Hi Multis

On or around the 15th each month, I release the Best Buys Now. This month, it's a day later, so without further ado, let's go!

1. Adobe

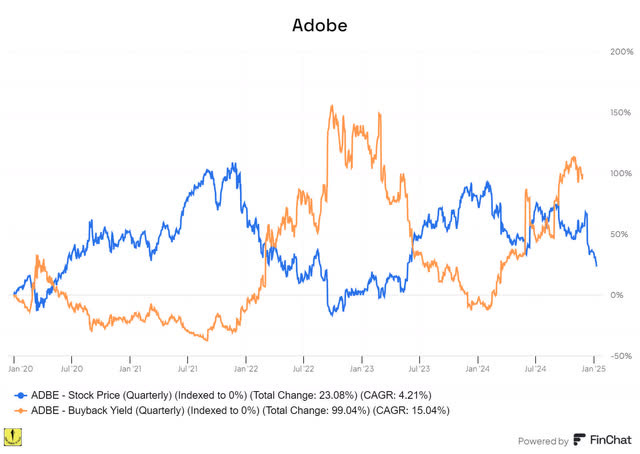

It's funny to see an established company like Adobe (ADBE) fluctuate on emotions in the market. Just look at the stock price over the last 5 years.

It's been a wild ride for such a big, established company. And overall, over the last five years, the stock is only up 21%. Ouch. Or: Hurray! Because it means that Adobe is quite attractive at this point, in my opinion.

Whether you look at it from a simple forward PE, free cash flow, or EV/EBITDA, Adobe is at its lowest valuation in a decade, except from a small time window in 2022, when LLMs were supposed to kill Adobe.

Despite the negative sentiment, Adobe is still expected to continue growing at double digits.

Adobe seems to agree that its stock is overvalued and it is ramping up its buyback program. Historically, that has been a sign that the stock was, indeed, undervalued. You can see that in the track record of the company. You can see that on these two Finchat charts.

A great company at what looks like a great price? Sign me up!

Nvidia

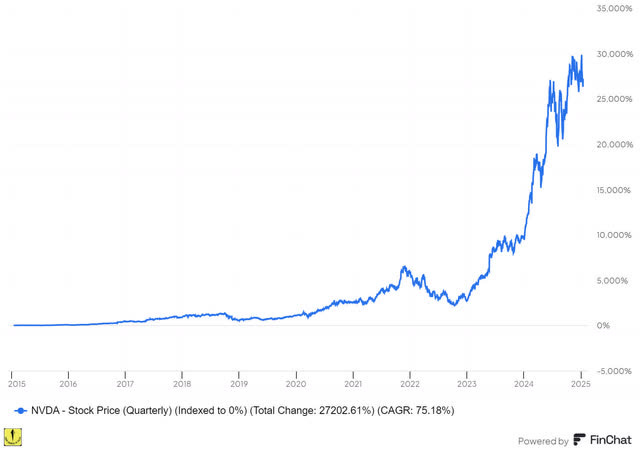

Nvidia (NVDA) is a freak stock. It's up 272x over the last decade. Wow! Over the last year, it's up 145%, but I still think it's attractive at this point.

There’s a lot of buzz surrounding artificial intelligence stocks these days, but, contrary to what many claim, I see no sign of a general bubble. While some companies may appear overhyped, such as Palantir, I don't see a broader market bubble. Don't get me wrong, I think Palantir is a fantastic company, but it's simply too expensive right now.

Nvidia is a prime example of why people call a bubble but there is not actually one. Analysts are projecting earnings per share growth of 50.49% by 2025, but the stock is trading at a forward price-to-earnings ratio of just 30.66. This gives it a 2025 PEG ratio of only 0.60. For a high-growth stock, this is a bargain.

Despite its huge gains over the past years, Nvidia remains attractively priced at this point. For long-term investors, which we are, it remains an attractive stock.