3 Reasons Why 2023 Could Be A Good Year For The Market

A look at the facts, not emotions

Summary

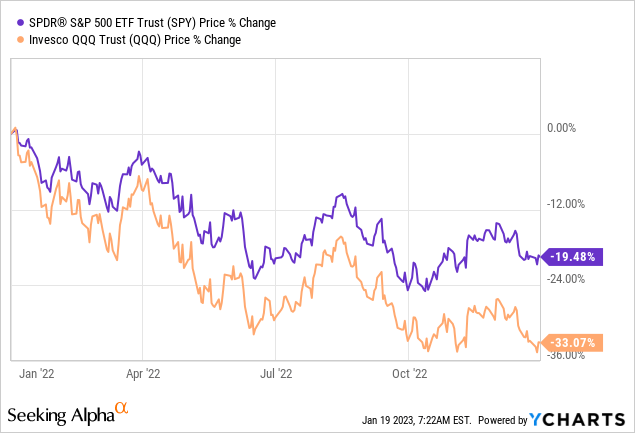

2022 was an awful year for the stock market, with the S&P 500 down 19.5 and the Nasdaq even 33%. Many expect 2023 to be a bad year as well.

Data from the past suggest that there are good reasons to believe 2023 may be a good year for the market.

Inflation and the earnings contractions may seem bearish but they might be very bullish.

The key mechanism leading the market is that it's 6 to 12 months ahead of the economic data.

Of course there are no certainties when it comes to the future. And even if 2023 is a good year, it will be a bumpy ride.

Introduction

Here it is, 2023, the year of the recession... or so many think. 2022 was an awful year for investors. The S&P 500 was down 19.5% and the Nasdaq even more than 33% last year.

For the S&P 500, only three years were worse in the past 65 years: 1974, 2002 and 2008. So in a sense, 2022 was a historically bad year. It's in the worst 6% of investing years since 1957.

For the Nasdaq, in the last 50 years, only four years were worse than this: 1974, 2000, 2002, and 2008.

That also means you should eliminate the feeling that you are not a good investor. You just need time to do its magic for you. But I have seen many investors give up, claiming they would stay out of the market from now on or only invest in the index. It's OK to get to know yourself better as an investor, but just like you shouldn't draw general conclusions from the boom after the COVID crash in 2020 and early 2021, you shouldn't do that from 2022.

The 2023 Recession?

But what about 2023? The general consensus seems that 2023 will be another bad year for the stock market. That's not a surprise. When the stock market goes up, the consensus is that it will continue to go up, when it goes down, the consensus is that it will continue its downward spiral.

On top of that, more and more pundits seem to agree that there will be a recession in 2023. This is from a Bloomberg survey of economists, for example.

As you can see, 65% (I don’t know where Bloomberg gets to 70%) estimate that there will be a recession, versus 18% on average over the long term. But even now, a recession is not a fact, just an informed opinion, even though many investors act as if the recession is inevitable. It's not.

The job numbers that came in for December were much stronger than the estimates. The Fed keeps saying unemployment should get up to tame inflation. Or should I say 'kept saying?' Because today, in a speech at the University of Chicago Booth School of Business, this is what Vice-Chair Brainard said:

Despite constrained supply, wages do not appear to be driving inflation in a 1970s-style wage–price spiral. It is true that wages have grown faster than the pace consistent with 2 percent inflation and productivity growth. It is also true that wages have grown slower than inflation over the past two years, and that aggregate real wages have fallen.

Now let's get into the reasons why 2023 might be a good year for the stock market.

Reason 1: The Timing Is Bullish

Don't get me wrong, I'm not a market timer and I think you know that by now. I invest every two weeks, whether the stock market goes up or down. If it goes down a lot, I invest even more.

But what I mean with timing is that historically, stocks go up a lot after a recession, much more than they go down before a recession.

A part of that is that recessions are usually announced much beforehand and often, the indexes have already corrected dramatically earlier than six months before the recession. You can see that now again. This is the chart for the last six months.

As you can see, the market is relatively flat, and almost all moves were between +10% and -10%.

The six previous months were much worse.

You have come so far already, don't give up now, even though it's very hard. If it were not so tough, everybody could do this.

But typically, many investors try to repair things when the damage is already done. I am convinced that the biggest damage, especially in growth stocks, is already in the rearview mirror and giving up now is not what you should do. It reminded me of this cartoon.

Reason 2: Inflation Peaks Are Bullish

Slowly, people start realizing that peak inflation is probably behind us. The data show that historically, stocks do well after inflation peaks, even if a recession follows.

So, this chart clearly shows that, unlike the consensus, we could see a great first half of the year if there is no recession and even a double-digit return if there is a recession. Not too shabby, right?

There are many reasons to believe inflation has peaked.

I remind you of the consumer price index numbers for December. Month-over-month, inflation was down 0.1%. The producer price index or PPI numbers that were released yesterday were much better than expected: down 0.5% month-over-month. Often, the PPI is a leading indicator of inflation in general because wholesale prices influence consumer prices.

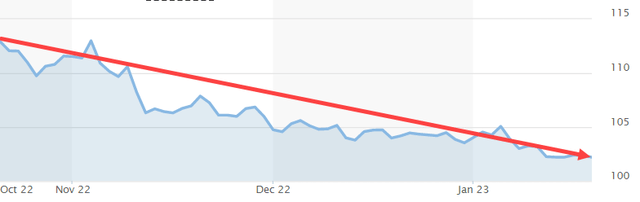

Another indicator is the 10-year yield curve. Just look how much it has dropped over the last three months.

The US Dollar Index has dropped quite a bit too, another indicator that inflation probably peaked in October of 2022. This is coupled with interest rates. Lower inflation means lower or stable interest rates. That means less demand for the US dollar.

(Source)

Even wages are down slightly in December, even though wages are a lagging indicator.

(Source)

Of course, just like you, I don't know what the Fed will do with interest rates, but it's pretty safe to say that the rates will not go up as much as in 2022. I can see flat rates for the rest of the year. I know the market is starting to price in a rate cut in the second part of the year and that's possible too, of course.

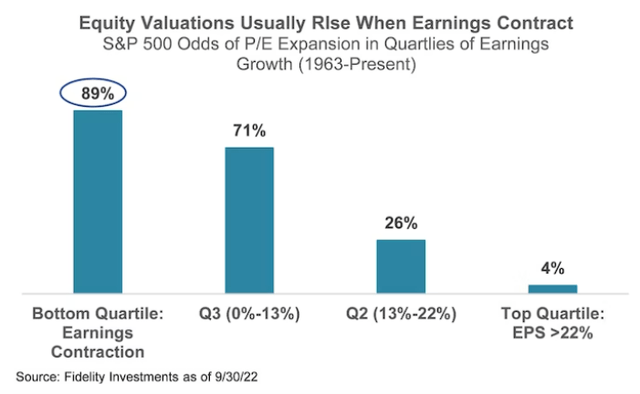

Reason 3: Earnings contractions are bullish

This now seems to have taken over the place of inflation fears as the most cited reason stocks will continue to decline.

Here again, evidence shows that valuations actually go up. Of course, this has partly to do with lower earnings, but also with investors already anticipating the recovery. With the S&P 500 and especially the Nasdaq down already so much, I think most of the earnings contraction is already priced in.

(Source)

I know what you think now. If a stock trades at $100, and earns $5 in EPS, it trades at a PE ratio of 20. If the EPS decreases to $2 and the stock drops to 60, the PE ratio is still higher, at 30 (60/2). So, it's not unusual that there's multiple expansion. Throw away this explanation.

The S&P 500 was up 7% on average in years where earnings were down.

The reason is simple: the stock market is a leading indicator, not a lagging one. Usually, the stock market precedes fundamental numbers by 6 to 12 months. For example, the stock market bottomed in March 2009, while unemployment only bottomed in April 2010. The same can be said about earnings contractions: they are priced in much before they become a reality. IF they become a reality.

The system behind the rising stock market with dropping earnings is the same: the earnings drops have already been discounted before they happen. I'm convinced that right now, we see the same system. Despite the negative attitude of many investors, probably all of the earnings declines are already factored in.

Analysts expect earnings to grow by about 4% in 2023. Probably that means that the earnings will not be down, even with pretty substantial misses. A 4% miss is quite high, historically. But it also creates an easier comp for the following year.

What can go wrong?

In short? Almost everything. The future is inherently unknowable. We can project but that should always be done with much caution. I see too many people making statements about the future that are too bold.

Inflation could go up again, there could be another shock coming from Russia, the Fed may misread the signals and keep tightening at a fanatic speed, and much more. Hell, there could even be another black swan, like the pandemic we all remember all too well.

There is one specific worry, though, inventory. On average, inventories are 28% higher than the average of the last ten years. Just think of Lululemon, which has built up its inventory by a whopping 80%. Tesla and Nike are other names that come to mind regarding more inventory. This could lead to lower prices, and therefore to a recession and maybe a deeper one we could anticipate. But the market is always full of such risks. Overall, I think the outlook is not dire at all.

Conclusion

My approach for 2023 will be the same as for 2022, 2021, 2020, 2019, 2018, and all the preceding years. I invest money every two weeks, without timing the market, and I buy stocks that I think have the potential to be great assets for the next 10, 15, and 20 years.

Seeing your investments go down is hard, but I have the rule to add more money when it feels painful. That's why my additions have been much higher for months now. Of course, it hurts, but I have my feelings under control, and I know that over the long run, this will pay off.

If you look well and you know the historical data, you can see that there are several reasons to believe that the stock market will do well in 2023. One thing is guaranteed, though; it will be a wild and bumpy ride.

If you liked this article, feel free to subscribe. It’s free, and you’ll never miss an article.

In the meantime, keep growing!

Thanks Kris, calm reasoning in the midst of current turmoil is very welcome. I’m adding to my portfolio regularly. I see so many despondent & angry retail investors selling up & leaving the market after taking a massive hit instead of sitting back and letting the game play out.