Hi Multis

You didn’t hear from me this week. Or at least, not through articles, I was on Slack for those who have a paid subscription.

As I shared in last week’s Overview Of The Week, I was in Dubai for ValueX Middle East. I’m actually writing this on my flight home. I am not even sure I will be able to publish it today, as I’m tired after an intense week. The sessions began with morning coffee at 8:30 am and concluded with dinner at 9:30 pm. But, of course, if you are an investor, and you are surrounded by other top-notch investors from all over the world, what do you do after you have talked about investing and business all day? You go to the bar and you continue talking about investing and business.

‘From all over the world’ is not an exaggeration. About a quarter of the attendees came from the Middle East, a quarter from Asia (many from India, but also Hong Kong, Singapore, and South Korea, for example), a quarter from Europe (including the UK), and a quarter from the US.

That’s a very diverse public and that makes it extremely interesting. People from other cultures sometimes look differently at business. Think of the discussion about dividends or buybacks, for example. Or about growth and value.

It was a fantastic week, full of inspiration. I’m sure that will pay off for you too, dear Multi. After this week, I know more, have more ideas and am better-connected.

I talked about Rubrik. Many didn’t know it but were enthusiastic after the presentation.

Articles In The Past Week

This is the only article of the week.

But get ready, as there’s a ton to come in the upcoming weeks!

Memes Of The Week

This is a meme I have already shared about a year and a half ago. It’s still applicable today, as the Mag7 suck up most of the gains.

I made this meme myself this week.

Multi Rule no 2 shared one on the same subject.

I also laughed because of this Bill Ackman reply.

Interesting Podcasts Or Books

One example of someone I met at a ValueX conference, in Klosters in February, is Luca Dellanna. He’s an author who is not on everyone’s radar, but he should be.

It feels like you are reading a book by Nassim Nicolas Taleb without the deliberate shin-kicking. Or, to put it differently, while Taleb can always provoke me with certain statements in his books, they can come across as very arrogant and, therefore, can make me angry. Luca Dellanna can do the same, giving thought-provoking thoughts on controversial subjects, but without the deliberate offense Taleb sometimes uses. To me, that makes it even more valuable.

On the flight to Dubai and back, I read his soon-to-be-published book Poverty and Prosperity. It’s a phenomal book. If every politician would read the book, this world would be a much better place. The book proves in a very logical but simple way what can lead communities to prosper.

The book is not out yet, so you can’t recommend buying it yet. But I would definitely also advise you to read Ergodicity, Luca’s book from 2023.

It talks about aspects of winning (including in the stock market) that many overlook. Just for example, the Olympic golden medal in skiing is not the best skiier, but the best of those who didn’t quit because they lost their motivation, got injured or didn’t make it for any other reason. That has consequences for investing.

The markets in the past week

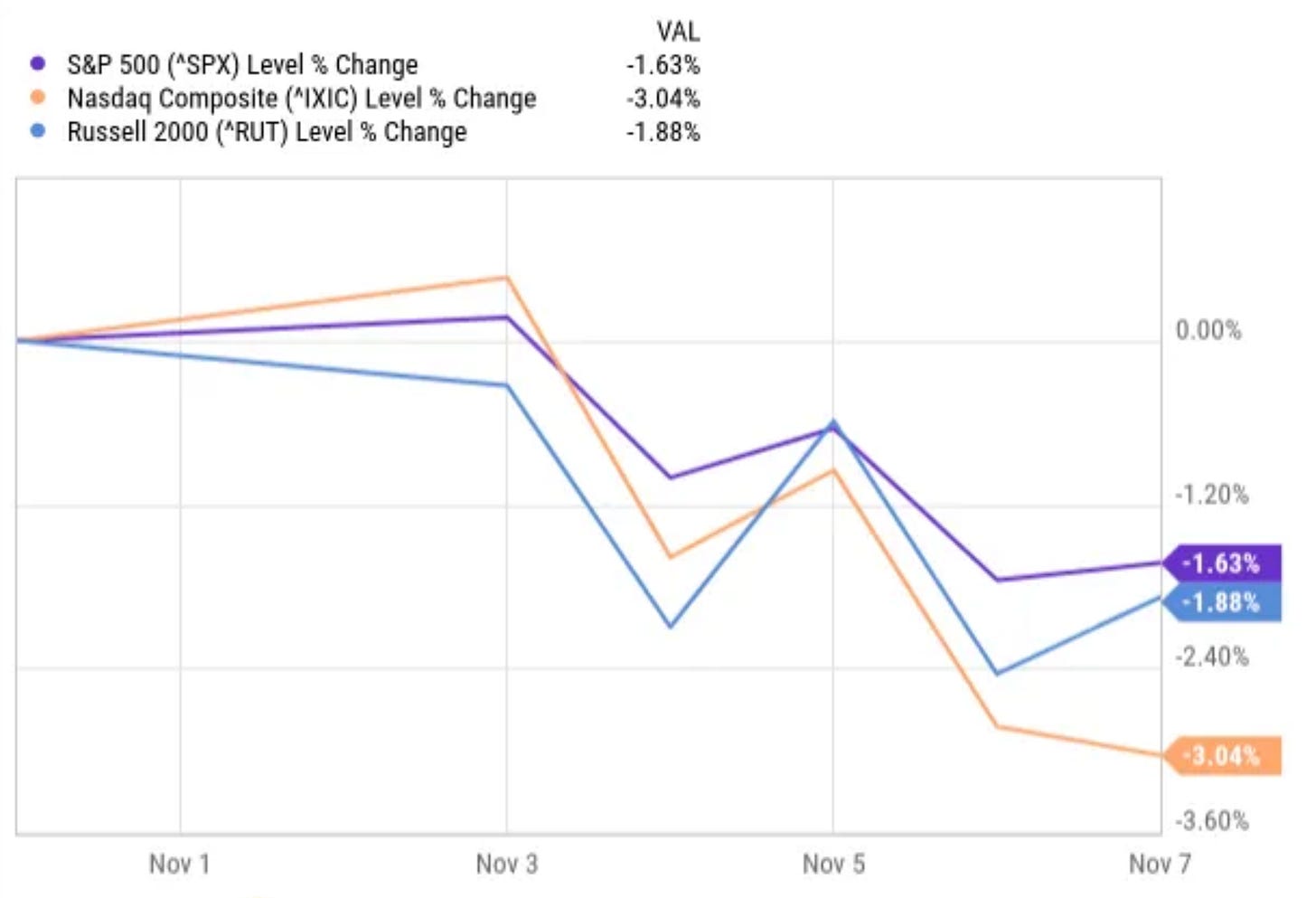

Because of the very busy schedule I had and the time difference, I didn’t follow the markets as closely this week. I heard some mention that the markets were down, but I have no idea to what extent. So, I am very curious to see the graph this week.

As you can see, the Nasdaq dropped the most, by 3.04%. The Russell 2000 dropped by 1.88% and the S&P 500 by 1.63%.

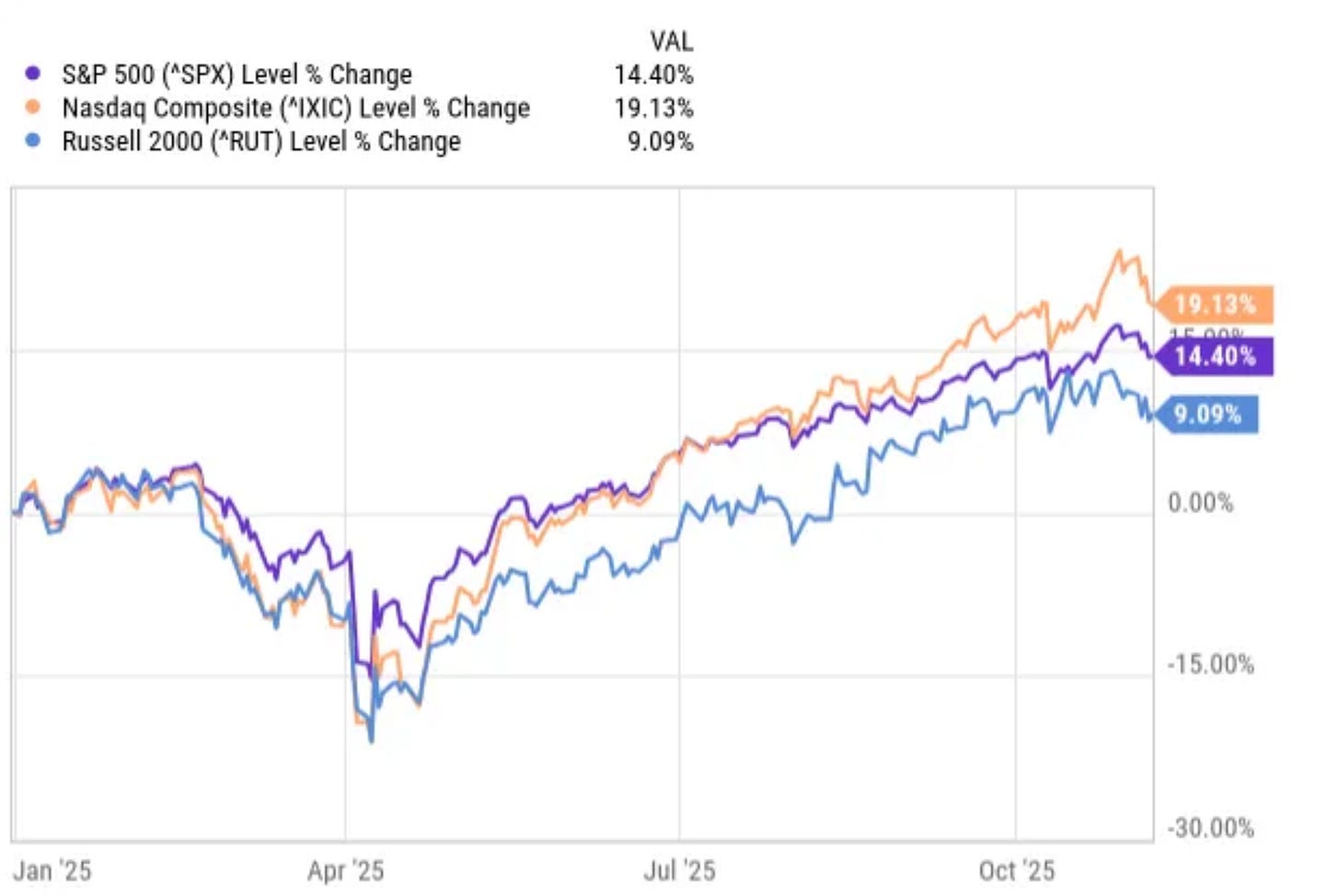

How do the different indexes stand year-to-date? Let’s have a look.

As you can see, the Nasdaq is still up the most, by 19.13%. The S&P 500 follows with 14.49%, and the Russell 2000 continues to demonstrate why the meme I shared remains applicable.

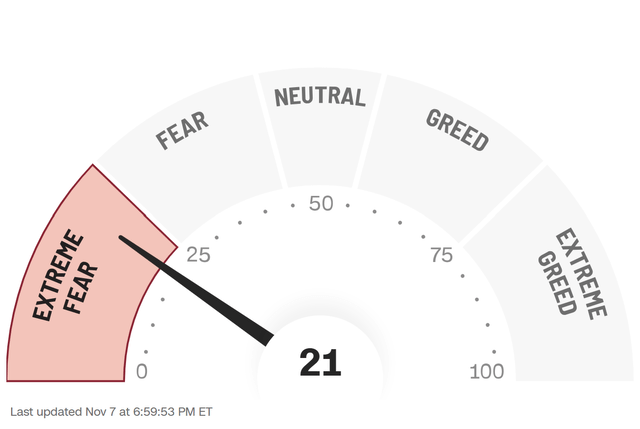

What did this down week mean for the Greed & Fear Index? Let’s check.

As expected, it dropped to Extreme Fear.

Lesson Of The Week

This week, the Lesson of the Week also has to do with Dubai. Throughout the entire congress, it was clear to me through numerous conversations that we, as individual investors, have a significant advantage over professional investors.

It’s very simple. If you invest your own money, you can afford to be down a year, even two or three. If you have investors, they will put you under a lot of pressure and many will leave at the very worst moment, when the markets are down. So, that means you have to sell positions to give those investors back their money. That causes even bigger drops because every other fund manager has the same problem.

On the other hand, when the markets are up, money flows into the fund. That means that you have to invest that money, even if you think there are not many great opportunities to invest.

One of the attendees was from Himalaya Capital, the fund of the legendary investor Li Lu. Li Lu is the only one to whom Charlie Munger ever gave money to invest. Need I say more?

Li Lu and Charly Munger (source)

The attendee from Himalaya Capital had an excellent presentation about (among other things), holding BYD for so long. Himalaya Capital made a killing on the company. It bought in 2003 and still holds it today. It’s a huge winner.

So, great success, right? However, during that period, the stock dropped by more than 50% on six separate occasions. Many of the attendees, professionals, said that they could never have done that. I could answer them that I have done it multiple times. For example, Shopify was down 85% in 2022 and I added multiple times.

Duolingo is now down more than 60%. To many professionals, that could cause pressure from clients if they hold the stock. To me, it’s simple: I will add quite a bit soon. I only have to look at myself, as it’s my own money that’s on the line.

I talked to the Li Lu collaborator during lunch, and I asked him what he did exactly at Himalaya. Did he work directly with Li Lu? The answer surprised me. He said he’s Li Lu’s shield. He said that even Li Lu would be influenced by the pressure of his investors. That’s why it was his task to talk to investors, so Li Lu doesn’t have to.

So, dear Multi, don’t squander the huge advantage you have. Don’t be a fund, but just follow your own path.

For years, I have been asked why I don’t give my yearly returns. In a way, I get that, as it is standard in the industry to do that. But this is the reason I have never given in to that pressure. If you invest for the long term, you should not be focused on the short term and yearly results are the short term. Over the years, I’ve had many people who didn’t want to subscribe to Potential Multibaggers because of that. But I am fine with that, because I know those people won’t be focused on the long term.

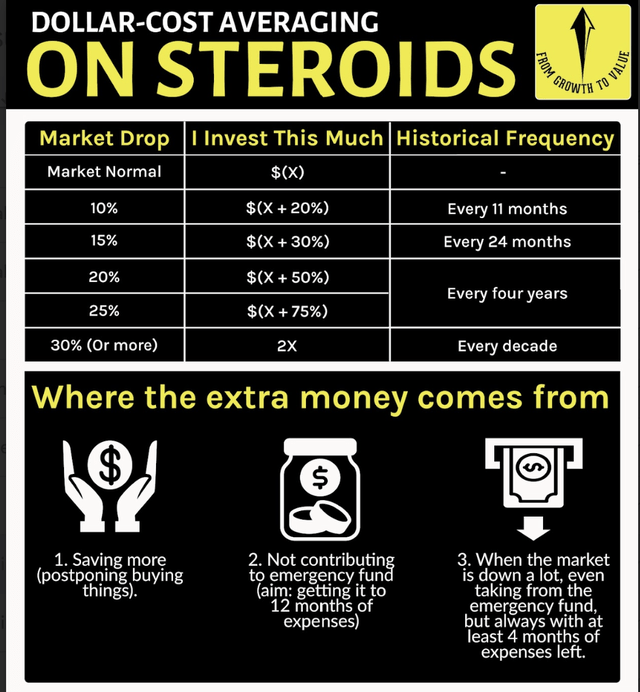

Everyone who has been a Multi throughout the years and has followed my system of averaging into positions over time and adding more when the market drops, knows that the results have been very good. If you didn’t know my dollar-cost averaging on steroids yet, this is the system.

Try implementing that as a fund manager. When the market drops, the money drops and when the market rises, the money increases. That’s a dollar-cost average on steroids in reverse.

Now, don’t get me wrong, I deeply admire many fund managers and portfolio managers. Most are extremely intelligent and well aware of their own disadvantage.

The main point I want to stress here is simple: even if professionals are smarter, your advantage is greater because of the systematic disadvantage that almost all professionals face. I know that some of the professionals will read this and they will nod their heads in agreement.

Don’t screw up that advantage by acting like you are a professional portfolio manager. Then you go into direct competition with them and as they are usually much smarter than you are, you’ll lose the game.

Or maybe even put simpler: Don’t sell when everyone sells, don’t buy what everyone buys and judge yourself over long periods, not short periods.

Quick Facts

1. Nubank and Shopee Team Up for Huge 11.11 Deals

Nubank (NU) and Shopee (SE), two long-time Potential multibaggers picks that have done very well, are partnering.

11.11 originally comes from China, and because the date consists only of 1s, it is known as Singles’ Day. It’s huge in China and Shopee started using it internationally as well. For Sea, it’s now bigger than Black Friday.

Shoppers who pay with a Nubank credit card on Shopee during the 11.11 event will get 50% off their purchase, capped at a maximum of 20 Brazilian reais (around $3.50) per person.

The discount is automatically applied at checkout and is limited to one per customer, since each person in Brazil has a unique tax ID number (called a CPF) that’s used to track the discount.

But there’s more. Nubank customers can also unlock extra rewards on Shopee, such as:

• R$5 off purchases over R$39 (about $7.00)

• R$50 off purchases over R$51 (about $9.00)

• Bonus Shopee Coins: 10 or 20 coins that can be used for future discounts

Plus, there’s a “Prize Roulette” where shoppers can win free shipping and coupons worth up to R$500 (around $85).

Nubank rewards its customers more and more with real-world perks. Recent offers include free Uber One and fast-food discounts. For Shopee, this leverages Nubank’s huge reach. Don’t forget that more than 60% of all Brazilian adults are Nubank users.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ Deep insights through quarterly earnings deep dives

✅ My complete portfolio (with every transaction)

✅ The Quality Score and valuation updates every quarter.

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% over 3 years!)