Hi Multis

Welcome in 2026! I want to wish you the very best for 2026. I hope you may have many dreams in this new year. As they say, people who are healthy have many wishes, people who are not healthy have only one, so that’s why I wish you many dreams in 2026.

My promise for 2026: I’ll keep digging for those rare companies worth holding for years. I’ll continue to be honest when I’m wrong, and I’ll continue to be totally transparent.

May 2026 become your best year ever!

Last week, there was no Overview Of The Week and I also published fewer articles. I took some time off with my family. It’s often said as a cliche but this time, it’s definitely 100% true: I’m really revitalized from this break and ready to rumble!

But first, let’s look back at the three articles in the past two weeks. But first, grab a cup of coffee (or tea if it’s too late or you prefer tea).

Articles In The Past Weeks

The first article you got in this two-week period was my article on what I added to the Forever Portfolio.

I have to add context here. Normally, the second addition for the month would have been based on the top 10 stocks for 2026. But the article took longer than I thought, and after the article was published, I had to hurry for New Year’s Eve preparations.

That means that I will buy those stocks in the upcoming week. I will classify them as December 2025/2 in the portfolio, nonetheless, so everything remains consistent. As most of you will know, I add to my portfolio twice a month, and while that will be three times in January because of this, it doesn’t really matter and will only confuse Multis in the future if I don’t classify it as the second buy in December. But here are again too: full transparency on this.

The main thing is that you can see all the buys I make in my portfolio and the exact prices.

The second article was a special one, as it featured my friends Michael Gielkens (Tresor Capital) and Pieter Slegers (Compounding Quality). We all looked forward to 2026 from our own angle.

Last year, I published my Top 10 Stocks for 2025. These did very well. They were up 54% on average.

On December 31, I published my Top 10 Stocks For 2026.

Memes Of The Week

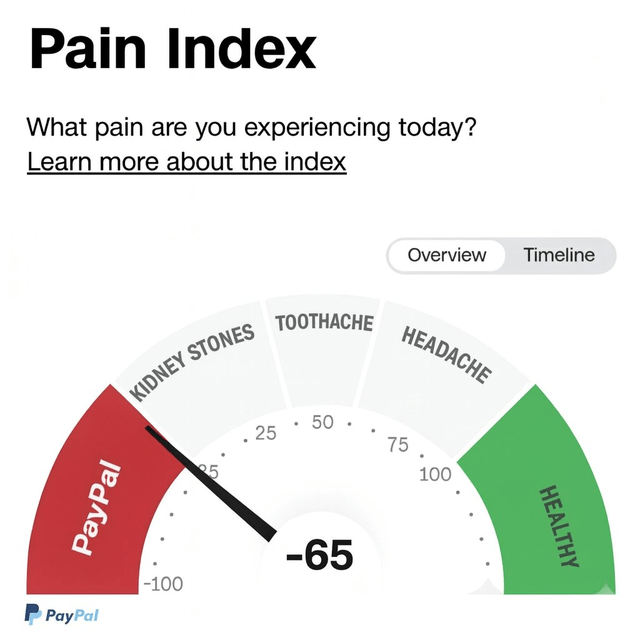

Just one meme this week. I hope ‘PainPal’ shareholders can laugh with it.

For those who didn’t know or don’t remember, I used to be a PayPal shareholder for a while but sold it years ago. The reason were some deeply negative personal experiences. My account was blocked three times. Each time, they said I had to give them my ID, which I had already given before, when I opened my account. It took weeks to reach customer service. They admitted it was their mistake and deblocked the account. I’m a patient guy, but after the third time of waiting for weeks to be deblocked, I swore never to use PayPal again.

A friend of mine had his business account blocked for almost 3 months. The reason they gave him was that the monthly amounts were too irregular. He works in cybersecurity and sells courses. Every two or three months, he sells a course (next to his direct cybersecurity work) and in those months, the amounts he earned were (obviously) much higher. That was enough for PayPal to block him. It took him more than 10 weeks before he could use his own money again. In the meantime, in the last weeks before the deblocking, he even had to borrow from his mother to pay his rent and to buy food.

When I say this to Americans, they almost always don’t believe me, saying they have never had a problem with PayPal. That’s possible, as Europe definitely has stricter money-moving policies. But why does PayPal fail where others (Wise, Revolut, for example) have outstanding services that don’t have this as often as PayPal does?

Just to be clear, I think PayPal as a stock is undervalued here. For me, that’s not a reason to buy it, though. Buying purely based on valuation is market timing and I don’t want that. I want time in the market. Will PayPal be a bigger business in five or ten years? I can’t answer that one but the answer I lean towards is no. That’s why I stay away from it.

Interesting Podcasts Or Books

As so many people, I start the new year with good resolutions. My health will be my number one priority in 2026.

The reason is that there were many days in 2025 I didn’t feel great. Starting in May, I felt extremely tired, with a culmination in the Summer. That got better at the end of September but I still had problems breathing. I had already been to the doctor two times before, but they found nothing. Blood tests were good; no parameters were off.

But finally, I visited a lung specialist, and she found that I had lung-COVID. Hence the fact that I was ill multiple times in 2025. The lung-COVID also triggered asthma and sensitivity to all sorts of things: pollen from grass and trees (that’s why I was so tired in Summer), perfume, dust mites, animals, etc.

In the last weeks of December, I got proper medication for that and that has finally made me feel better. That’s also why I really feel revitalized after this short break. I can work out better and that makes my concentration go up. Good times ahead!

That’s also why I started reading a book about health. I’m not far yet, as I only started it two days ago.

It’s Outlive by Peter Attia and I’m eager to learn what can make my health even better. In September, I will turn 50, and if I want to double that number, I’ll have to pay attention to my health. Just like with the stock market, there are no certainties when it comes to health. You can improve your chances for success, but you can not force it into existence. Knowledge is often the basis for both health and investing. The best investment remains one in yourself.

My Fiscal AI Partnership

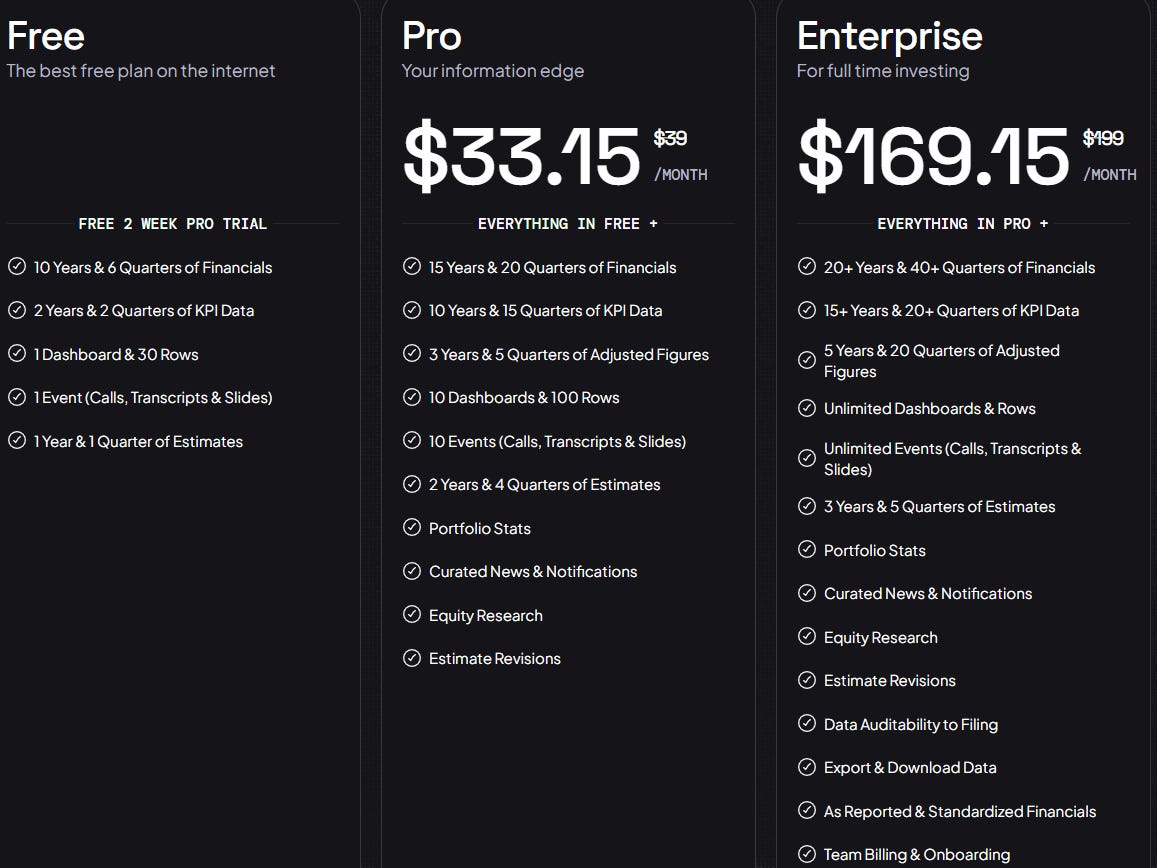

Do you want to upgrade your investing? Take a Fiscal AI subscription. You can’t believe how much I use this! Chart, all filings, analyst consensus numbers, holdings of superinvestors, the best screener out there, the Morningstar research and so much more. The price is just $33.15 per month if you use my discount link.

The markets in the past weeks

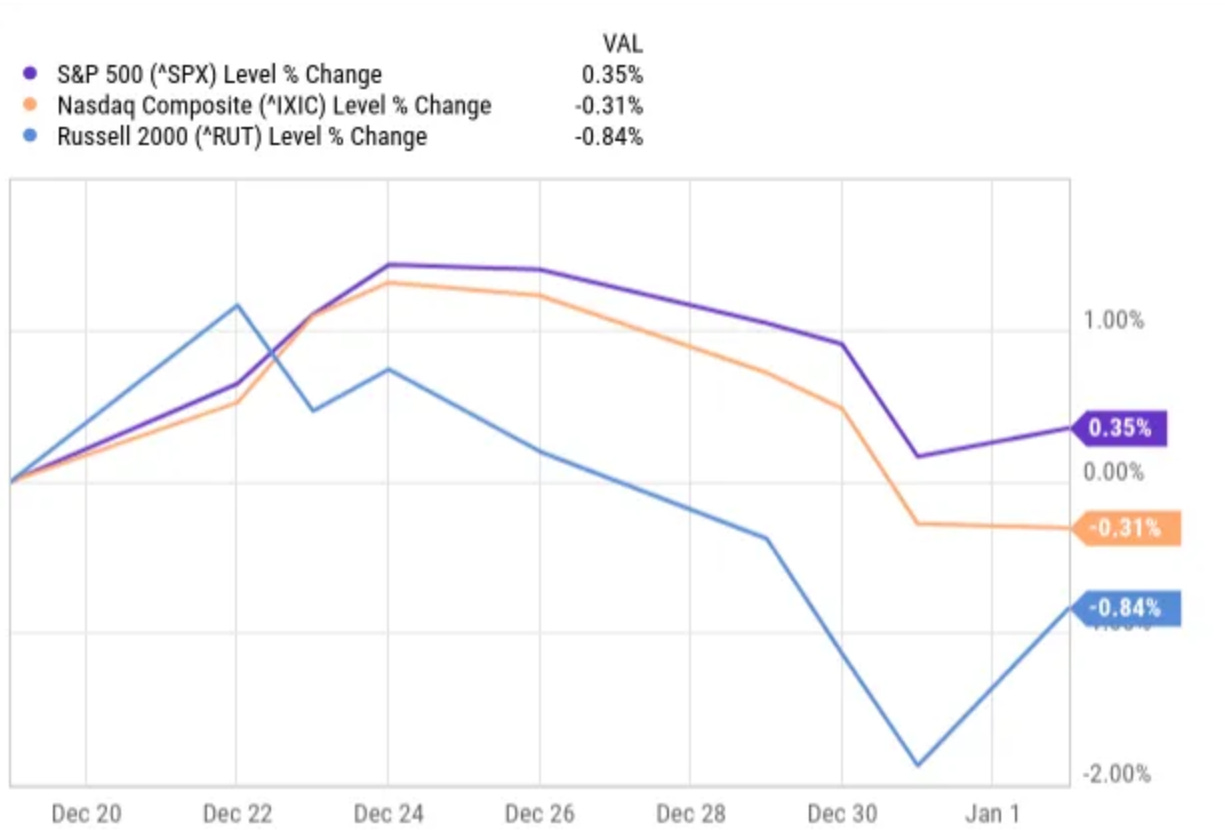

Usually, I have a pretty good idea of what the stock market did, but now I don’t have a clue about the movements over the last two weeks. Not that I didn’t check things at all, but I have no overall take. So, I’m curious to find out. We take the returns from the last Overview Of The Week, December 21.

The S&P 500 was the only index that was up, by 0.35%. The Nasdaq lost 0.31%, and the Russell 2000 was up 0.84%.

All in all, no big movements and that also explains why I didn’t have an idea. When there are big gains or big losses, I usually know.

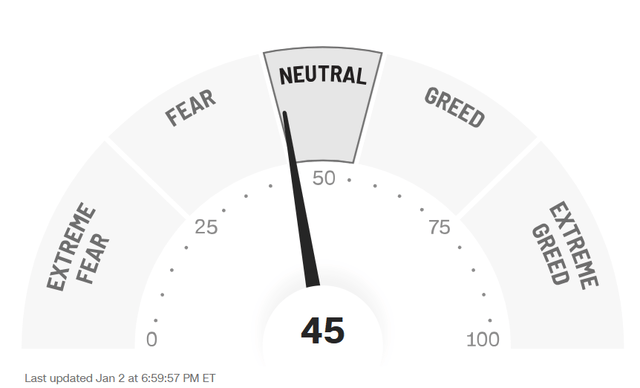

The Greed & Fear Index remained in Neutral territory.

5 Bold Predictions for 2026

Usually, there’s a Stock Market Lesson here, but for this first OOTW in 2026, I want to do something special: 5 bold predictions for 2026.

Don’t take these too seriously. These are just my thoughts and I think if just 3 will become a reality, it will be a lot. Probably, it will be more like 2, 1 or even none.

The Nasdaq, S&P 500, and Dow Jones indexes will all drop at least 20% at some point.

Markets have gotten faster, both on the way up and the way down. I think we’ll see a very short but intense crash in 2026. It could look similar to the Liberation Day selloff, where the S&P 500 and Dow Jones both fell just short of 20%, while the Nasdaq dropped almost 25%. This might happen just before or after the midterm elections. By year-end, though, all indices will still be up more than 10%.

Mercado Libre will do a 20-for-1 stock split.

As of January 1st, founder Marcos Galperin is no longer CEO. He’s being replaced by Ariel Szarfsztejn (what a spelling on that last name!). I think he’ll want to make Mercado Libre’s share price more accessible for individual investors. The stock price is currently sitting at $1,974. Could be a 10-for-1 split too, of course, but let’s keep things exciting and go for a 20-for-1.

3. Palantir will drop by 60% (to around $67).

The stock has been overvalued for about a year and a half now, way longer than short sellers can stomach. That’s why shorting a stock is so dangerous. There’s an infinite downside, but only a limited upside.

Don’t get me wrong: I think Palantir is an excellent company. But overvaluations always correct at some point. I think 2026 is when it happens. The same could happen for CrowdStrike and Cloudflare. If it happens, I will take advantage of it.

4. Amazon will be 2026’s Google.

In early 2025, everyone was bearish on Alphabet/Google. AI was going to make it obsolete. The narrative around Amazon is pretty much the same, and I could see things getting worse before they get better. But Amazon has more intelligent robots than any country in the world except China. In the second half of 2026, that’ll get a lot more attention and that’s why Amazon’s stock will shoot up.

5. AI infrastructure spending will continue to be much higher than everyone thinks

I see predictions everywhere that say that in 2026 investors of the Mag7 will demand profits from the big investments in AI infrastructure spending. I will take the other side of that. I think this spending will continue to grow in 2026. I could see Nvidia and AMD having a great year, despite the skepticism.

Quick Facts

There wasn’t much news in the last few weeks, so no Mark this week.

1. Venezuela

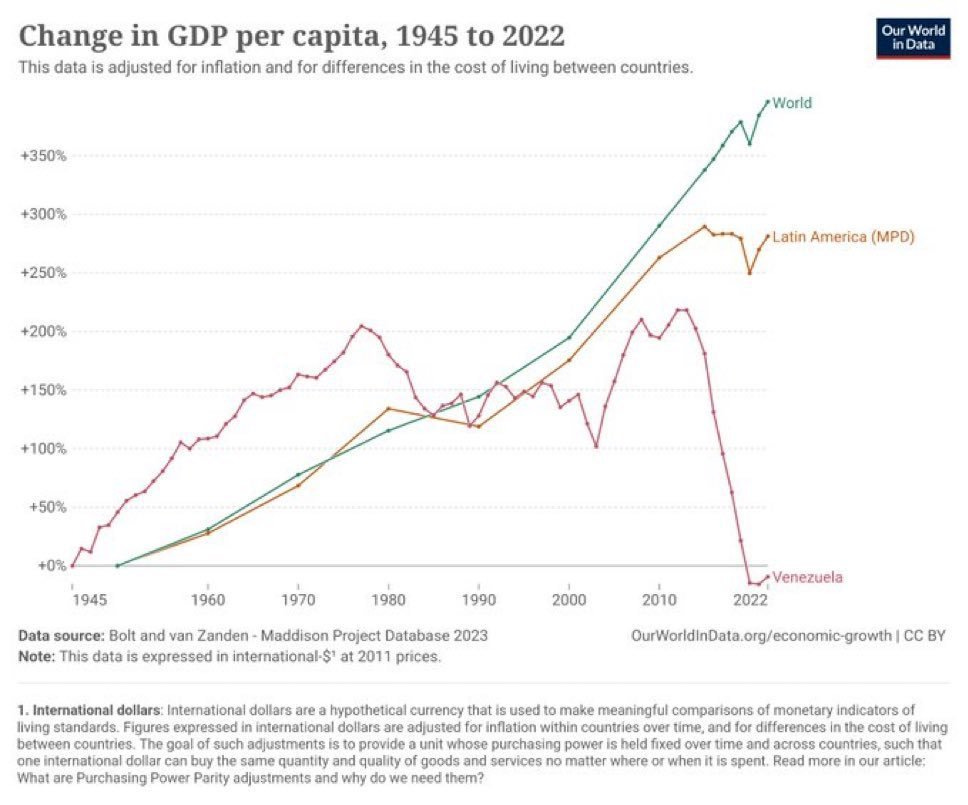

As you probably all know, something happened in Venezuela. As always, I don’t want to go deeper into politics. I just want to look at the investing side of things. But let me tell you that I do understand the footage of the people of Venezuela celebrating. Just look at this.

The GDP per capita in Venezuela is lower now than it was in 1945. What a disgrace, for a country full of oil, gold and minerals! This is what communism does.

Someone I know is married to a Venezuelan woman. She says her aunt hasn’t been able to buy feminine hygiene products for over 5 years, simply because they are not available.

You can discuss whether the way this operation was conducted is legal, but I prefer this to war. The Chinese and Russians who were in Venezuela were there for the oil as well.

But the real question here is what it means for my investing. For me? Nothing changes. As always, I don’t know what the markets will do, but I’m OK with that. If the markets drop, I’ll buy more.

Some Multis ask me about Mercado Libre and Nu Holdings. Both are in Latin America, but not in Venezuela. For the short term, that means nothing changes. For the long term, it may open a new market for them. So, I only see this as positive. Again, if the market sees this differently, I’ll add to my positions.

2. Are American Stocks Expensive?

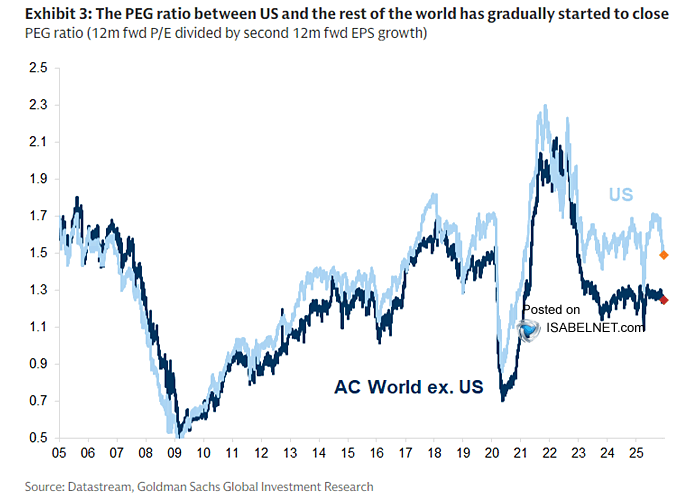

Last week, I saw this chart.

For at least a decade now, I have heard that American stocks are excessively expensive. And for at least a decade, I have argued that you should take growth into account. In the last three years or so, American stocks have been clearly more expensive than historically. but as you see, the gap is shrinking. If you add the longer period of higher expected EPS growth, I think American stocks are a tad on the expensive side (especially Palantir, haha, no that’s a joke). But they are not extremely overvalued compared to growth. A premium of about 20% is not that big for me. But of course, it could be enough for some to be bearish about American stocks and call the market overvalued.

3. Nvidia & Groq: It’s Complicated

Nvidia “acquired” Groq, but you can’t call it an acquisition, even if Nvidia’s shelling out $20 billion. Relationship status: it’s complicated.

Nvidia has signed a non-exclusive license for Groq’s inference technology and is bringing over founder Jonathan Ross, President Sunny Madra, and other top talent to Nvidia. Groq will continue independently and it will be led by Simon Edwards. But key pieces are clearly going to Nvidia.

Nvidia is buying nearly all of Groq’s assets for $20 billion, excluding its early-stage cloud business. If accurate, it would be Nvidia’s largest acquisition ever. The previous one was the $7 billion Mellanox deal. It makes it clear that Nvidia is preparing for a new phase in AI: ultra-fast, low-latency inference.

AI models now run in two steps. First, they take in information. Then, they generate responses one piece at a time. Groq’s chips are especially good at that second step, making answers appear almost instantly.

Nvidia already makes chips for the other parts of the process. One type handles training and big batches of responses. Another is built to hold large amounts of data. Now, with Groq’s help, Nvidia is adding a third kind of chip focused just on fast replies. This will be useful for real-time chat and AI agents that need to respond quickly.

This looks like the deal Nvidia needed to help it stay ahead of the competition.

The Return Of The Potential Multibaggers

Do you want the best information on growth stocks?

Do you appreciate my work?

Do you want to find the best companies earlier than most?