Bubble? Look At This First

Overview Of The Week 37

Hi Multis

I hope you are doing great. I was ill this week, but recovered just in time for my birthday tomorrow. So, I don’t think you will get an article tomorrow. Let’s look at this week.

Articles In The Past Week

This is just the third article this week. I know, for many others, that’s a lot, but not for Potential Multibaggers. The introduction already explained why.

In the first article this week, you got the new Potential Multibaggers pick. The reactions were very positive.

In the second article, Anand analyzed CrowdStrike’s Fal.Con.

Memes Of The Week

The first one this week is about Duolingo. It’s taken from my life.

This is the second meme this week.

I’ve been hearing for a full year now that’s it’s 2021 all over again. That’s why I sent out this message.

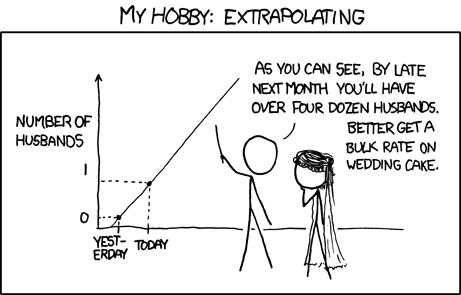

And just before the deadline, Multi bep posted this one in our meme channel on our private chat group:

Interesting Podcasts Or Books

This week, I’m recommending a podcast that just launched its first episode. You may know David Senra from his fantastic podcast Founders. That’s an eternal recommendation.

In that podcast, Senra analyzes biographies of the biggest business minds ever. It’s a fantastic podcast.

Now, David Senra launches a second podcast. After months of brainstorming, he and his team came up with the name David Senra for the new podcast. ;-)

In that podcast, he will talk with founders that are still alive today.

The first episode was released today. It is with Daniel Ek, the founder and CEO of Spotify and I really liked it. Ek talks about why happiness is a trailing factor for impact, how his role in Spotify has changed and much more. You can listen to it here.

Fiscal AI: Lock In The Old Price And Get A Free Upgrade!

This is only if you are fast enough.

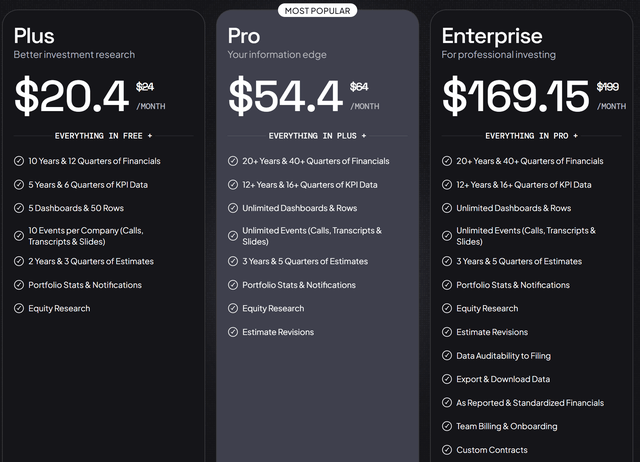

If you have been on the fence about taking a subscription to Fiscal, NOW is the time. The price is going up and you get a fantastic free update if you subscribe before (!! before!! not on) Wednesday.

I’ll let Braden Dennis, the founder and CEO of Fiscal AI do the talking:

Next Wednesday (October 1st), we’re ending our Plus plan.

What happens if I subscribe to Plus today?

Short answer: You’ll be upgraded to Fiscal Pro!

Starting next Wednesday (Oct. 1st), all Plus users will automatically be grandfathered into Fiscal Pro at a special, legacy-only price point!

Legacy-Only Pricing

Standard Pricing

Annual Billing: $29/mo

Annual Billing: $39/mo

Monthly Billing: $39/mo

Monthly Billing: $49/mo

After next Wednesday, all prices will become the standard prices listed above. This is your one and only chance to lock-in an exclusive, legacy-only price point!

What happens if I subscribe to Pro?

All Pro Users will be upgraded to Enterprise at no additional cost!

That means, if you buy a Pro Plan ($64/mo) before next Wednesday, you’ll automatically receive Fiscal Enterprise access ($199/mo) starting on October 1st!

That’s $1,620 in annual savings!

In addition to all Pro features, you’ll get:

Data Download/Export Capabilities

Standardized & As-Reported Financial Statements

Excel Add-In (coming soon)

Even better!

As you may know, I have a partnership with Fiscal AI.

It’s a great tool at a great price. These are the prices you get with my link.

So, you get what costs $54 per month for just $20.4 per month (if you pay per year).

And you get the Enterprise plan at the price of the Pro plan.

But only if you do that before Wednesday.

And if you subscribe to the Pro plan, you will be upgraded to the Enterprise.

Tuesday is the last day.

Lock in the Pro plan at the price of the Plus plan now.

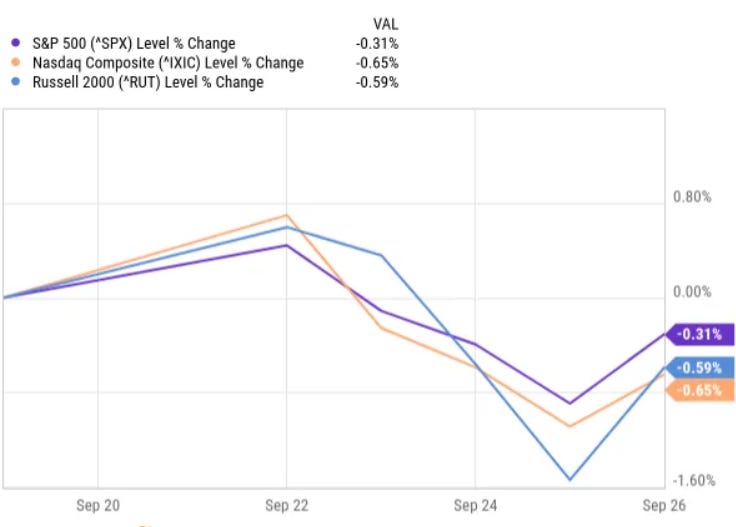

The markets in the past week

This week, the markets were down.

The S&P 500 was down 0.31%, the Russell 2000 0.59% and the Nasdaq 0.65%.

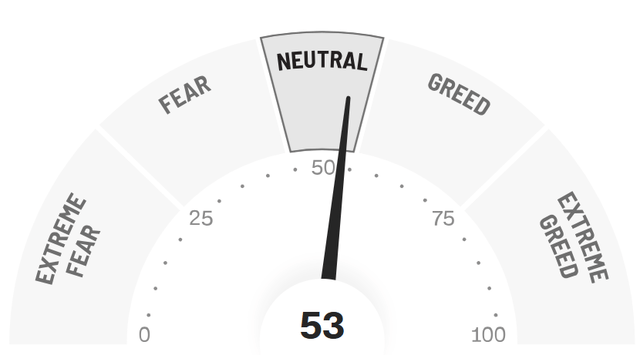

The Greed & Fear Index went back to Neutral, after just one week in Greed.

Lesson Of The Week

This week, the lesson is short and simple. It’s one of the things I regularly repeat.

The best way to get poor fast is to want to get rich fast. The best way to get rich is to get rich relatively slow.

The markets are not cheap now, and the worst thing you can do in that case is go into very speculative names.

Quick Facts

1. Bubble? Look At This First.

I hear so many people claiming we are in a bubble. I don’t know. As in: I really don’t know. And nobody really does. They are all just guessing, making it sound as if it were a certainty.

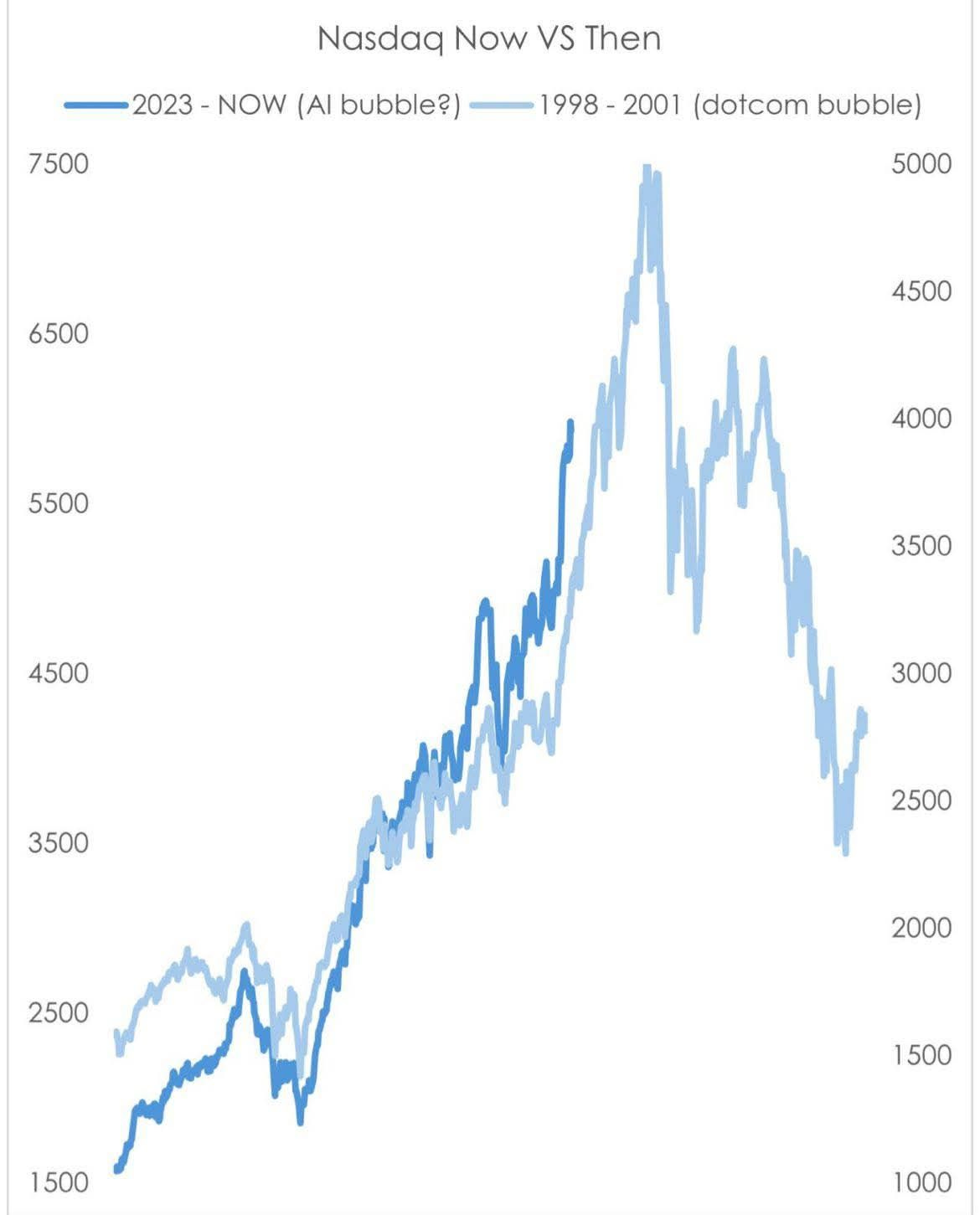

Someone sent me this

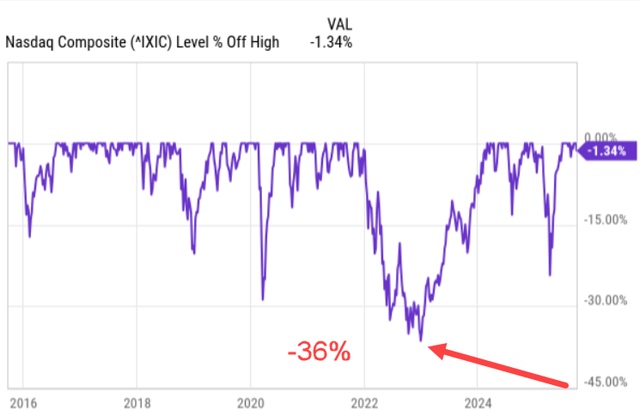

And in a private Facebook group I’m in, this was shared. (Thanks, Tom!)

This all looks convincing and definitely frightening, but I’ve seen soooo many of these overlying charts for years. 99.99% never come out but those are forgotten. But you can be sure that the one chart that will come through will be slapped in your face again and again with the message: “You see! I was right! I can predict the market.” But they won’t show you all the charts they had wrong.

On top of this, it’s very convenient and not a coincidence that these charts start in 2023. The previous batch of these started in March 2020. These charts that scare you will always use the bottom of the market to show how much the stock market is up in such a short time.

Don’t forget this. The starting point of these charts is at the moment the S&P 500 was down 36% from its previous high, more than in the Covid crash in 2020.

The turning point was exactly January 1, 2023, very convenient for these kinds of charts.

On top of that, there’s a good reason the stock market is up so much.

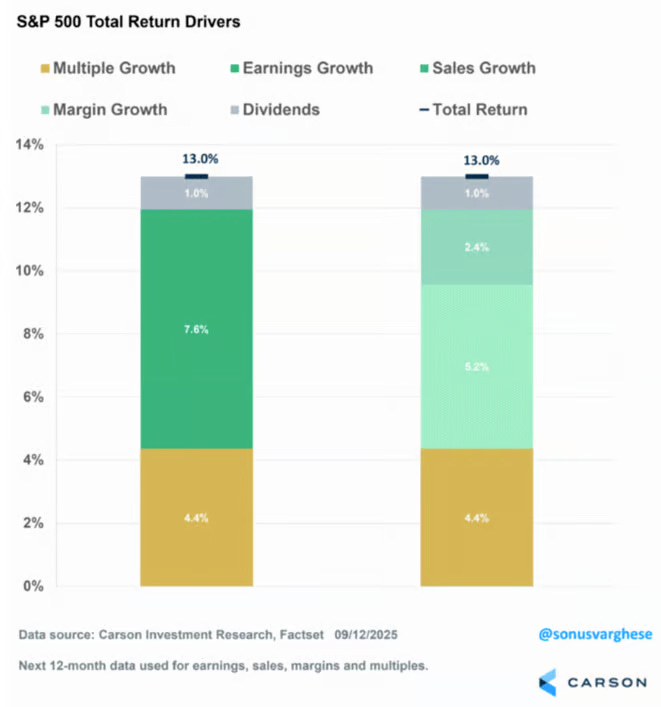

This is the breakdown of why stocks have performed well this year.

As you can see, there’s some multiple expansion, but mostly, the returns come from earnings growth.

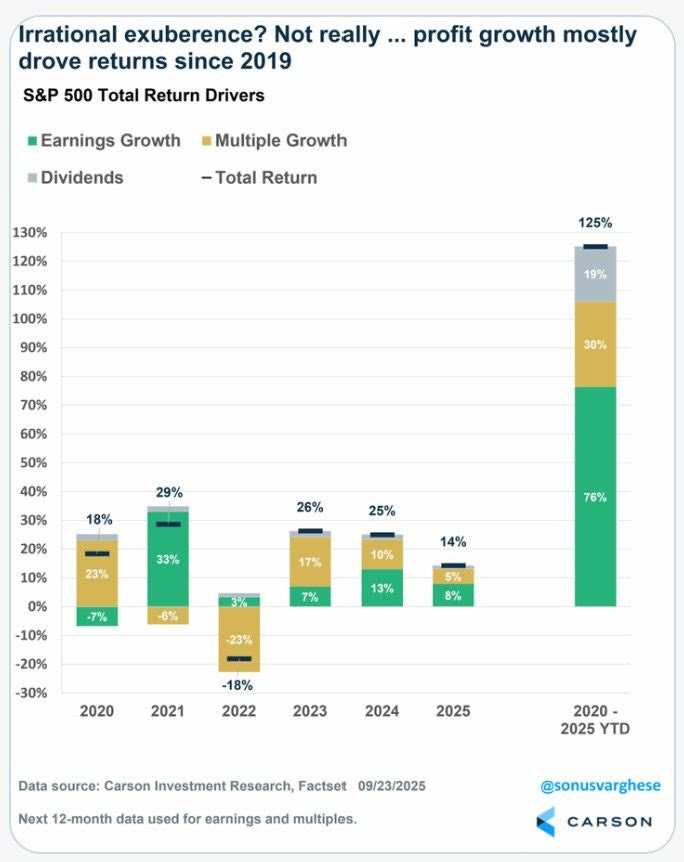

If you look at the returns since 2019, the same is true. Again, there is multiple expansion, but sales growth is by far the biggest contributor.

As a long-term investor, this is what you want to see. Of course, just as in 2022, a multiple decrease is always possible.

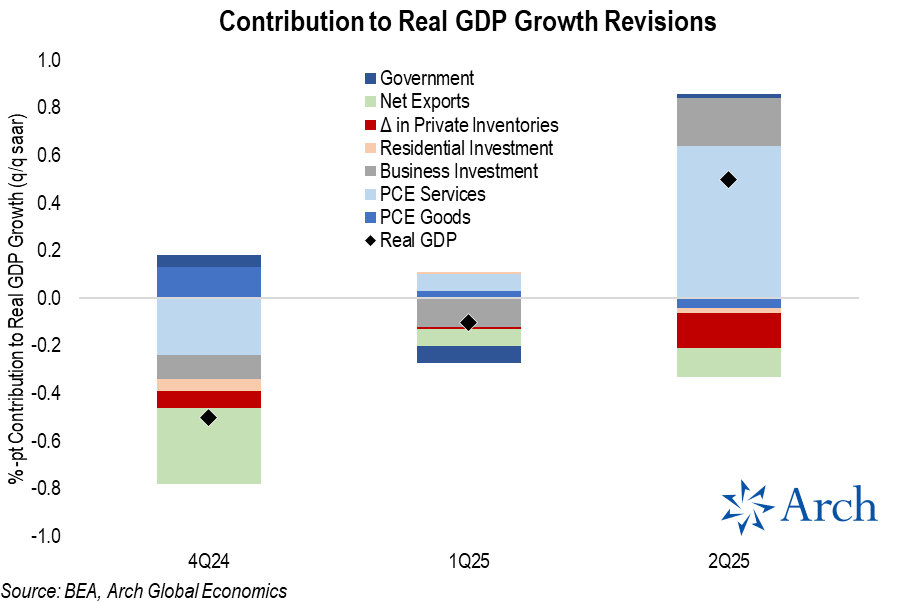

But there was another positive sign. The Q2 GDP growth was also much better than expected. Look at this:

The GDP growth was revised from 3.3% to 3.8%, pretty remarkable.

2. The Worst Performing Stocks This Year

This week, a list of the worst-performing stocks in the S&P 500 was shared.

The Trade Desk has only been in the S&P 500 since July, so only a few months but it won already a price, haha.

These lists don’t always mean so much. I’ve been quite vocal that I think The Trade Desk is a clear buy now. Maybe there are other opportunities in this list as well.

3. AI Bubble? Not Yet, Says Ellison.

I’ve also heard multiple times that AI is in a bubble. Many already said that in early 2023. This is what Larry Ellison, the founder of Oracle, says:

“Training AI models is a gigantic multitrillion-dollar market. It’s hard to conceive of a technology market as large as that one. But if you look close, you can find one that’s even larger. And it’s the market for AI inferencing.”

Spending AI is not over yet. That’s why I don’t worry about my positions in Nvidia and AMD. To the contrary, I’m still enthusiastic about these stocks.

4. Constellation Software & AI

This week, there was a special gathering for Constellation Software. The reason? A big shareholder had asked about AI and Mark Leonard decided to make it open for everyone.

The takeaway: No, AI has not eaten vertical market software, or at least not yet.

Mark Leonard began with a story about Geoff Hinton, often referred to as the godfather of AI. In 2016, Hinton said AI would soon replace radiologists. Nine years later, the number of U.S. radiologists has increased by 17%.

AI has made them more effective, not obsolete. Leonard’s point was clear: If Hinton got the forecast wrong, everyone else should be humble about predicting how AI will reshape programming or software.

That skepticism carried through the call. Management sees two paths for AI in programming: either efficiency gains boost demand for developers, or productivity surges create oversupply. No one knows which.

Customization was another theme. Big clients often build their own systems once they outgrow Constellation’s tools. AI could change that balance. If Constellation can utilize AI to deliver more customization at a lower cost, retention rates improve. But AI also helps clients build in-house. The tension is real.

On software maintenance, Leonard warned against claims of 10x productivity. Code written with AI still requires maintenance. If it proves buggy or inflexible, lifetime costs rise, not fall.

Management argued that Constellation’s real moat isn’t customer data, but rather embedded workflows. Their software reflects decades of industry-specific practices. AI can enhance those, moving systems from simple record-keeping to “systems of action.”

AI is unlikely to shrink software budgets. Instead, management believes budgets could expand as businesses adopt more automation to stay competitive.

On costs, Constellation has built a “neutral” AI platform. It negotiates directly with model providers, uses multiple LLMs, and deploys on-premise models when possible. That flexibility should enable them to ride out price wars and maintain their margins intact.

M&A remains unchanged. AI hasn’t slowed deal flow or shifted the company’s target pool.

Toward the end, management shared usage data. About 27% of business units are developing AI products, 29% use AI in customer support, 50% in sales, 61% in R&D. Only 3% have replaced staff with AI tools. These numbers were lower than hype might suggest. But overall, I don’t think they are very dissimilar to businesses of that size overall.

Leonard closed by saying that predicting the future is nearly impossible. Tracking what works today is not and that’s why companies should test a lot.

For Constellation, AI hasn’t broken the model and might even strengthen it. But anyone who claims certainty about what comes next is bluffing.

I liked the presentation. No fluff, no false promises, no hype. But nevertheless, the stock dropped on this news again. And that was not the end yet.

5. Mark Leonard Withdraws

Just three days after the AI update, Constellation Software issued a note that Mark Leonard, the founder and President, resigned immediately from his position as President because of health reasons. Leonard will remain Director Of The Board.

Mark Miller will take over as the President of Constellation Software. Of course, we hope Mark Leonard will recover soon and completely.

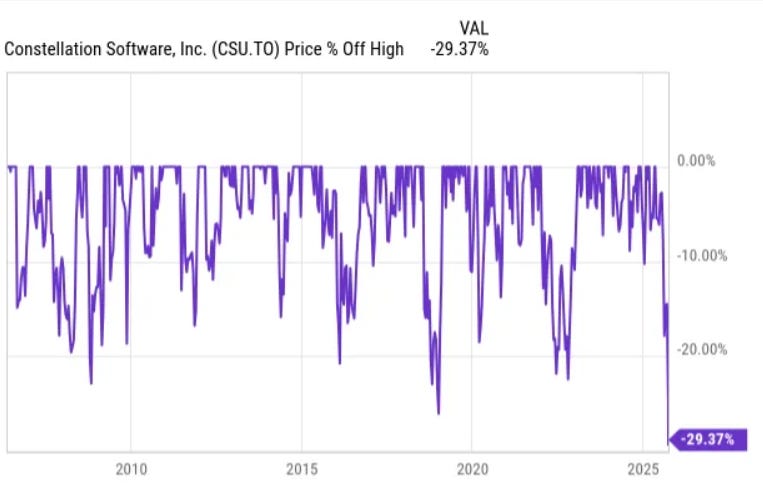

The stock dropped. And then, it happened... Constellation Software’s stock dropped more than 25% for the first time since its IPO in 2006.

But if there’s one company I’m not worried about the founder-CEO resigning, it’s Constellation Software. It’s probably the most decentralized company I know, alongside Berkshire Hathaway, perhaps.

Of course, you want Mark Leonard in your company. But look at this:

The new President, Mark Miller, joined Constellation Software in 1995. He was the founder of Trapeze, the very first acquisition.

Bernard Anzarouth, the CIO, also joined in 1995.

Jamal Baksh, the CFO, joined in 2003. This is a very experienced team.

In the press release, Mark Leonard stated:

The Board and I have complete confidence in Mark Miller and our executive team to execute on Constellation’s business plan. Mark Miller has been a trusted adviser and a driving force within Constellation’s executive leadership team for over thirty years and I can think of no one more experienced, knowledgeable and capable to lead the company at this time.

While Topicus and Lumine are split off from Constellation Software, they also dropped in the news.

Maybe because of that, the company announced that it would host another call to discuss the transition on Wednesday, October 1.

This is where the free part ends.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ My full portfolio (with every transaction)

✅ The most recent pick

✅ The upcoming pick

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by more than 30% over 3 years.