Hi Multis

Anand here with the Datadog (DDOG) Q1 2025 earnings result. Datadog reported strong Q1 results last week, on May 6, 2025.

The stock price went up marginally, no big swing, and that's really good for long-term investors.

We first go through the earnings and then Kris will take over for the Quality Score and Valuation Score updates.

The Numbers

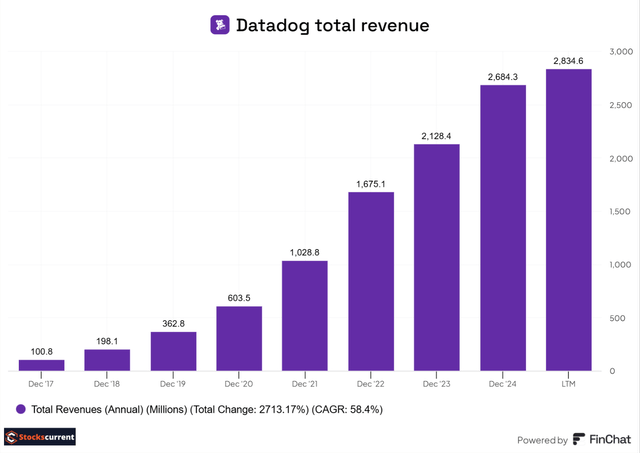

Datadog reported total revenue of $762 million, an increase of 25% year over year. The company's eight-year revenue CAGR of 58.43% (see the bottom of this chart) shows how strongly it has delivered.

Source: Finchat

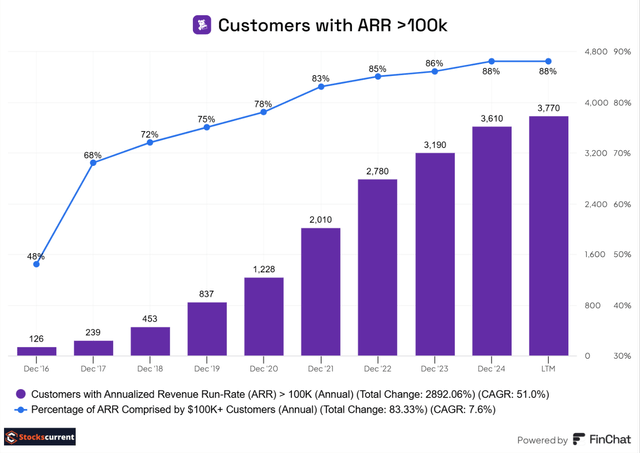

Datadog ended Q1 2025 with about 30,500 total customers, up about 9% from about 28,000 a year ago. There were 3,770 customers with an ARR (Annual Recurring Revenue) of $100,000 or more, an increase of 13% from 3340 a year ago. Management didn't provide numbers for total customers with more than $1 million in ARR.

Source: Finchat

The dollar-based net retention rate is steady at 120%, which is a good thing; expansion into the existing customers is getting into a normalized environment.

Source: Finchat

Last year, the dollar-based net retention rate was down to 115%, which concerned some investors. On top of that, industry-wide cloud cost optimization efforts put more pressure on Datadog. I must mention that Datadog maintained a dollar-based net retention rate of 115% (which many companies would give an arm and a leg for) during the tough times and that it remained a profitable company.

Datadog's platform adoption is growing steadily. Datadog’s land-and-expand model is working as management expected.

By the end of the first quarter, 83% of its customers had adopted 2 or more products, up from 82% a year ago. Furthermore, 51% of Datadog's customers used 4 or more products, up from 47% a year ago. 28% of the customers were using 6 or more products, an increase from 23% a year ago. Finally, 13% of the company's customers were using 8 or more products, up from 10% last year.

These are impressive numbers.

Source: Finchat

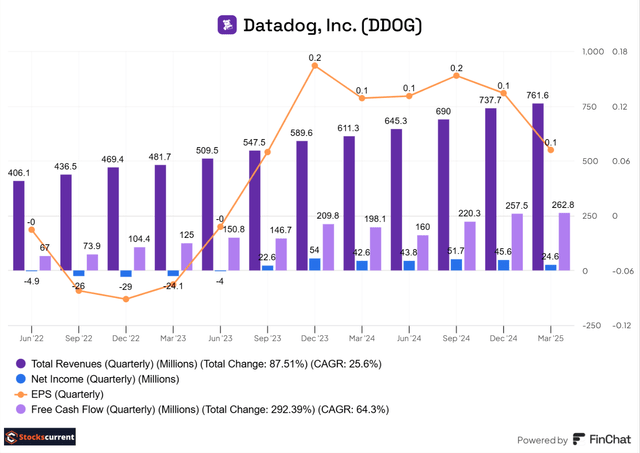

Datadog reported a GAAP net income of $0.7 per diluted share, while the non-GAAP net income was $0.46 per diluted share.

The company reported billings of $748 million, up 21% year over year. The remaining performance obligations, or RPO, were $2.31 billion, up 33% year over year. CFO David Obstler thinks revenue is a better indication of business trends than billings and RPO because these can be noisy. The length of contracts plays a role here. Moving forward, I will focus more on revenue and not the RPO or billings. I will cover them occasionally or if there is a major change on either side.

For Q1 2025, the company's operating cash flow was $272 million, with a free cash flow of $244 million and a free cash flow margin of 32%. Free cash flow and free cash flow margin are improving; this is a sign that growth is profitable, and the company is strengthening its balance sheet.

Source: Finchat

By the end of Q1 2025, Datadog had cash and cash equivalents totaling $4.4 billion. The company made two small acquisitions, but still, the cash pile kept growing steadily. I am impressed with their cash position and how carefully this management is deploying the cash in a meaningful way.

Source: Finchat

Guidance

Q1 2025 Outlook:

Management guided for revenue between $787 million and $791 million, which is up more than 22.6%. The management team has raised its Q2 revenue guidance. I still think it is conservative, and they will beat in actual results. That's more or less a tradition for Datadog. Non-GAAP operating income is expected to be between $148 million and $152 million, which translates to non-GAAP EPS from $0.40 to $0.42.

Full-Year 2025 Outlook

For the full year, the management team guided revenue to be between $3.215 billion and $3.235 billion, or 19.25% up year over year on the midpoint. They raised full-year guidance from $3.175 to $3.195 billion from the last quarter. Non-GAAP operating income is expected to be between $625 and $645 million, but it decreased from the previously guided range of $655 to $675 million. Non-GAAP net income per share ranges from $1.67 to $1.71.

The management team mentioned that they raised the full-year guidance based on the visibility till April, and they haven't changed the guidance for the second half of the year in the calculations. Based on Q1 progress and the management team's track record, they will beat their guidance for the full year.

Highlights from the conference call

Not one but two acquisitions

Datadog announced two small acquisitions, Eppo and Metaplane. The financial terms are not published publicly, but they include $10 million in acquisition-related costs. These are pretty small-sized acquisitions but meaningful, and they have synergy and a clear path to integration into the existing Datadog Platform offerings.

Eppo is a platform that helps customers with self-serve experimentation and feature management. Eppo's platform supports everything from simple A/B tests and rollout flags to AI personalization.

More broadly, I think automated experimentation is a key part of modern application development, with KPI results and real-time analytics helping the product team create more value for the business. With the rapid adoption of AI generative code and more of the application logic itself being implemented with nondeterministic AI models, it is important to have visibility into the experiment results with real-time users. Datadog plans to integrate with its product analytics offering.

Metaplane helps prevent, detect, and resolve data availability and quality issues across the company's data warehouses and data pipelines. As you know, data is gold for the next set of AI applications. Data is becoming a key enabler of creating new enterprise AI workloads; that's why Datadog bought Metaplane and integrated them into its end-to-end data observability offerings.

Datadog has database monitoring products that allow customers to optimize database queries, performance, and cost. Datadog’s Data Jobs Monitoring monitors big data workflows (like Spark or ETL jobs), measures their time, logs any errors, and alerts customers if they slow down or fail.

By adding data quality and data pipelines with Metaplane, they have a full suite that allows customers to manage everything from getting data from their core data stores into all of the products, AI workloads, and reports they need to populate that data.

I love the management team's forward-thinking about a new set of required capabilities. The management team is proactive, not reactive. They spent a little bit, but I am sure this is a much-needed capability that their customers have requested (or will in the future).

They can strengthen and increase the value of their product offering, which can translate into a high dollar amount. They are not splurging cash but thoughtfully investing in the platform. Even after these two acquisitions, the company's cash position is at a record level.

Product Updates

Datadog's log management offering Flex Logs is off to the fastest ramp at that level in the company's history and now exceeds $50 million in ARR. Flex Logs has achieved this milestone in just 6 quarters, which echoes its value to customers and the size of the log management market opportunity.

Second, the Database Monitoring product is also approaching the $50 million ARR level and is growing 60% year-over-year. Over 5,000 customers have now adopted Database Monitoring. This product is getting traction, and the management team is doubling the investment since they see strong demand signals in that area.

In June of last year, at the Dash conference, Datadog announced the LLM observability product. In less than one year (technically, in nine months), more than 4,000 customers and more than 13% of total customers used one or more Datadog AI integrations, and this number has doubled year over year.

With LLM Observability, the management team sees continued growth in customers and usage as they seek to manage end-to-end model performance, security, and quality. Datadog CEO Olivier Pomel on the call:

I'll call out the fact that the number of companies using LLM Observability has more than doubled in the past 6 months.

I love the statistics and adoption of LLM observability, and this is just beginning; as more LLM applications and AI agents go into production, the adoption will be even higher.

In the security segments, Datadog customers can use agentless scanning to scan their entire infrastructure stack in minutes, and existing Datadog customers using the lightweight agent immediately gain deep, granular, and timely security visibility.

7,500 customers, about one-fourth of the total customer base, are using security products. Over half of its Fortune 500 customers use the security products, which is a good sign of the opportunities with the largest enterprises. These are very encouraging numbers, and I am impressed with Datadog's penetration into the large customer base.

Updates on customer wins and sales trends

In the last quarter, Datadog increased its sales and marketing headcount. Generally, it takes a year or two to see the results. In this quarter, I already see some early results, and that is promising. CEO Olivier Pomel announced six major deals, five of which were seven-figure deals and one of which was a six-figure deal.

Not only that, but Datadog signed 11 deals with a contract value of $10 million or more, up from just 1 in the year-ago quarter. That's a huge number as they are expanding into large customers. It's still early, but it seems like the strategy is showing signs of success.

In this quarter, the management team confirmed that the year-over-year usage growth is healthy and saw strong booking activity from enterprise customers. Datadog is executing the hiring plan and has increased the sales representative headcount by over 25% year-over-year.

This investment has been weighed a little bit towards international expansion, and the team believed that there is white space there to support this growth. In addition, they increased the R&D headcount by over 30%. That is why the operating expenses and operating margin came below the year-over-year comparison.

CFO David Obstler on the call:

Our dollar based new logos increased 70% year-over-year, and our pipeline for Q2 is strong and growing healthy year-over-year.

And founder and CEO Olivier Pomel on the call:

We look hard for any signs of trouble in our customer base. We haven't seen that in the dealmaking so far. Our sales cycles haven't been affected. Our pipelines are growing healthy.

It's too early to say since there are two whole months left in the quarter, but the management team is seeing a better-than-expected pipeline in Q2, which is encouraging, and no sign of trouble. Please don't forget that the DASH annual conference is coming at the end of June, which will help to get some more traction in sales and in making deals. The company is investing in long-term plans while balancing near-term adjustments.

AI is going to be writing 100% of the code

Some CEOs are making bold public statements about the percentage of code written by AI. Anthropic's CEO recently said that within 12 to 18 months, AI will write 100% of all code. Let's say that even if it's written by AI, it must be validated by a software engineer. I guess everybody can write code pretty quickly.

You can have the machine do a lot of it, and the software engineers complement it with a little bit of their own work. But the real difficulty is in validating that code, making sure that it's safe, running in a performant and cost-efficient way, performing, and doing what it's supposed to do for the business.

That's another area for Datadog to shine; since it observes and understands the applications in production, it can also validate and ensure that the code written by AI is safe and performance-optimized to run on the production environment. We might hear some new announcements at the upcoming DASH conference, but that's an interesting area and opportunity to capture.

Conclusion Earnings

Datadog reported strong quarter results, beat earnings, and raised guidance for the full year. I am confident that the Datadog team will deliver strongly. The management team consistently underpromised and overdelivered. They are growing in existing enterprise customers and, at the same time, confirmed that the pipeline is healthy and strong. They are delivering profitable growth, and if they continue for a few quarters, this company is a potential candidate to be added to the S&P 500 list.

Datadog is investing in the sales team, and I am pleased with the early results. There are also investments in R&D teams and the product offering.

Disclosure: I personally own the shares of Datadog (DDOG) since October 2019.

If you like the article, please share your feedback in a comment on the article and follow me on X@anandkhatri.