Hi Multis

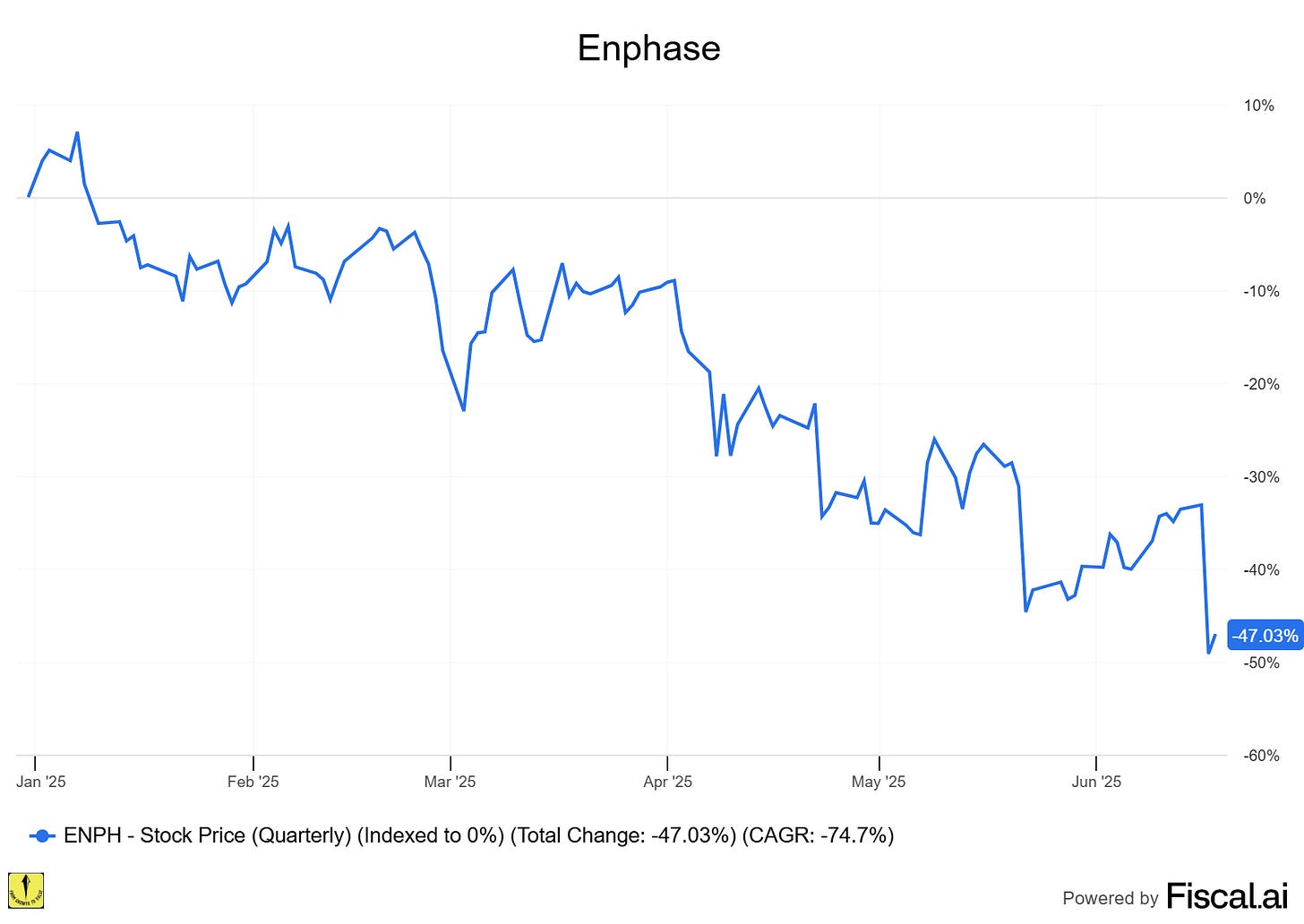

Enphase (ENPH) posted its results a while ago, but in the last few weeks, the complete abolishment of solar subsidies has hurt the stock quite a bit. The stock is down 47% year-to-date.

The question I want to answer with this article is whether Enphase is attractive after this drop or one to avoid.

The Numbers

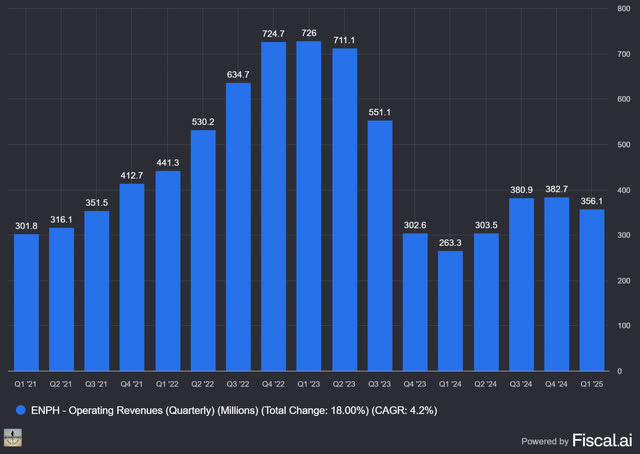

Enphase's revenue came in at $356 M, down 10 % QoQ but up 35% YoY because of the very weak quarter last year. Revenue was 1.64% lower than the consensus. This has become a bad tradition at Enphase since Q2 2023. Seven revenue misses in eight quarters. Ouch.

(Made by Kris)

Revenue appeared to have turned around in the last three quarters, with growth resuming. But this quarter broke that trend again. Revenue is almost similar to that of Q1 2021, four years ago.

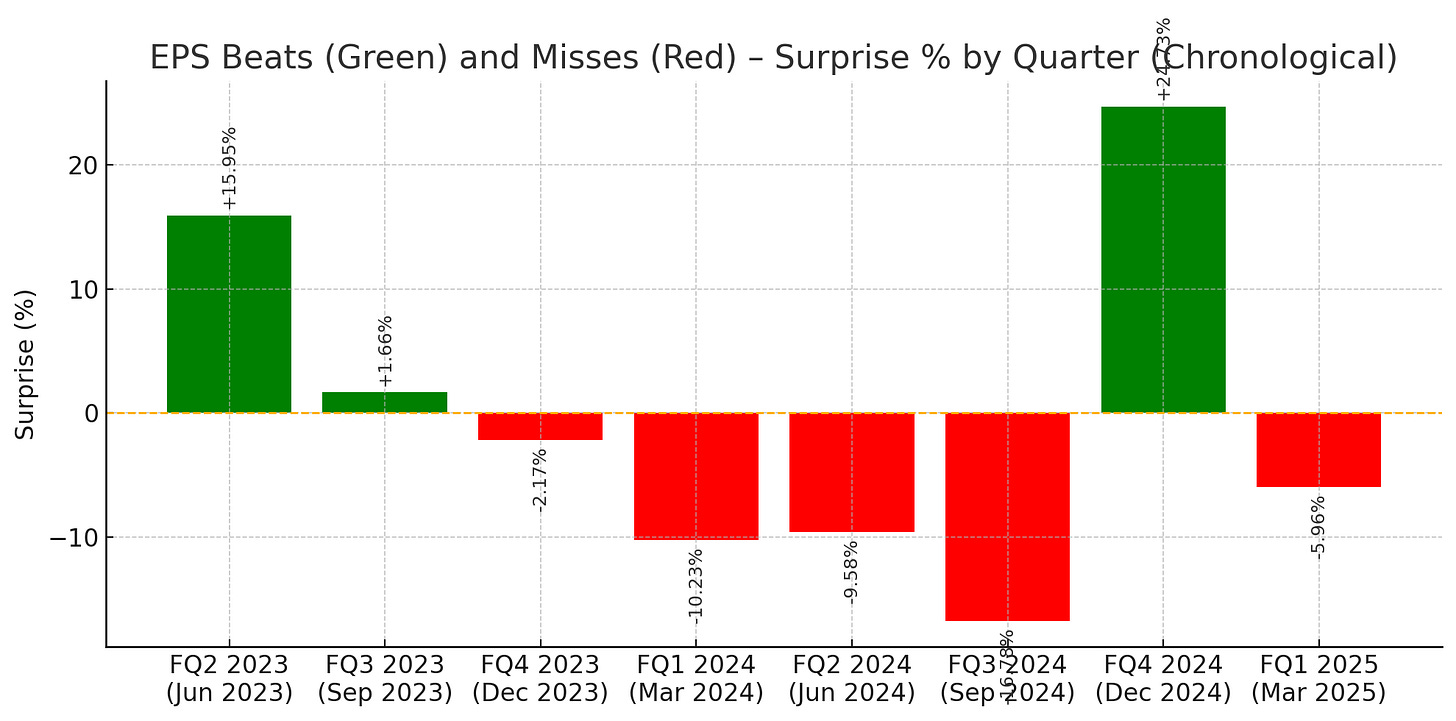

EPS came in at $0.68, another miss, as the consensus stood at $0.72. Here too, Enphase's recent track record is not rosy, with 5 misses in the last 8 quarters.

(Made by Kris)

As you can see, the previous quarter was really strong and that spurred optimism, which was already killed again by this quarter.

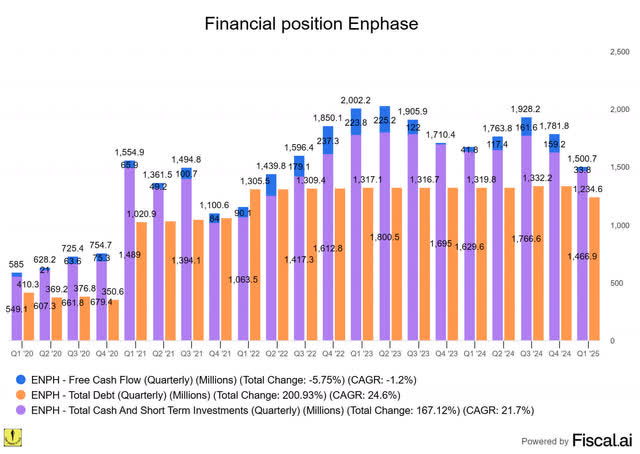

Gross margin slipped 430 bips QoQ to 48.9 %. Positive is that free cash flow stayed positive at $33.8 M despite a $100 M buy-back and final repayment of 2025 convertible bonds.

Still, it's the lowest FCF but two of the last 21 quarters.

Management guided for Q2 revenue in the range of $340 million to $380 million. At the midpoint, this would translate to an 18.6% revenue growth. Of course, Q2 2024 was a very weak quarter. Most analysts had expected guidance to be around $380, so the lower midpoint of the guidance bracket was seen as another disappointment.

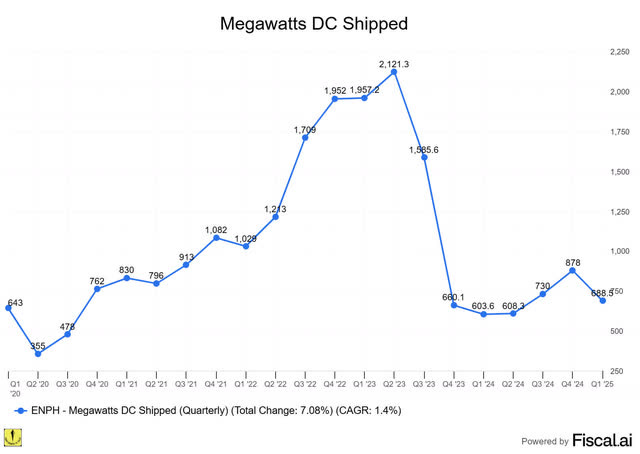

If we dig a bit deeper, we see the KPIs (key performance indicators) of Enphase.

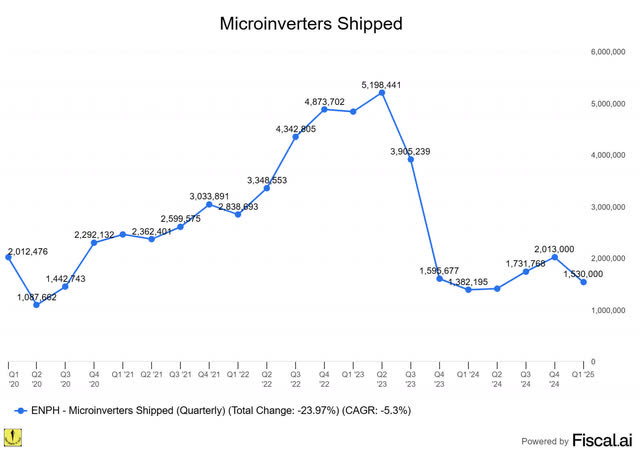

A worrying trend is the dropping megawatts shipped. That had been in an uptrend but dropped again this quarter. Here too, you see that in the current quarter, Enphase could not top the Q4 2020 quarter and the following 13 quarters.

You see the same trend in the number of microinverters shipped.

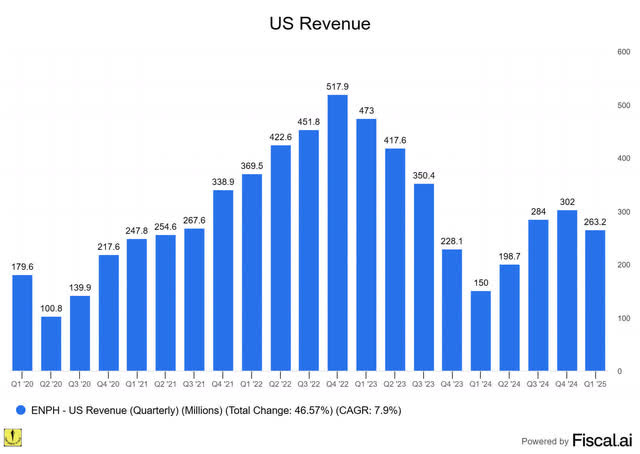

Of course, you see the same trend in the US revenue, still by far Enphase's biggest geography.

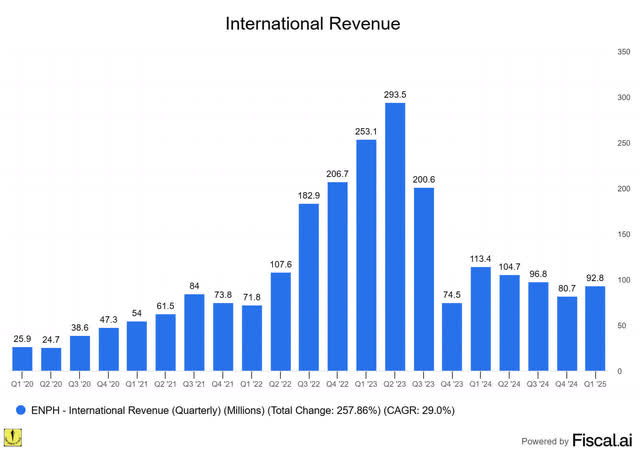

The only exception to this trend is the international revenue, which was slightly up QoQ. But as you can see, it saw steep declines since Q2 2023 and unlike the other metrics, it kept dropping in the previous quarter.

But even that could hardly be seen as positive. Sell-through actually fell by 9% in Europe. But the FlexPhase battery was launched in Germany during the first quarter.

Intermission: if you want to make all these great graphs yourself, and get great insights, Fiscal.ai (formerly Finchat) gives you a 15% discount with this link.

Insights from the call

Let's start with the big one: Why was revenue down in Q1, after several quarters that suggested improvements? CEO Badri Kothandaraman:

One of the large national lease providers is facing financial challenges … installers had difficulty managing cash flow, originations suffered, and sell-through fell 18%.

The other theme everyone was interested in? Tariffs.

CEO Badri Kothandaraman said right away:

The newly announced 145% tariff on products from China, along with the 10% reciprocal tariffs on import from other countries is expected to have minimal impact on our microinverters and accessories. Thanks to the excellent work our team has done to diversify its supply chain.

That doesn't mean there will be no impact at all. After all, the products from China are cheaper. And Enphase is not just microinverters.

Kothandaraman continued:

However, our batteries will be more impacted as we currently source battery cell packs from China. These tariffs are expected to reduce our gross margin by approximately 2% in Q2 of '25. The effect of the tariffs is limited in Q2 due to us having pre-tariff inventory.

Starting in Q3, we anticipate a 6% to 8% total gross margin impact after accounting for pricing adjustments.

In the Q&A part, it became clear that Enphase will partly shift the impact to installers and eat the rest.

But the impact should be limited in time. Again CEO Kothandaraman

We have already identified tangible sourcing options outside China and we are fast tracking the qualification. These efforts are progressing quickly, and we expect to fully offset the impact starting in Q2 '26.

I liked this quote:

While we cannot control the macroeconomic conditions, we can absolutely control our response. This means doubling down on what has always made Enphase successful, relentless product innovation, world class reliability and exceptional customer service.

That's very true, of course, but it doesn't take away that the company is still to a great extent subject to the macro conditions.

The interest rates play a crucial role, both positively and negatively. You can clearly see that in the post-COVID zero-interest environment. Solar got a huge boost. When the Fed raised interest rates at record speed to cool the post-COVID inflation, you saw the reverse effect for Enphase, with some delay, as people had locked in their rates. So, any higher-than-expected inflation is bad for Enphase.

Let's go to the Quality Score.

Quality Score

Before we begin this one, I have to admit that I'm actually curious about this one, as Enphase had the lowest Quality Score of all Potential Multibaggers.

Personal conviction: 5.5/10, down from 7/10

Enphase seems to be very susceptible to any macro change and that's not very convincing.

Profitability: 6.5/10 (unchanged)

Despite dropping revenue, Enphase has consistently been profitable on a free cash flow basis. On net income, which ranks under free cash flow for me, it was also consistently profitable on a yearly basis, although there were 2 quarters in which that was not the case.

But look at both this quarter. Very weak. And that's before the impact of the tariffs.

The score must still be positive, but must be lower because of the CAGR you can see under the bar charts: the CAGR or compound annual growth rate. For Free cash flow, that's -1.2% over the last five years (20 quarters!), for net income, it's -15.5%. That's not what you want to see as a shareholder.

But, again, because both remain positive, I give a positive score: 6.5/10.

Sales efficiency: 8/10 (down 10/10)

The sales efficiency formula is one I developed myself. I look at Sales & Marketing as a % of revenue, revenue growth, revenue growth expectations and gross margins. I divide the result by 10 to get the efficiency score. This is Enphase’s:

This is a very volatile score for Enphase. It jumped from 1/10 to 10/10 and now to 8/10. Of course, revenue growth is an important factor and in a way, that high revenue growth seems undeserved because it comes after such a weak quarter last year. But the numbers are the numbers.

Innovation: 3.5/5 (unchanged)

Mark has updated you consistently in the Overview Of The Week: the company has significantly accelerated its international launches and new product introductions. It was also a focus point on the conference call.

Must-have?: 0.5/5 (down from 1.5/5)

The abolition of subsidies for solar energy caused me to drop this score.

Revenue growth: 4/5 (unchanged)

35% revenue growth, that's great. Why not more than 4/5, then? Because this is compared to the very easy comps last year.

Durability of growth: 6/10 (down from 6.5)

Many will be surprised that this score was so high (and remains high now) but there's a difference between short-term revenue drops and long-term growth potential. You already see that in the most recent quarter.

Management quality: 7/10 (down from 7.5/10)

I get it. There are many factors that management can't control. But the continuous misses mean that management should guide even more conservative.

Insiders' ownership: 2.25/5 (unchanged)

Multibagger potential now: 1.5/5 (down from 3.5/5)

The macro context, the abolition of the subsidies, the continuous misses... Things don't look great for Enphase. If you look at multibaggers in the past, there were always moments when the company could have failed, but turned around in time. Think of the Qwikster debacle at Netflix, for example.

But those companies held their fate in their own hands. I don't have that feeling anymore for Enphase, and that's why I lowered this score substantially.

TAM & SAM: 4/5 (unchanged)

The total addressable market and serviceable addressable market remain huge.

Financial Strength: 7/10 (unchanged)

Enphase has a relatively strong balance sheet, but due to its lower cash and relatively high debt, I rate it 6.5/10.

Risk (negative): 3.5/5 (from 2.5/5)

The risks have definitely become bigger, although I think we should not despair. The cost of solar has come down substantially and it will keep getting more efficient. But over the foreseeable future, there is definitely more risk.2222

Competition (negative): 4/5 (from 3/5)

The competition has always been cut-throat in solar, but I still raised this score because Hoymiles also started with microinverters and is expanding them. That increases the pressure on Enphase.

Dilution (negative): 0/5 (unchanged)

Enphase reduces its outstanding shares through its buy-back program.

Scale advantages shared (-5/+5): 2/5 (unchanged)

PMQS conclusion

In the previous quarter, Enphase's Quality Score jumped from 49 to 64 but this was a weak quarter and the abolition of subsidies made things even worse.

So, what will I do with the stock? Buy, Sell or Hold?

There's also too much competition the sector, not just from solar, but also from oil, gas, nuclear and on top of that, there's political risk.

On top of that, there’s no relation with the end customer. The installers decide and that’s why the pricing power of Enphase is limited. With more competition, no more subsidies and China tariffs, Enphase is in a bad place and that’s why I rate it a sell.

There's one problem: I'm awful at timing. I usually buy over time, and one of the reasons is definitely that I'm not good at market-timing. So, it could be that Enphase is at or near its bottom here. You often see that when the worst news is out, the stock bottoms.

That’s also why I would not want to take a short position. It’s hard to time these events, that play out live before our eyes.