A Letter From Me To Me (Or From You To You)

Hi Friends

This is a letter I wrote to myself last year. I have updated a bit and took new dates for you and me. I hope you enjoy it.

Hi Kris

This is Kris. You probably know me, as I am you. :-)

I'm not writing to you, even though I also call you Kris. But the Kris I'm writing this for is not 46 years old, like I am, but 49 and 51. Yes, this is written to two future versions of you, Kris. But I need your help to deliver those letters in time. So, could you set an alarm in your agenda for May 18, 2026, and May 18, 2029, to read this letter from me to me, or from you to you, if you prefer that phrasing?

Right now, there’s a lot of negativity about growth stocks. I wonder which growth stocks will be the biggest winners when I/you read this in three years and five years. You will also have sold several of your stocks when you read this. There will be mistakes; there always are in investing.

But probably, there will also be massive winners, maybe even stocks that are not in your portfolio yet. People's imagination always fails for both the positive and the negative. No one could think that some of the highest-quality stocks out there (Shopify, Mercado Libre, The Trade Desk) and even huge companies like PayPal or Meta would be down more than 60% from their previous high at a certain moment. Few have enough imagination to see they could go back to their highs faster than most think, just as they went down faster than most thought possible.

Well, Kris, this is your chance to live up to what you preach. Remember how you have mentioned so many times that every single stock that was a 100 bagger, all 365 that were mentioned in Chris Mayer's great book 100 Baggers, all of them went down 50% at least once, most several times and most more than 75%?

This is your time to live up to what you preach. You are in growth stocks, and this is something to expect. High volatility, both up and down. You know that Amazon dropped 92% in the dotcom crash, you know that Netflix dropped 80% after the Quikster debacle, you know that Mercado Libre lost 90% during the Great Financial Crisis in 2008-2009. And you know that the market exaggerates in both ways.

Mentally, you have been preparing for this and up to now, you still feel OK, although it sometimes feels a bit stressful, of course. I'm pretty confident in 2026, you will have a better view of what happened here in 2023. From everything I have read, all the studies, the books, and the podcasts, I know that this too will pass.

People always refer to Microsoft or Intel in the dotcom crash but they double-cherry-pick if they say it took 15 years to recover:

1. They don't pick Amazon, Apple, Nvidia and so many other stocks that recovered much faster. The business fundamentals at both Intel and Microsoft were just less favorable. And at Microsoft, you had Steve Balmer, not exactly a great CEO. I mean, laughing with the iPhone, seriously? He should have rushed into action in panic. Microsoft missed mobile completely and it was lucky that Satya Nadella made them not miss the next revolution, the cloud.

2. They act as if you put in all of their money exactly on the day of the market peak. All of their money on one day in one stock. That's not exactly reality. This is Microsoft from 1995 to 2000. Not even at the top, just the first of January.

Suppose your average price over that period was the price of near the end of 1998, because you practiced dollar-cost averaging all the way up. The stock was up 600% at that point from 1995.

Of course, Microsoft’s stock first continued its uptrend and doubled in about a year.

Then came the crash. This is what the stock did over the next year.

This chart looks pretty familiar these days, doesn't it?

But what if you had bought at an average price of what the stock traded at in July 1998, when the stock was already up 600% in the last three years? Without any additional buy during the crash, you would be up. This is the stock exactly three years after that price point.

This is not the stuff that dreams are made of, 32% in three years. But for a market crash, not too bad at all.

This stock chart is pretty similar, isn’t it? It’s Sea Limited’s last three years.

Kris, Kris, Kris... You wondered off to a side path again. And also, it's not about Microsoft or Sea here, it's about here and now.

Kris, you always tell me I should watch revenue growth for long-term market success. How many times have you shared this graph already? Your most loyal Multis, the subscribers to Potential Multibaggers, are probably sick of seeing it again and again.

Yeah, Kris, I know, you were a teacher before you started doing this and repetition is the mother of all knowledge, right? But still, man, don't take it too far.

Let's get back to that Microsoft 'it-took-15-years-to-recover' story. If this graph you shared above would be correct, that's also what you should see over that period, right? You should be able to see revenue growth and stock price appreciation together over that 15-year period.

As you can see, Kris, that actually lived up to reality pretty well for that period. not perfectly, sure, but good enough. Amazon and Apple had huge revenue growth, both at a CAGR of about 26%.

“Hey, Kris, 26%, that's the same price appreciation that gets you to a 10-bagger over 10 years!”

“Yeah, we know that, Kris, nothing new to us. Don't forget that we know as much as you do. Well, more, actually, as we have three and five years more experience under our belts.”

“You're right, Kris and Kris, you're right. I keep forgetting that.”

Now, of course, I would like to know from you about how this market will end. But while I can speak to you from the past, you can't really speak to me from the future, do you? So, let me make an educated guess.

Right now, people are afraid of a recession. Who knows, it may come, although the market has been up quite a bit year-to-date, confusing many.

I have learned a long time ago, as you probably remember, Kris, that there is always something to worry about in the stock market. Every year, there are one or two or three themes scaring investors. But still, the market has always gone up.

As you see, Kris, even the huge tech crash of 2000-2003, when the Nasdaq dropped by 75% only seems a temporary blip from this perspective. That's always how it has been when you invest.

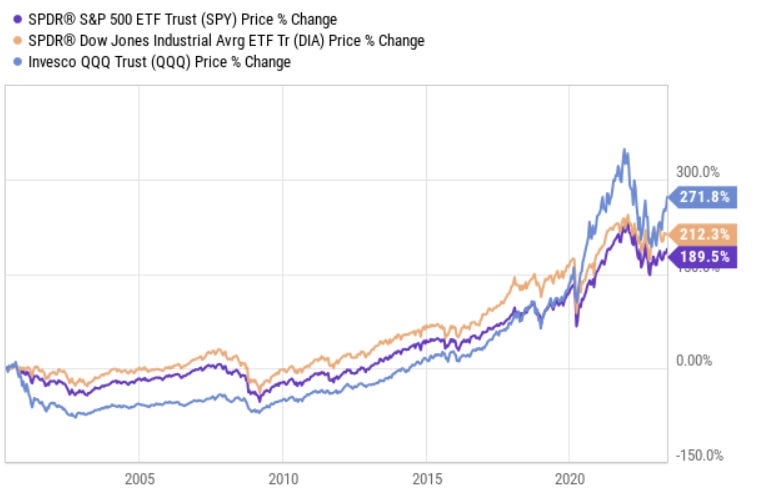

As you know, Kris, my personal investing horizon is 20 years. That's when we will be 66, so that's the goal. This would be your return in the past 20 years if you invested in the indexes.

As you see, the "risky" stocks, heavily tech-oriented, have outperformed the other indexes. That goes hand in hand with more volatility, as you now also feel, but that's the price you pay for outsized returns. Some people can pay the price, others feel bad about it. That's OK, to each his own, it's just important that you know yourself very well.

In 20 years' time, many things might happen. 20 years ago, there was even no mobile internet for example. And I'm pretty sure the next 20 years will see several other inventions that will impact our daily lives so much. Think of the iPhone moment of ChatGPT recently. But for several, we don’t have any idea yet.

When I write about my investing horizon, I always think about this graph, comparing 5 people who invest $2,000 every year for 20 years.

(Source)

Peter Perfect is the perfect market timer and invests his money perfectly at the bottom each year. Of course, he has the highest return. If you invest the money immediately when you get it (lump-sum investing) or if you dollar-cost average almost makes no difference, just 0.45% on the total end result. Even if you would have invested at the very worst time each year, you would still have decent returns. If you invested in T-bills (“stay in cash investments”), that's when your returns would have been meager.

Of course, there are exceptions, but of the 76 20-year periods mentioned in this research, 66 had the expected pattern. That's 87%! 2020 was a fantastic year, 2021 already less so and 2022 was a terrible one, especially for growth stocks. But that's OK. I keep investing. Maybe 2023 could be the next bad year, who knows? But the good years will make up for that and more, as long as you stay invested.

Just be patient, Kris. I know you are, as you are me, but still, be patient. Don't get carried away by the noise of the market. The stock market has always been the most effective way to build wealth over time. That won't change, bear market or no bear market. Your goal is not a YTD (year-to-date) performance but a 20-year performance.

Portfolio managers always have customers that go away after a bad year or even after a few bad months. Peter Lynch made more than 29% per year over a 13-year period as portfolio manager of the Magellan Fund. But it's said that the average investor actually lost money by moving in and out of the fund. Don't be that kind of average investor, Kris.

In this current market, it's just like when people are angry. If they are really angry, seething, then no matter what someone else does, it will be taken wrong anyway, even if it was meant with good intentions. So, what you see now is good or even great earnings stocks being punished and mediocre earnings immediately send down the stocks by double digits.

When we are angry, we are angry. You have been that person, I have too. You are angry and someone says, for example, "Calm down." and it only makes you angrier, especially if that person is the reason for your temper.

How do you come out of this? Time, just like with people. If you are angry and your partner wants to make up and you are not ready, it will probably make you even angrier. You need time to cool down and the same will happen with the market. When will it happen? We don't know; we'll have to see that in the future, where you reside, Kris and Kris.

I hope that even in 2026 and 2028, you'll keep growing!

All the best

With love

Kris

If you liked this and you want to know what I think are the best growth stocks, feel free to try out Potential Multibaggers for free for two weeks. If it’s not for you, no worries, you can cancel with 3 clicks.