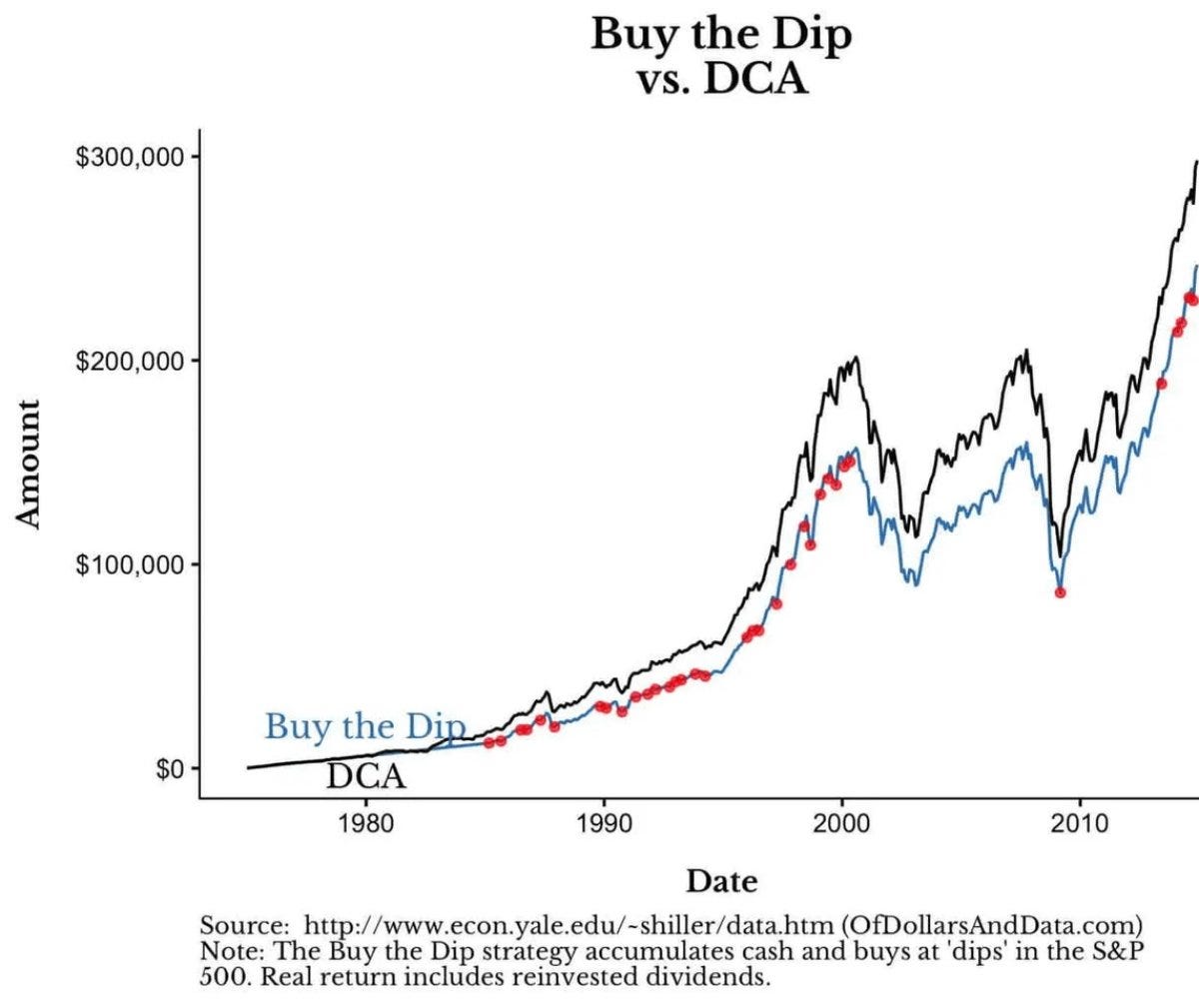

On the one hand, I view the market as expensive now. On the other hand, I also know about these two charts.

It may sound counterintuitive but buying the dip perfectly (which nobody can) underperforms dollar-cost averaging.

This is counterintuitive but true. The reason is that the market is often much higher at the next dip than it was at the previous one.

So, while I think the market is expensive in general, I know it's best to keep up the dollar-cost averaging.

We also know that the market can stay irrational longer than you think. Or in the words of the famous economist John Maynard Keynes:

I could just be wrong about the market being expensive. AI could (could!) accelerate earnings faster than the analysts expect and the market often has a tendency to know that. And in every bull market, there are pockets of bubbles. I'm pretty sure multiple of the stocks that more than doubled in a few months are in that category, but it doesn't have to mean the whole market is in a bubble.

And the last thing. If you have a plan, it's better to follow it, no matter what. And that's why I invested.

If you’re already a paid subscriber, thank you. 🙏

You’re getting the full experience.

If you’re still on the free plan, this is just a preview. My complete portfolio is waiting on the other side.

Join today and get 20% off your subscription.

So, what did I buy?

If you burn with curiosity, let me give it away right away. This is what I added to the Forever Portfolio today.